Region:Middle East

Author(s):Rebecca

Product Code:KRAC0285

Pages:81

Published On:August 2025

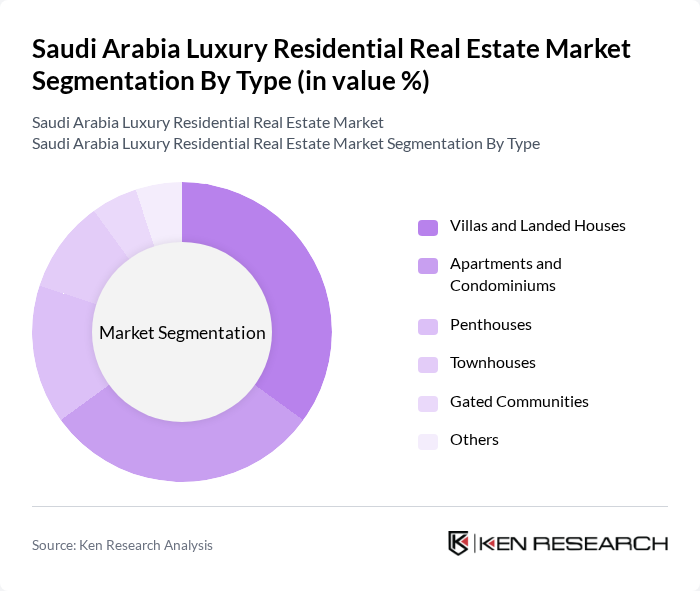

By Type:The luxury residential real estate market is segmented into villas and landed houses, apartments and condominiums, penthouses, townhouses, gated communities, and others. Villas and landed houses are especially popular among affluent families seeking privacy and expansive living spaces. Apartments and condominiums are increasingly favored by expatriates and young professionals who value modern amenities, security, and proximity to business districts. Penthouses, townhouses, and gated communities cater to niche preferences for exclusivity, community living, and enhanced security.

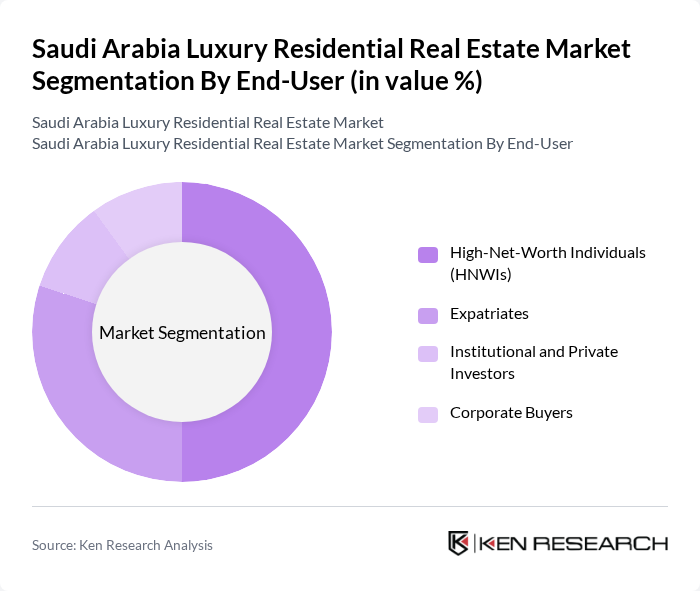

By End-User:The end-user segmentation of the luxury residential real estate market includes high-net-worth individuals (HNWIs), expatriates, institutional and private investors, and corporate buyers. High-net-worth individuals are the primary drivers, motivated by the desire for exclusive, secure, and amenity-rich properties. Expatriates represent a significant and growing segment, especially as regulatory changes make ownership more accessible. Institutional and private investors are increasingly active, seeking capital appreciation and rental yields in the luxury segment. Corporate buyers are also present, acquiring properties for executive housing and investment purposes.

The Saudi Arabia luxury residential real estate market is characterized by a dynamic mix of regional and international players. Leading participants such as Dar Al Arkan, Emaar, The Economic City, ROSHN (Saudi Public Investment Fund), Kingdom Holding Company, JLL (Jones Lang LaSalle), Colliers International, CBRE Group, DAMAC Properties, Saudi Real Estate Company (Al Akaria), Alinma Investment, Makkah Construction and Development Company, Al Oula Real Estate Development Company, Al Fozan Group, Al Jomaih Group, and Cayan Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury residential real estate market in Saudi Arabia appears promising, driven by ongoing urbanization and government initiatives aimed at diversifying the economy. As the country continues to develop smart cities and enhance infrastructure, demand for high-quality living spaces is expected to rise. Additionally, the increasing interest in sustainable living and eco-friendly developments will likely shape future projects, attracting both local and international investors seeking modern, environmentally conscious properties.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas and Landed Houses Apartments and Condominiums Penthouses Townhouses Gated Communities Others |

| By End-User | High-Net-Worth Individuals (HNWIs) Expatriates Institutional and Private Investors Corporate Buyers |

| By Price Range | Below SAR 1 Million SAR 1 Million - SAR 5 Million SAR 5 Million - SAR 10 Million Above SAR 10 Million |

| By Location | Riyadh Jeddah Dammam Metropolitan Area Khobar Mecca Medina NEOM and Other New Economic Cities Others |

| By Amenities | Swimming Pools Gyms and Fitness Centers Security Services Parking Facilities Landscaping and Gardens Smart Home Features Concierge and Lifestyle Services Others |

| By Construction Type | New Developments Renovated Properties Off-Plan Sales |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Residential Buyers | 100 | High-Net-Worth Individuals, Investors |

| Real Estate Developers | 60 | Project Managers, Business Development Heads |

| Real Estate Agents | 50 | Luxury Property Specialists, Sales Executives |

| Financial Institutions | 40 | Mortgage Advisors, Wealth Management Consultants |

| Government Officials | 40 | Urban Planning Officers, Regulatory Authorities |

The Saudi Arabia luxury residential real estate market is valued at approximately USD 15 billion, driven by increasing disposable incomes, urbanization, and a rise in high-net-worth expatriates seeking premium living options.