Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4778

Pages:81

Published On:December 2025

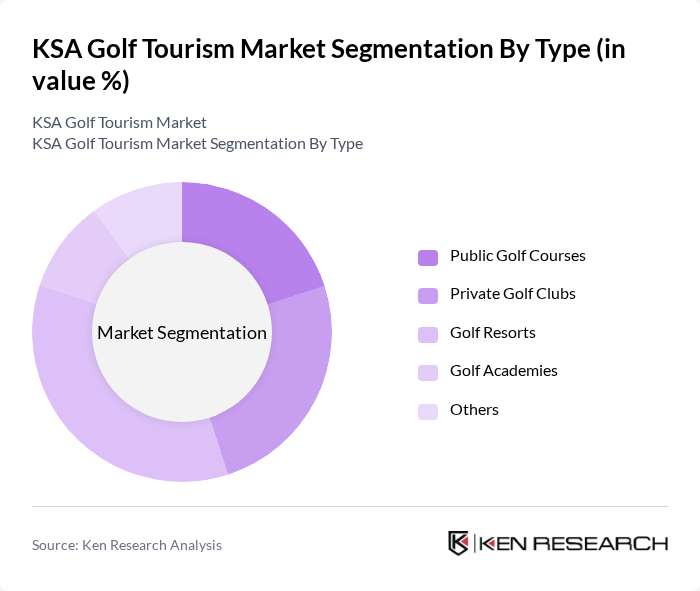

By Type:The KSA Golf Tourism Market is segmented into various types, including Public Golf Courses, Private Golf Clubs, Golf Resorts, Golf Academies, and Others. Public Golf Courses are increasingly important as part of Golf Saudi’s mass participation strategy, offering more accessible and affordable entry points for new players, while Private Golf Clubs continue to cater to affluent members with exclusive facilities and services. Among these, Golf Resorts are currently the leading subsegment, driven by the increasing demand for integrated leisure experiences that combine luxury accommodation with golfing facilities, especially within large-scale destination developments on the Red Sea coast, in Riyadh, and at mixed-use projects like King Abdullah Economic City. The trend towards wellness and leisure travel, coupled with high-end hospitality brands integrating golf access into their offerings, has further boosted the popularity of golf resorts, making them a preferred choice for both domestic and international tourists.

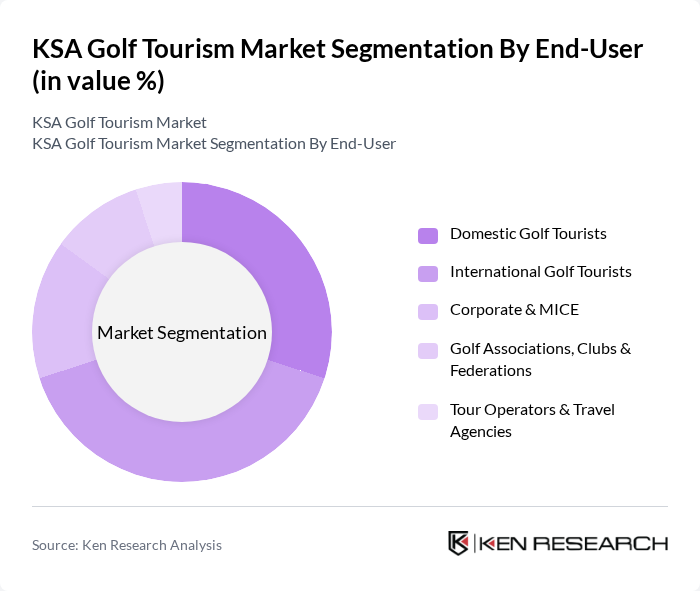

By End-User:The market is also segmented by end-users, which include Domestic Golf Tourists, International Golf Tourists, Corporate & MICE (Meetings, Incentives, Conferences, Exhibitions), Golf Associations, Clubs & Federations, and Tour Operators & Travel Agencies. The International Golf Tourists segment is currently the most significant, as the Kingdom attracts a growing number of international visitors seeking unique golfing experiences, particularly during major tournaments and events such as the Saudi International, Aramco Team Series, and LIV Golf tournaments hosted at courses like Royal Greens and Riyadh Golf Club. At the same time, domestic tourists and local golf enthusiasts are expanding rapidly thanks to Golf Saudi’s grassroots programs and academy growth at facilities including Riyadh Golf Club and Dirab Golf & Country Club, which are cultivating a sustained local demand base that complements inbound tourism and corporate golf-related travel.

The KSA Golf Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Golf Saudi (subsidiary of Saudi Golf Federation), Saudi Golf Federation, Royal Greens Golf & Country Club (King Abdullah Economic City), Riyadh Golf Club, Dirab Golf & Country Club, Troon Golf (management of select KSA golf assets), IMG Golf (course & event management partner), Emaar Hospitality Group (The Address Hotels + Resorts), Four Seasons Hotels and Resorts (Saudi Arabia properties with golf access), The Ritz-Carlton, Riyadh & Jeddah, Marriott International (including JW Marriott & other brands in KSA), Hilton Worldwide (including Waldorf Astoria & Hilton-branded resorts), Accor Hotels (including Fairmont, Sofitel & Raffles in KSA), Jumeirah Group (Jumeirah Jeddah & regional luxury portfolio), Banyan Tree Hotels & Resorts (Banyan Tree AlUla & Red Sea developments) contribute to innovation, geographic expansion, and service delivery in this space, often integrating championship-standard courses with luxury hospitality to attract both international and domestic golf travelers.

The future of KSA's golf tourism market appears promising, driven by increasing investments and a growing local interest in the sport. In future, the number of golf courses is expected to double, enhancing the region's appeal. Additionally, the integration of technology in golf experiences, such as virtual reality and mobile apps, will attract tech-savvy tourists. As KSA continues to promote itself as a luxury destination, the synergy between golf and wellness tourism will likely create new avenues for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Golf Courses Private Golf Clubs Golf Resorts Golf Academies Others |

| By End-User | Domestic Golf Tourists International Golf Tourists Corporate & MICE (Meetings, Incentives, Conferences, Exhibitions) Golf Associations, Clubs & Federations Tour Operators & Travel Agencies |

| By Region | Riyadh Jeddah Dammam / Eastern Province Mecca & Red Sea Coast (incl. KAEC, Red Sea Project & NEOM) Others |

| By Demographics | Age Groups Gender Income Levels Nationality (KSA Nationals vs. Expatriates vs. Foreign Visitors) Others |

| By Trip Purpose | Dedicated Golf Holidays Golf as Part of Multi-Activity Leisure Trips Golf for Business & Incentive Travel Golf for Events & Championships Others |

| By Service Type | Golf Course Access & Green Fees Golf Equipment & Cart Rentals Coaching & Academy Services Event & Tournament Hosting Golf Travel & Accommodation Packages |

| By Booking Channel | Online Direct (Club / Resort Websites & Apps) Online Intermediaries & OTAs Offline Travel Agencies & Tour Operators Corporate & MICE Travel Desk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Golf Tourists | 120 | Golf Enthusiasts, Travel Agents |

| Local Golf Course Operators | 45 | Course Managers, Marketing Directors |

| Tourism Agency Representatives | 40 | Tourism Development Officers, Event Coordinators |

| Golf Equipment Retailers | 35 | Store Managers, Sales Representatives |

| Hospitality Sector Stakeholders | 50 | Hotel Managers, Resort Directors |

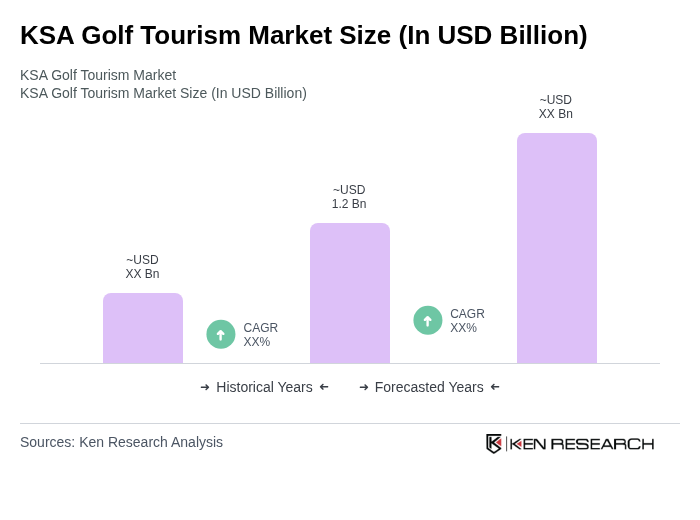

The KSA Golf Tourism Market is valued at approximately USD 1.2 billion, driven by the increasing popularity of golf, significant investments in infrastructure, and the government's commitment to promoting tourism as part of its Vision 2030 initiative.