Region:Middle East

Author(s):Shubham

Product Code:KRAA4981

Pages:98

Published On:September 2025

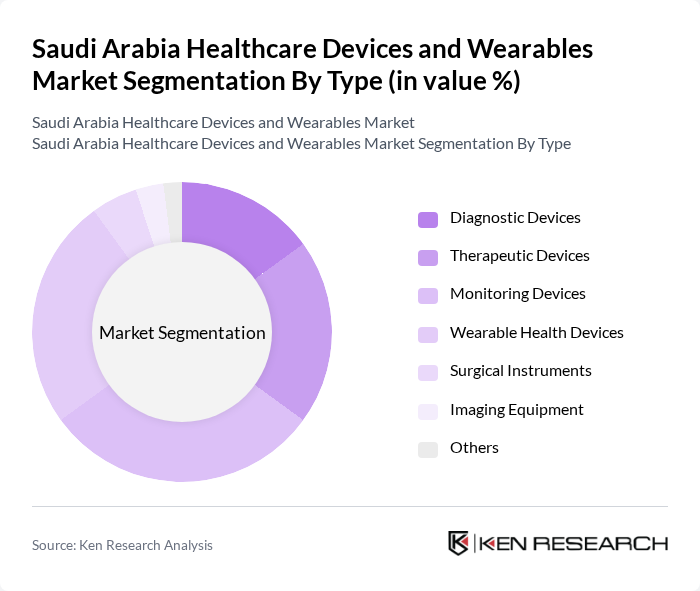

By Type:The market is segmented into various types of healthcare devices and wearables, including diagnostic devices, therapeutic devices, monitoring devices, wearable health devices, surgical instruments, imaging equipment, and others. Among these, monitoring devices and wearable health devices are gaining significant traction due to the increasing focus on preventive healthcare and remote patient monitoring. The rise in chronic diseases and the demand for continuous health tracking are driving the growth of these segments.

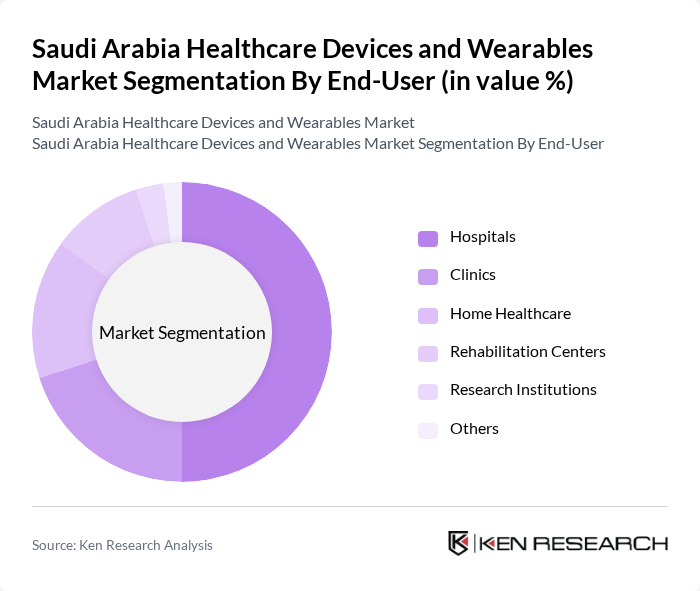

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, rehabilitation centers, research institutions, and others. Hospitals are the leading end-users due to their extensive use of advanced medical devices for patient care and diagnostics. The increasing number of hospitals and healthcare facilities in urban areas is further propelling the demand for healthcare devices and wearables.

The Saudi Arabia Healthcare Devices and Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, GE Healthcare, Medtronic, Abbott Laboratories, Johnson & Johnson, Boston Scientific, B. Braun Melsungen AG, Omron Healthcare, Fitbit, Inc., Garmin Ltd., Apple Inc., Samsung Electronics, Huawei Technologies Co., Ltd., Xiaomi Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare devices and wearables market in Saudi Arabia appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on digital health solutions. As the government continues to support initiatives aimed at enhancing healthcare access and quality, the integration of advanced technologies such as AI and telehealth will likely reshape the market landscape. Furthermore, consumer demand for personalized healthcare solutions is expected to rise, fostering innovation and competition among device manufacturers.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Monitoring Devices Wearable Health Devices Surgical Instruments Imaging Equipment Others |

| By End-User | Hospitals Clinics Home Healthcare Rehabilitation Centers Research Institutions Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Pharmacies Others |

| By Application | Cardiovascular Diabetes Management Respiratory Care Fitness Tracking Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Technology | Bluetooth Enabled Devices Wi-Fi Enabled Devices Cellular Enabled Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Doctors, Nurses, Health Technologists |

| Wearable Device Users | 100 | Fitness Enthusiasts, Patients with Chronic Conditions |

| Healthcare Administrators | 80 | Hospital Managers, Clinic Directors |

| Medical Device Manufacturers | 70 | Product Managers, R&D Heads |

| Technology Providers | 60 | Software Developers, IT Managers in Healthcare |

The Saudi Arabia Healthcare Devices and Wearables Market is valued at approximately USD 2.5 billion, driven by increasing healthcare expenditure, technological advancements, and a rising prevalence of chronic diseases among the population.