Region:Middle East

Author(s):Dev

Product Code:KRAC2755

Pages:98

Published On:October 2025

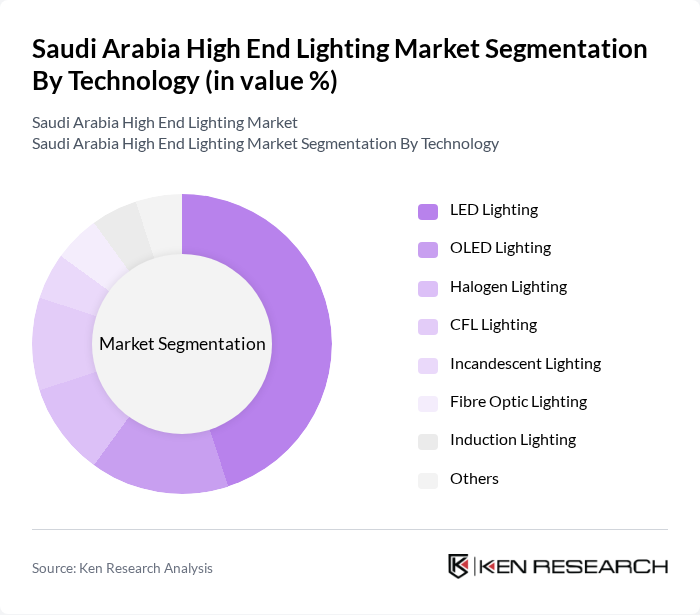

By Technology:The technology segment includes various lighting technologies such as LED, OLED, Halogen, CFL, Incandescent, Fibre Optic, Induction, and others. Among these, LED lighting is the most dominant due to its superior energy efficiency, long lifespan, and rapidly declining costs, making it the preferred choice for both residential and commercial applications. The increasing adoption of smart lighting solutions—integrating IoT and automation—further accelerates demand for LED technology, as it offers seamless compatibility with modern home and building management systems. OLED and fibre optic lighting are gaining traction in premium architectural and decorative applications, while halogen and CFL continue to serve niche segments .

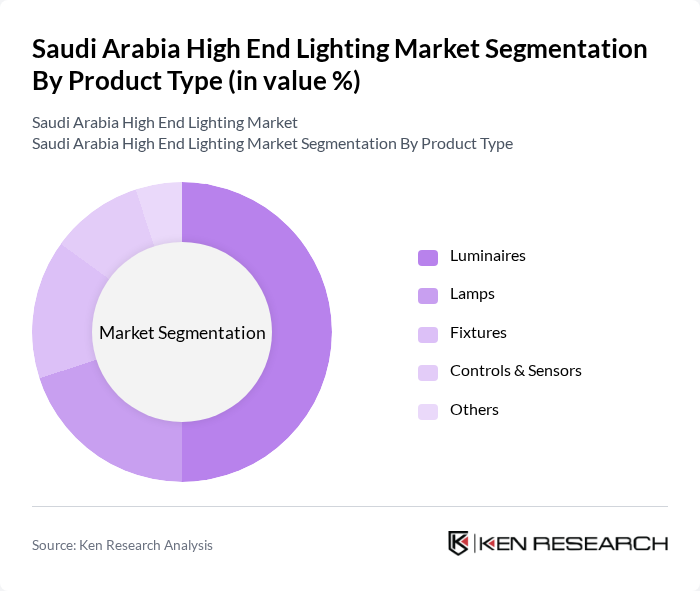

By Product Type:This segment encompasses various product types including Luminaires, Lamps, Fixtures, Controls & Sensors, and others. Luminaires are the leading product type, driven by robust demand for stylish, functional, and energy-efficient lighting solutions in both residential and commercial environments. The rapid growth of smart lighting systems is boosting sales of controls and sensors, as consumers and businesses seek enhanced energy management, automation, and convenience. Lamps remain significant for retrofit and replacement markets, while fixtures and specialty products cater to architectural and industrial applications .

The Saudi Arabia High End Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting Saudi Arabia Company), Osram Licht AG, Zumtobel Lighting Saudi Arabia, General Electric Company, Al Nasser Group, Alfanar, Cinmar Lighting Systems, Huda Lighting, Zubair Electric Group, Al AbdulKarim Trading Company, Fagerhult Group, Legrand S.A., Lutron Electronics Co., Inc., Panasonic Corporation, Schneider Electric, Delta Light, Cooper Lighting (Eaton Corporation), and Hubbell Lighting contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia high-end lighting market is poised for significant growth, driven by urbanization, rising incomes, and government initiatives. As consumers increasingly prioritize energy efficiency and smart technologies, the demand for innovative lighting solutions will likely rise. Additionally, the integration of IoT in lighting systems will enhance user experience and operational efficiency. The market is expected to evolve with a focus on sustainability and customization, aligning with global trends and local consumer preferences, creating a dynamic landscape for industry players.

| Segment | Sub-Segments |

|---|---|

| By Technology | LED Lighting OLED Lighting Halogen Lighting CFL Lighting Incandescent Lighting Fibre Optic Lighting Induction Lighting Others |

| By Product Type | Luminaires Lamps Fixtures Controls & Sensors Others |

| By Application | Indoor Lighting Outdoor Lighting Architectural Lighting Decorative Lighting Landscape Lighting Event Lighting Emergency Lighting Others |

| By End-User | Residential Commercial Hospitality Retail Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Value Brands Others |

| By Sustainability Focus | Energy-Efficient Products Eco-Friendly Materials Recyclable Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Lighting Solutions | 100 | Homeowners, Interior Designers |

| Commercial Lighting Applications | 80 | Facility Managers, Architects |

| Industrial Lighting Systems | 60 | Operations Managers, Safety Officers |

| Smart Lighting Technologies | 50 | Technology Integrators, Product Developers |

| LED Lighting Market | 40 | Retail Buyers, Procurement Managers |

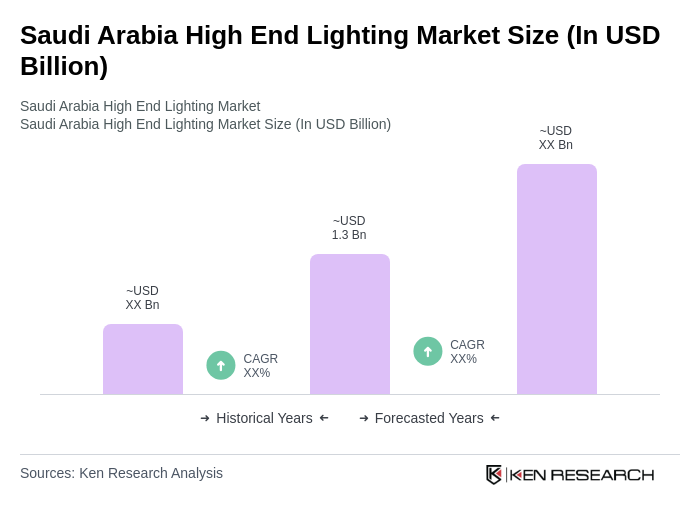

The Saudi Arabia High End Lighting Market is valued at approximately USD 1.3 billion, driven by urbanization, infrastructure development, and a growing demand for energy-efficient and smart lighting solutions across various sectors.