Region:Middle East

Author(s):Dev

Product Code:KRAD5297

Pages:97

Published On:December 2025

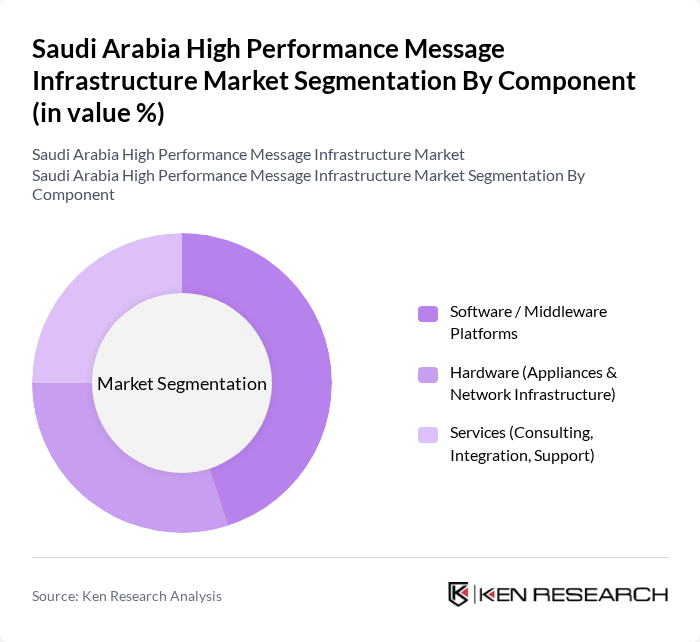

By Component:

The components of the market include Software / Middleware Platforms, Hardware (Appliances & Network Infrastructure), and Services (Consulting, Integration, Support). Among these, Software / Middleware Platforms are dominating the market due to their critical role in enabling seamless, low-latency communication and integration across microservices, trading platforms, telecom backbones, and real-time analytics applications. The increasing adoption of cloud-based solutions, API-driven architectures, and event-driven microservices, together with the need for real-time data processing in sectors such as financial services, telecom, and online services, is driving the demand for these platforms. Hardware components are also significant, particularly in sectors requiring robust network and edge infrastructure, low-latency data center fabrics, and 5G transport to support high-throughput messaging workloads, while services are essential for architecture design, integration with legacy core systems, migration to cloud-native stacks, and ongoing optimization, monitoring, and support.

By Messaging Pattern:

The messaging patterns in the market include Point-to-Point Messaging, Publish–Subscribe (Pub/Sub), Request–Reply, and Streaming / Event-Driven Messaging. The Publish–Subscribe model is currently leading the market due to its scalability, decoupling of producers and consumers, and efficiency in handling large volumes of messages across distributed and cloud-native systems, which aligns with how high-performance message infrastructure and streaming platforms are architected globally. This pattern is particularly favored in sectors like telecommunications and finance, where real-time data dissemination, market data distribution, network telemetry, and alerting are crucial. Point-to-Point Messaging also holds a significant share, especially in transactional and back-office applications that require guaranteed delivery and ordered processing, while Streaming / Event-Driven Messaging is gaining strong traction with the rise of IoT, 5G-enabled use cases, real-time analytics, and event-sourcing architectures in industries such as industrial, logistics, and digital services.

The Saudi Arabia High Performance Message Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM (IBM MQ, IBM Event Streams), Microsoft (Azure Service Bus, Event Hubs), Oracle (Oracle Advanced Queuing, Oracle Cloud Infrastructure Streaming), Red Hat (Red Hat AMQ, Red Hat OpenShift Streams), TIBCO Software (TIBCO Enterprise Message Service), Confluent (Confluent Platform & Confluent Cloud for Apache Kafka), Solace (Solace PubSub+ Platform), Software AG (webMethods.io Integration & Messaging), SAP (SAP Event Mesh, SAP Integration Suite), Cisco Systems (Cisco Messaging & Application Networking Solutions), Amazon Web Services (Amazon MQ, Amazon Kinesis, Amazon SQS/SNS), Google Cloud (Pub/Sub & Eventarc), STC Solutions (Saudi Telecom Company – Cloud & Integration Services), Mobily (Etihad Etisalat – Enterprise Cloud & Messaging Services), Zain KSA (Zain Saudi Arabia – 5G & Edge Messaging Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high-performance message infrastructure market in Saudi Arabia appears promising, driven by ongoing digital transformation and increased investments in technology. As organizations prioritize real-time data processing and cloud integration, the demand for advanced messaging solutions is expected to rise. Additionally, the government's commitment to smart city projects will further stimulate innovation, creating a conducive environment for market growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Software / Middleware Platforms Hardware (Appliances & Network Infrastructure) Services (Consulting, Integration, Support) |

| By Messaging Pattern | Point-to-Point Messaging Publish–Subscribe (Pub/Sub) Request–Reply Streaming / Event-Driven Messaging |

| By Deployment Model | On-Premises Public Cloud Private Cloud Hybrid / Multi-Cloud |

| By Throughput & Latency Class | Ultra-Low Latency (Sub-Millisecond) Low Latency Standard Enterprise Messaging |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Telecommunications & 5G Operators Government & Smart City Programs Healthcare & Life Sciences Retail & E-commerce Energy, Utilities & Industrial (Including Oil & Gas) Others |

| By Communication Protocol / Technology | AMQP MQTT REST / HTTP APIs Proprietary High-Performance Protocols Others |

| By Service Type | Managed Services Professional & Integration Services Support and Maintenance Training & Managed Security Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Messaging Solutions | 110 | IT Managers, System Architects |

| Cloud Messaging Services | 85 | Cloud Service Providers, DevOps Engineers |

| Telecommunications Messaging Infrastructure | 75 | Network Engineers, Product Managers |

| Healthcare Messaging Systems | 55 | Healthcare IT Directors, Compliance Officers |

| Financial Services Messaging Platforms | 95 | Risk Management Officers, Operations Managers |

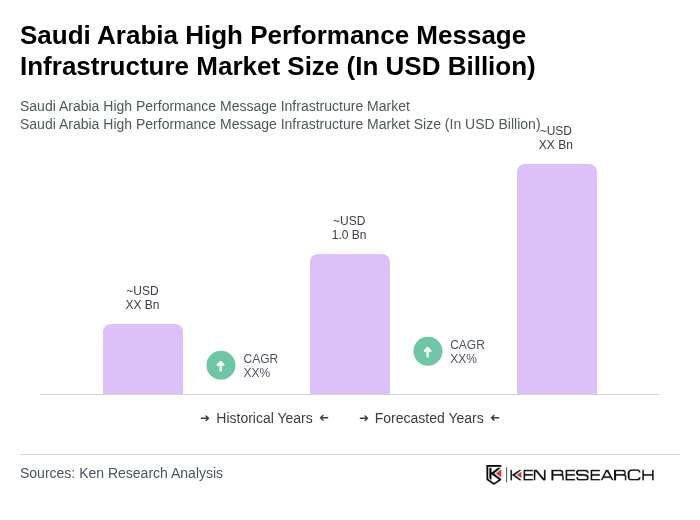

The Saudi Arabia High Performance Message Infrastructure Market is valued at approximately USD 1.0 billion, reflecting the country's significant investment in digital infrastructure and enterprise ICT spending as part of its Vision 2030 initiatives.