Region:Middle East

Author(s):Rebecca

Product Code:KRAC1696

Pages:88

Published On:January 2026

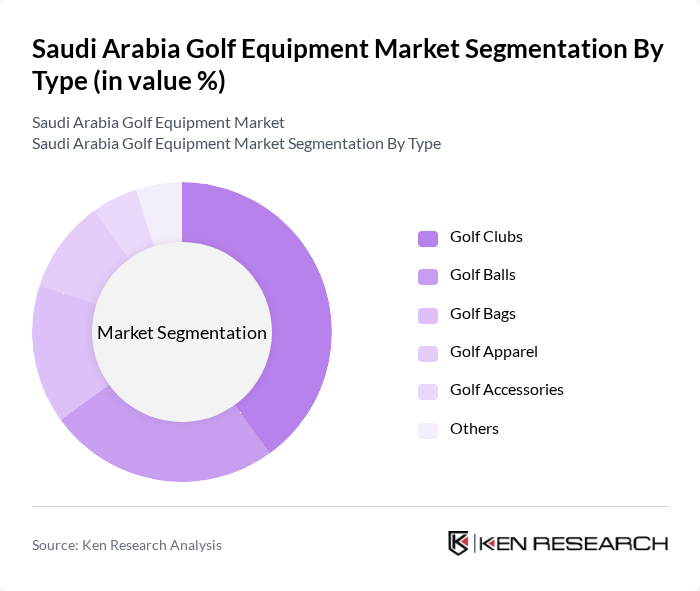

By Type:The market is segmented into various types of golf equipment, including golf clubs, golf balls, golf bags, golf apparel, golf accessories, and others. Among these, golf clubs dominate the market due to their essential role in the game and the increasing number of golfers in the region. The demand for high-quality clubs, particularly from renowned brands, is driving growth in this segment. Golf balls and apparel also contribute significantly, reflecting the growing interest in golf as a leisure activity.

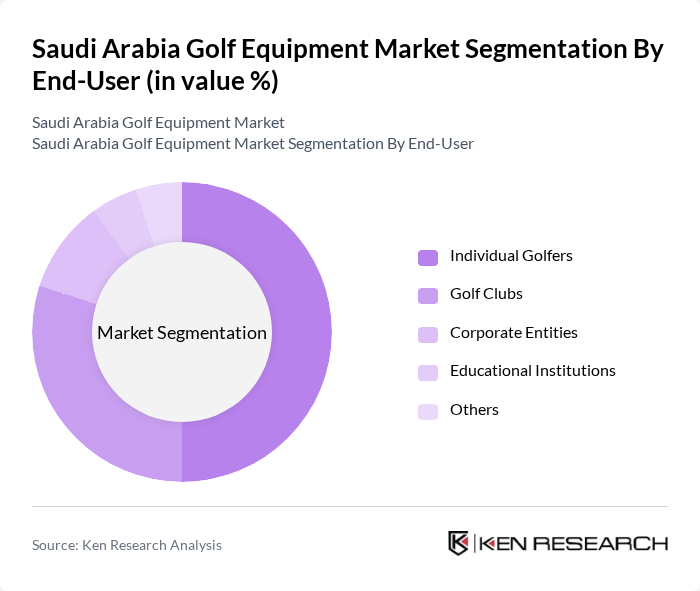

By End-User:The end-user segmentation includes individual golfers, golf clubs, corporate entities, educational institutions, and others. Individual golfers represent the largest segment, driven by the increasing number of people taking up golf as a hobby and sport. Golf clubs also play a significant role, as they require a variety of equipment for their members. Corporate entities are increasingly investing in golf as a means of networking and team-building, further boosting demand.

The Saudi Arabia Golf Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Callaway Golf Company, TaylorMade Golf Company, Titleist, Ping, Mizuno, Cobra Golf, Wilson Sporting Goods, Srixon, Odyssey, Cleveland Golf, PXG (Parsons Xtreme Golf), Bridgestone Golf, Adams Golf, Tour Edge, Ben Hogan Golf contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia golf equipment market appears promising, driven by significant investments in leisure infrastructure and the growing popularity of golf as a recreational activity. With projects like Qiddiya and Soudah Peaks, which have budgets of USD 9.8 billion and USD 7.7 billion respectively, the demand for golf facilities and equipment is expected to rise. Additionally, the increasing integration of technology in golf, particularly through simulators, will likely enhance consumer engagement and drive sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Golf Clubs Golf Balls Golf Bags Golf Apparel Golf Accessories Others |

| By End-User | Individual Golfers Golf Clubs Corporate Entities Educational Institutions Others |

| By Distribution Channel | Online Retail Specialty Sports Stores Department Stores Direct Sales Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Brand | International Brands Local Brands Emerging Brands Others |

| By Age Group | Youth Adults Seniors Others |

| By Skill Level | Beginners Intermediate Advanced Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Golf Equipment Sales | 150 | Store Managers, Sales Representatives |

| Golf Course Management Insights | 100 | Golf Course Managers, Event Coordinators |

| Consumer Preferences in Golf Equipment | 200 | Amateur Golfers, Golf Club Members |

| Professional Golfers' Equipment Choices | 50 | Professional Golfers, Coaches |

| Golf Equipment Importers and Distributors | 80 | Import Managers, Distribution Heads |

The Saudi Arabia Golf Equipment Market is valued at approximately USD 15 million. This valuation reflects the growing interest in golf, driven by health consciousness and increased sports participation among the population.