Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1022

Pages:91

Published On:October 2025

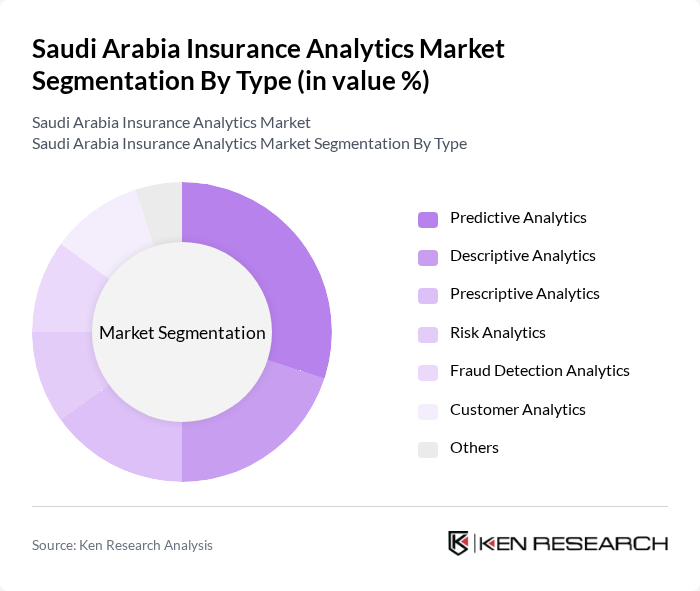

By Type:The market is segmented into various types of analytics, including Predictive Analytics, Descriptive Analytics, Prescriptive Analytics, Risk Analytics, Fraud Detection Analytics, Customer Analytics, and Others. Each of these sub-segments plays a crucial role in helping insurance companies make data-driven decisions, optimize operations, and enhance customer satisfaction. Among these, Predictive Analytics is gaining significant traction as it allows insurers to forecast trends and behaviors, thereby improving risk management and underwriting processes .

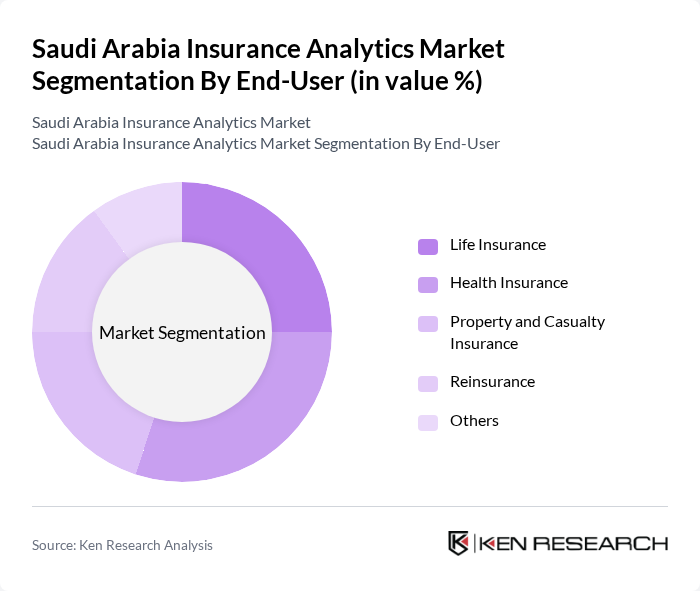

By End-User:The end-user segmentation includes Life Insurance, Health Insurance, Property and Casualty Insurance, Reinsurance, and Others. Each segment utilizes analytics differently, with Health Insurance and Property and Casualty Insurance being the most prominent users of analytics solutions. The increasing complexity of health data, regulatory requirements for digital transformation, and the need for effective claims management in property insurance are driving the demand for analytics in these sectors .

The Saudi Arabia Insurance Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, Allianz Saudi Fransi, Medgulf, Alinma Tokio Marine, United Cooperative Assurance, Al-Ahlia Insurance Company, Al Sagr Cooperative Insurance, Saudi Re, Al-Etihad Cooperative Insurance, Al-Jazira Takaful, Al-Mawared Insurance, Al-Bilad Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia insurance analytics market appears promising, driven by technological advancements and regulatory support. As insurers increasingly adopt AI and machine learning, the focus will shift towards enhancing customer experiences and operational efficiencies. The integration of real-time analytics will enable insurers to respond swiftly to market changes, while cloud-based solutions will facilitate scalability and cost-effectiveness. Overall, the market is poised for significant transformation, aligning with the Kingdom's broader economic goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Descriptive Analytics Prescriptive Analytics Risk Analytics Fraud Detection Analytics Customer Analytics Others |

| By End-User | Life Insurance Health Insurance Property and Casualty Insurance Reinsurance Others |

| By Application | Risk Assessment Claims Management Customer Retention Marketing Optimization Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises Large Corporations Government Entities Others |

| By Technology | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Mobile Analytics Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Products | 100 | Insurance Agents, Financial Advisors |

| Health Insurance Market | 90 | Healthcare Administrators, Policyholders |

| Motor Insurance Sector | 80 | Claims Adjusters, Underwriters |

| Property Insurance Insights | 60 | Real Estate Developers, Risk Managers |

| Insurance Technology Adoption | 50 | IT Managers, Digital Transformation Leads |

The Saudi Arabia Insurance Analytics Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of data analytics technologies by insurance companies to enhance operational efficiency and customer experience.