Region:Middle East

Author(s):Rebecca

Product Code:KRAC1179

Pages:97

Published On:October 2025

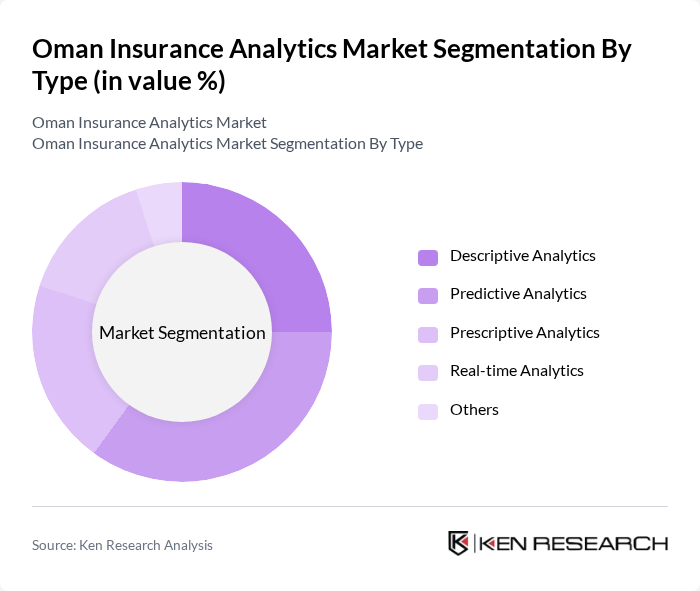

By Type:The segmentation by type includes various analytics methodologies that address distinct operational and strategic needs within the insurance sector. The subsegments are Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-time Analytics, and Others. Descriptive Analytics focuses on historical data review and performance reporting. Predictive Analytics utilizes statistical models and machine learning to forecast risk and customer behavior. Prescriptive Analytics recommends optimal actions based on predictive outcomes. Real-time Analytics enables immediate decision-making for claims and fraud detection. The "Others" category includes emerging and hybrid analytics approaches .

The Predictive Analytics subsegment is currently dominating the market due to its ability to forecast future trends and behaviors based on historical data. Insurance companies are increasingly leveraging predictive models to assess risks, optimize pricing strategies, and enhance customer targeting. This trend is driven by the growing need for data-driven decision-making in a competitive landscape, where understanding customer behavior and market dynamics is crucial for success .

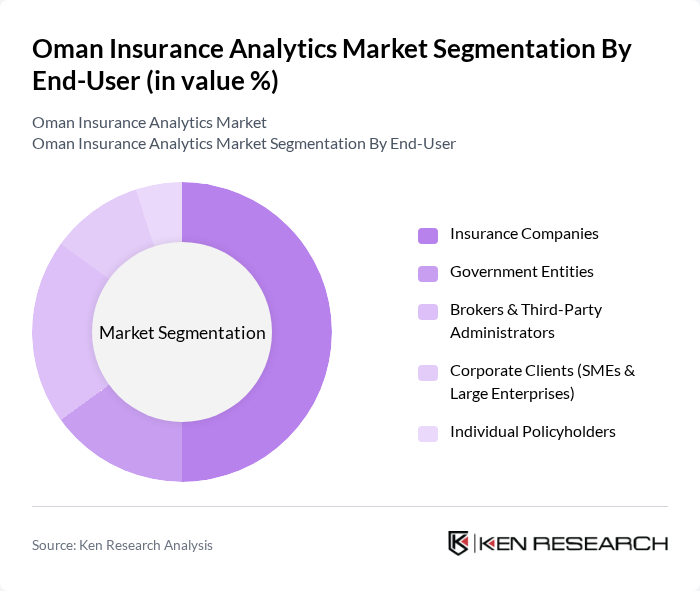

By End-User:The end-user segmentation includes Insurance Companies, Government Entities, Brokers & Third-Party Administrators, Corporate Clients (SMEs & Large Enterprises), and Individual Policyholders. Each of these segments utilizes analytics differently: Insurance Companies focus on underwriting and claims optimization; Government Entities use analytics for regulatory oversight and policy development; Brokers & Third-Party Administrators leverage analytics for risk assessment and client management; Corporate Clients seek insights for risk mitigation and benefits optimization; Individual Policyholders benefit from personalized product recommendations and improved service delivery .

Insurance Companies are the leading end-users of analytics solutions, accounting for a significant portion of the market. This dominance is attributed to their need for comprehensive data analysis to improve underwriting processes, enhance customer service, and streamline claims management. The increasing complexity of insurance products and the competitive nature of the market compel these companies to invest heavily in analytics to maintain their edge .

The Oman Insurance Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Insurance Company S.A.O.G., Dhofar Insurance Company S.A.O.G., Muscat Insurance Company S.A.O.G., Al Madina Takaful S.A.O.G., Oman United Insurance Company S.A.O.G., National Life & General Insurance Company S.A.O.G., Takaful Oman Insurance S.A.O.G., Al Ahlia Insurance Company S.A.O.G., Oman Reinsurance Company S.A.O.G., Al Izz Islamic Bank, Muscat Capital LLC, Oman Insurance Brokers LLC, Al Batinah Insurance Company S.A.O.G., Bank Muscat, Oman Data Analytics Solutions LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman insurance analytics market is poised for significant advancements as digital transformation continues to reshape the industry landscape. With increasing investments in AI and machine learning, insurers are expected to enhance their predictive capabilities, leading to improved risk management and customer engagement. Furthermore, the integration of IoT data will facilitate real-time analytics, allowing insurers to offer personalized products. As regulatory frameworks evolve, compliance-driven analytics will become essential, driving further innovation and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-time Analytics Others |

| By End-User | Insurance Companies Government Entities Brokers & Third-Party Administrators Corporate Clients (SMEs & Large Enterprises) Individual Policyholders |

| By Application | Risk Assessment & Underwriting Fraud Detection & Prevention Customer Segmentation & Personalization Claims Management & Optimization Regulatory Compliance & Reporting |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services Managed Analytics Services |

| By Data Source | Internal Data (Policy, Claims, Customer) External Data (Market, Regulatory, IoT) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Products | 60 | Insurance Agents, Financial Advisors |

| Health Insurance Market | 50 | Healthcare Administrators, Policyholders |

| Property and Casualty Insurance | 40 | Risk Managers, Business Owners |

| Motor Insurance Sector | 45 | Insurance Underwriters, Claims Adjusters |

| Insurance Technology Adoption | 42 | IT Managers, Digital Transformation Leads |

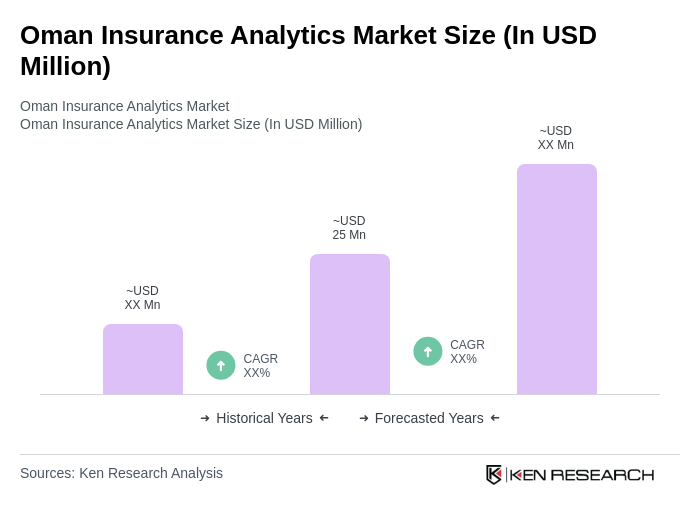

The Oman Insurance Analytics Market is valued at approximately USD 25 million, reflecting a significant growth trend driven by the adoption of data analytics technologies by insurance companies to enhance operational efficiency and customer experience.