Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4066

Pages:86

Published On:December 2025

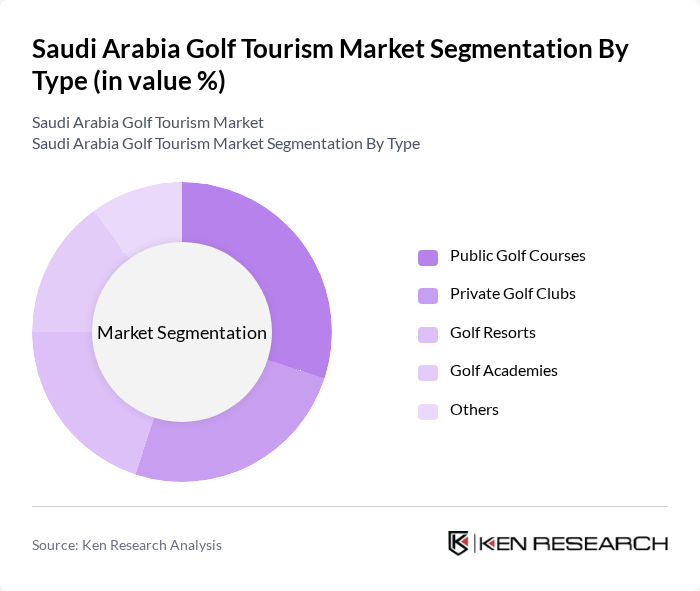

By Type:The segmentation by type includes Public Golf Courses, Private Golf Clubs, Golf Resorts, Golf Academies, and Others. Public Golf Courses are popular due to their accessibility and affordability, attracting a wide range of players. Private Golf Clubs cater to affluent individuals, offering exclusive services and facilities. Golf Resorts combine accommodation with golfing experiences, appealing to tourists seeking leisure. Golf Academies focus on training and skill development, attracting enthusiasts looking to improve their game. The "Others" category includes various golf-related services and facilities.

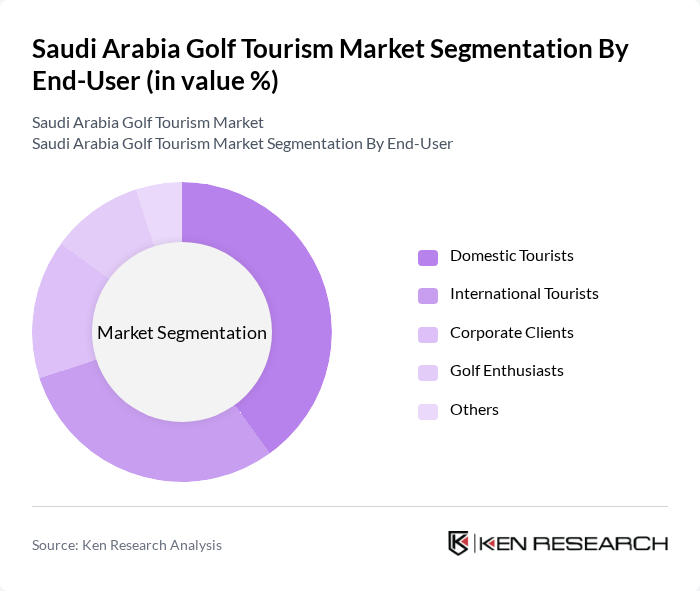

By End-User:The end-user segmentation includes Domestic Tourists, International Tourists, Corporate Clients, Golf Enthusiasts, and Others. Domestic Tourists represent a significant portion of the market, driven by local interest in golf. International Tourists are attracted by the unique golfing experiences and events hosted in the country. Corporate Clients often engage in golf for networking and team-building activities. Golf Enthusiasts are dedicated players seeking quality courses and facilities. The "Others" category encompasses various user groups, including families and casual players.

The Saudi Arabia Golf Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Golf Federation, Al Habtoor Group, Troon Golf, IMG Golf, Emaar Hospitality Group, The Address Hotels + Resorts, Four Seasons Hotels and Resorts, Ritz-Carlton, Marriott International, Hilton Worldwide, Accor Hotels, Jumeirah Group, Banyan Tree Hotels & Resorts, Radisson Hotel Group, Atlantis The Palm contribute to innovation, geographic expansion, and service delivery in this space.

The future of golf tourism in Saudi Arabia appears promising, driven by ongoing investments and a strategic focus on international events. The government’s commitment to enhancing tourism infrastructure and promoting local interest in golf is expected to yield significant returns. In the future, the market is likely to see a substantial increase in both domestic and international visitors, with a projected growth in golf-related tourism activities. This growth will be supported by innovative marketing strategies and partnerships with global golf brands.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Golf Courses Private Golf Clubs Golf Resorts Golf Academies Others |

| By End-User | Domestic Tourists International Tourists Corporate Clients Golf Enthusiasts Others |

| By Region | Riyadh Jeddah Dammam Mecca Others |

| By Seasonality | Peak Season Off-Peak Season Year-Round Others |

| By Service Type | Golf Course Access Equipment Rental Coaching Services Event Hosting Others |

| By Demographics | Age Groups Gender Income Levels Others |

| By Marketing Channel | Online Marketing Travel Agencies Direct Sales Partnerships with Hotels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Golf Course Operators | 75 | General Managers, Marketing Directors |

| Golf Tourists | 120 | Domestic and International Golf Travelers |

| Travel Agents Specializing in Golf | 60 | Travel Consultants, Sales Managers |

| Hospitality Sector Stakeholders | 55 | Hotel Managers, Event Coordinators |

| Government Tourism Officials | 40 | Policy Makers, Tourism Development Officers |

The Saudi Arabia Golf Tourism Market is valued at approximately USD 1.2 billion, driven by the increasing popularity of golf, significant investments in infrastructure, and the government's initiatives under Vision 2030 to promote tourism.