Region:Middle East

Author(s):Shubham

Product Code:KRAE0476

Pages:85

Published On:December 2025

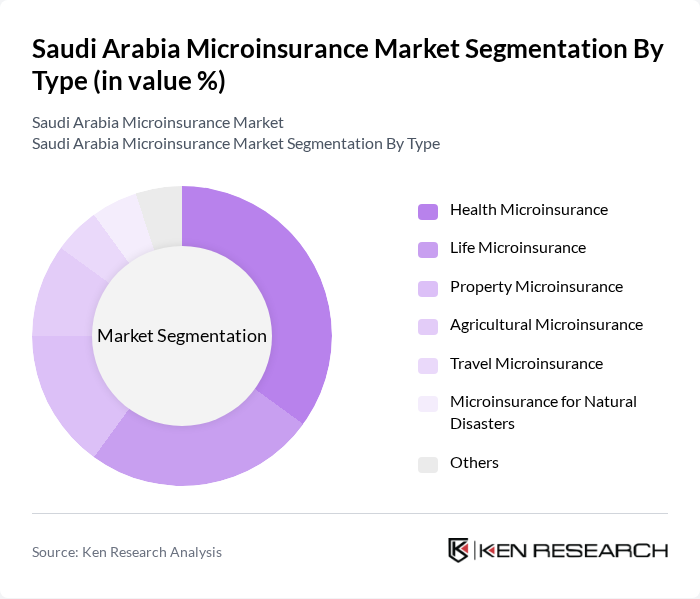

By Type:The microinsurance market in Saudi Arabia is segmented into various types, including Health Microinsurance, Life Microinsurance, Property Microinsurance, Agricultural Microinsurance, Travel Microinsurance, Microinsurance for Natural Disasters, and Others. Among these, Health Microinsurance is currently the dominant segment due to the increasing healthcare costs and the rising awareness of health-related risks among the population. The demand for affordable health coverage is further fueled by the growing informal workforce, which often lacks access to traditional health insurance. This trend is expected to continue as more individuals seek financial protection against health-related expenses.

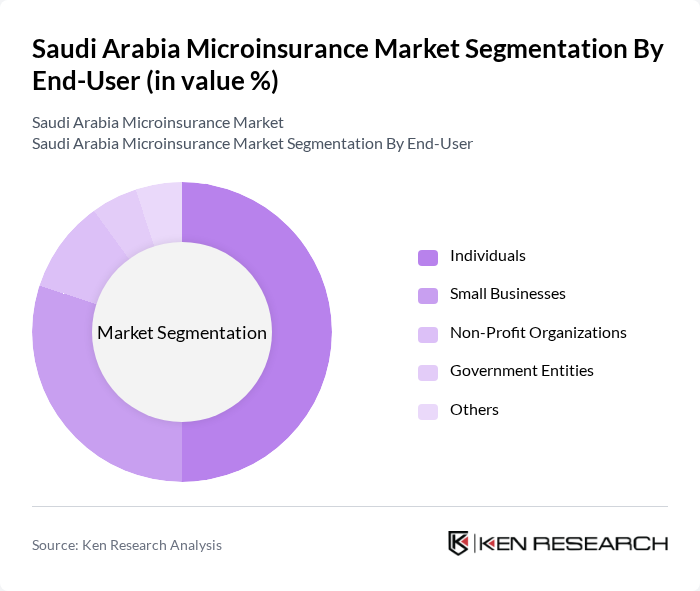

By End-User:The end-user segmentation of the microinsurance market includes Individuals, Small Businesses, Non-Profit Organizations, Government Entities, and Others. Individuals represent the largest segment, driven by the increasing need for personal financial security and the rising awareness of microinsurance products. The growing informal workforce, which often lacks access to traditional insurance, is a significant contributor to this trend. Small businesses also show a growing interest in microinsurance as they seek affordable coverage options to protect their assets and employees.

The Saudi Arabia Microinsurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, Saudi Arabian Insurance Company (SAICO), United Cooperative Assurance, Alinma Tokio Marine, Al-Ahlia Insurance Company, Al-Etihad Cooperative Insurance, Al-Jazira Takaful Taawuni Company, Al-Mawared Insurance, Al-Sagr Cooperative Insurance, Al-Bilad Insurance, Al-Faisal Takaful, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microinsurance market in Saudi Arabia appears promising, driven by ongoing government support and technological advancements. As financial literacy initiatives continue to gain traction, more consumers are expected to engage with microinsurance products. Additionally, the integration of artificial intelligence in underwriting processes is likely to enhance risk assessment and pricing strategies, making microinsurance more accessible and appealing to a broader demographic, particularly in rural areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Microinsurance Life Microinsurance Property Microinsurance Agricultural Microinsurance Travel Microinsurance Microinsurance for Natural Disasters Others |

| By End-User | Individuals Small Businesses Non-Profit Organizations Government Entities Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Partnerships with NGOs Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customizable Plans Others |

| By Premium Payment Frequency | Monthly Payments Quarterly Payments Annual Payments Others |

| By Risk Type | Low Risk Medium Risk High Risk Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Low-Income Households | 150 | Policyholders, Potential Customers |

| Insurance Agents and Brokers | 100 | Insurance Agents, Financial Advisors |

| Microfinance Institutions | 80 | Microfinance Managers, Loan Officers |

| Community Organizations | 70 | NGO Representatives, Community Leaders |

| Insurance Regulators | 50 | Regulatory Officials, Policy Makers |

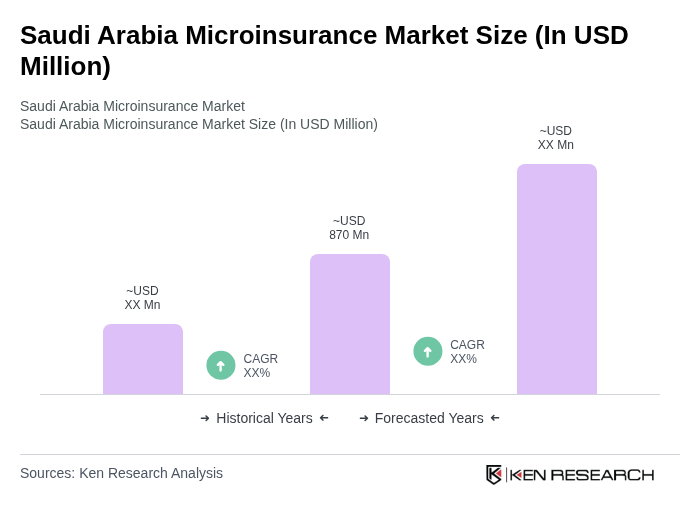

The Saudi Arabia Microinsurance Market is valued at approximately USD 870 million. This growth is attributed to expanding financial inclusion policies and the increasing demand for accessible protection among the informal workforce lacking traditional social security.