Region:Middle East

Author(s):Dev

Product Code:KRAC8836

Pages:93

Published On:November 2025

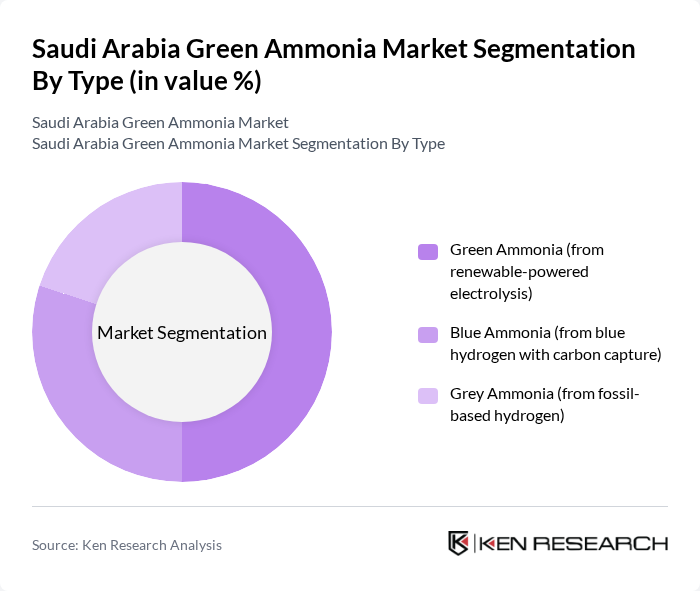

By Type:The market is segmented into three main types: Green Ammonia (from renewable-powered electrolysis), Blue Ammonia (from blue hydrogen with carbon capture), and Grey Ammonia (from fossil-based hydrogen). Green Ammonia is gaining traction due to its environmental benefits and alignment with global sustainability goals. Blue Ammonia is also significant as it allows for a transitional approach to hydrogen production, while Grey Ammonia remains relevant due to existing infrastructure and lower costs.

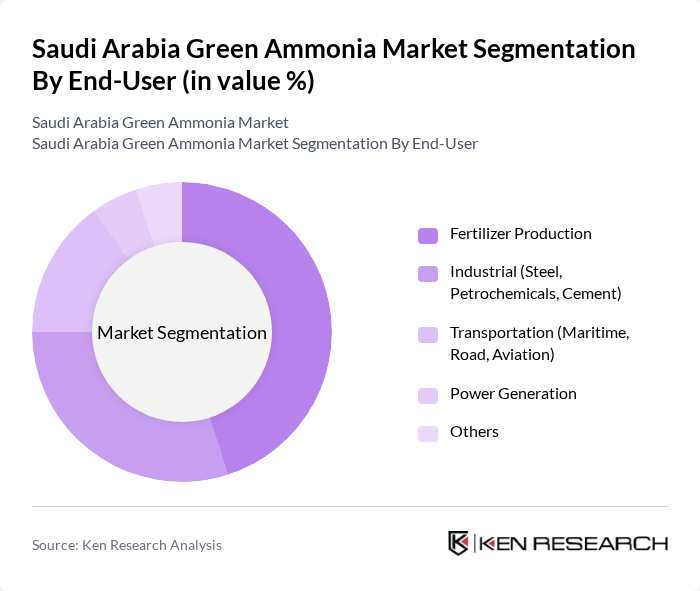

By End-User:The end-user segmentation includes Fertilizer Production, Industrial (Steel, Petrochemicals, Cement), Transportation (Maritime, Road, Aviation), Power Generation, and Others. Fertilizer production is the leading segment due to the high demand for ammonia as a key ingredient in fertilizers. The industrial sector follows closely, driven by the need for ammonia in various manufacturing processes, while transportation and power generation are emerging as significant consumers of green ammonia.

The Saudi Arabia Green Ammonia Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Saudi Aramco, SABIC, Air Products and Chemicals, Inc., NEOM Green Hydrogen Company, Alfanar Energy, JGC Corporation, ThyssenKrupp, Siemens Energy, Linde plc, ENGIE, TotalEnergies, Eni S.p.A., Mitsubishi Heavy Industries, Black & Veatch contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green ammonia market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and government support for sustainable technologies. As the country continues to enhance its renewable energy capacity, the production of green ammonia is expected to gain momentum. Additionally, the establishment of strategic partnerships with international firms will likely accelerate technological advancements, positioning Saudi Arabia as a key player in the global green ammonia landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Ammonia (from renewable-powered electrolysis) Blue Ammonia (from blue hydrogen with carbon capture) Grey Ammonia (from fossil-based hydrogen) |

| By End-User | Fertilizer Production Industrial (Steel, Petrochemicals, Cement) Transportation (Maritime, Road, Aviation) Power Generation Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Alkaline Water Electrolysis (AWE) Proton Exchange Membrane (PEM) Electrolysis Solid Oxide Electrolysis (SOE) Hybrid/Other Electrolysis Routes |

| By Application | Fertilizer Feedstock Marine Fuel Energy Storage Power Generation Industrial Heating Others |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Ammonia Production Facilities | 100 | Plant Managers, Production Engineers |

| Agricultural Sector Stakeholders | 60 | Agronomists, Fertilizer Procurement Managers |

| Energy Sector Executives | 50 | Energy Analysts, Business Development Managers |

| Research Institutions and Universities | 40 | Research Scientists, Professors in Chemical Engineering |

| Government Policy Makers | 40 | Energy Policy Advisors, Regulatory Affairs Specialists |

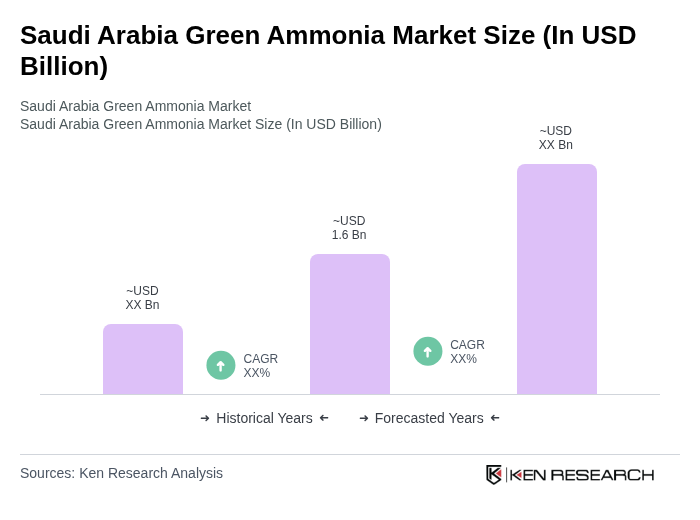

The Saudi Arabia Green Ammonia Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by the country's commitment to diversifying energy sources and reducing carbon emissions.