Region:Middle East

Author(s):Rebecca

Product Code:KRAD8468

Pages:92

Published On:December 2025

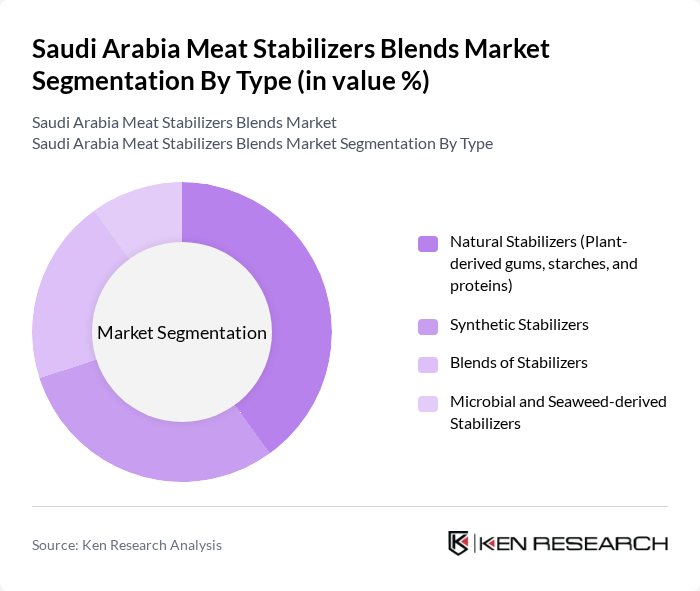

By Type:The market is segmented into various types of stabilizers, including Natural Stabilizers (Plant-derived gums, starches, and proteins), Synthetic Stabilizers, Blends of Stabilizers, and Microbial and Seaweed-derived Stabilizers. Among these, Natural Stabilizers are gaining traction due to the increasing consumer preference for clean-label products and natural ingredients, accounting for approximately 40% of the market. Synthetic Stabilizers, while still significant at around 30% market share, face scrutiny due to health concerns. The Blends of Stabilizers are popular for their versatility in applications at 20% market share, while Microbial and Seaweed-derived Stabilizers are emerging as innovative solutions representing 10% of the market.

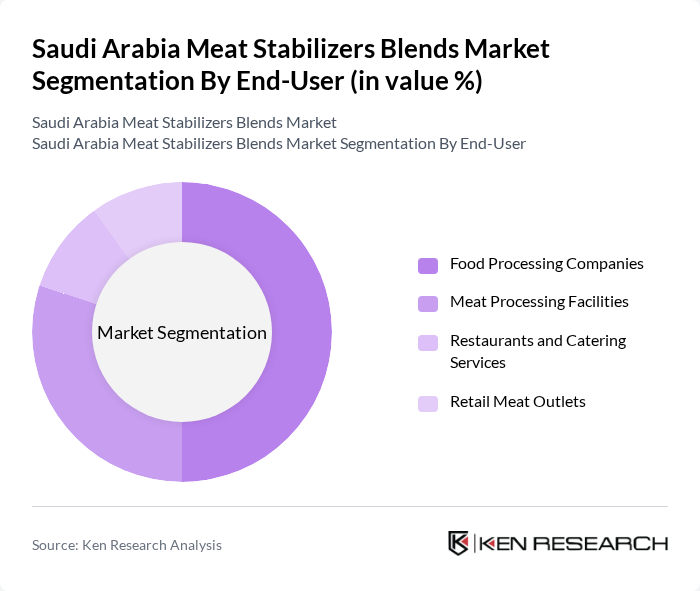

By End-User:The end-user segmentation includes Food Processing Companies, Meat Processing Facilities, Restaurants and Catering Services, and Retail Meat Outlets. Food Processing Companies are the largest consumers of stabilizers at 50% market share, driven by the need for quality and shelf-life extension in processed meat products. Meat Processing Facilities also represent a significant segment at 30%, as they require stabilizers for various meat products. Restaurants and Catering Services are increasingly adopting stabilizers to enhance the quality of their offerings at 10% market share, while Retail Meat Outlets are focusing on providing high-quality meat products to consumers at 10% market share.

The Saudi Arabia Meat Stabilizers Blends Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Watania Poultry Company, Al-Faisal Meat Company, Al-Jazeera Poultry Company, Al-Muhaidib Group, Al-Othaim Markets, Al-Safi Danone, Al-Baik Food Systems, Al-Mansour Group, Panda Retail Company, Herfy Food Services, Kudu Restaurants, Saudia Dairy and Foodstuff Company, National Agricultural Development Company (NADEC), Astra Industrial Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia meat stabilizers blends market appears promising, driven by evolving consumer preferences and technological advancements. The shift towards natural and organic stabilizers is expected to gain momentum, aligning with the health-conscious trends among consumers. Additionally, the expansion of e-commerce platforms for meat products will facilitate greater accessibility, allowing manufacturers to reach a broader audience. As the food service industry continues to grow, opportunities for collaboration with local food manufacturers will further enhance market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Stabilizers (Plant-derived gums, starches, and proteins) Synthetic Stabilizers Blends of Stabilizers Microbial and Seaweed-derived Stabilizers |

| By End-User | Food Processing Companies Meat Processing Facilities Restaurants and Catering Services Retail Meat Outlets |

| By Application | Sausages and Processed Meat Products Ready-to-Eat Meals Fresh Meat Products Deli Meats and Hot Dogs |

| By Distribution Channel | Online Retail and E-commerce Supermarkets and Hypermarkets Specialty Stores and Butcher Shops Direct B2B Sales to Food Processors |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha, Jizan) |

| By Product Form | Powdered Stabilizers Liquid Stabilizers Granulated Stabilizers Paste and Gel Formulations |

| By Packaging Type | Bulk Packaging (25-50 kg bags) Retail Packaging (500g-2kg) Eco-friendly Packaging Customized Industrial Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Plants | 100 | Plant Managers, Production Supervisors |

| Food Retailers | 80 | Category Managers, Purchasing Agents |

| Food Service Operators | 70 | Restaurant Owners, Menu Developers |

| Regulatory Bodies | 40 | Food Safety Inspectors, Compliance Officers |

| Research Institutions | 60 | Food Scientists, Market Analysts |

The Saudi Arabia Meat Stabilizers Blends Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the increasing demand for processed meat products and consumer preferences for high-quality meat that requires stabilizers for preservation and texture enhancement.