Region:Middle East

Author(s):Rebecca

Product Code:KRAB7367

Pages:84

Published On:October 2025

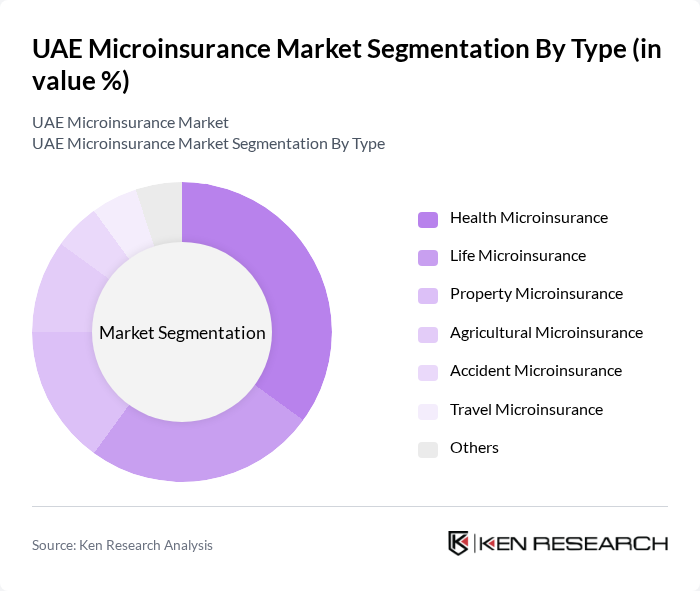

By Type:The microinsurance market can be segmented into various types, including Health Microinsurance, Life Microinsurance, Property Microinsurance, Agricultural Microinsurance, Accident Microinsurance, Travel Microinsurance, and Others. Among these, Health Microinsurance is currently the leading sub-segment, driven by the rising healthcare costs and the increasing need for affordable health coverage among low-income individuals. The demand for Life Microinsurance is also growing, as families seek financial security in the event of unforeseen circumstances.

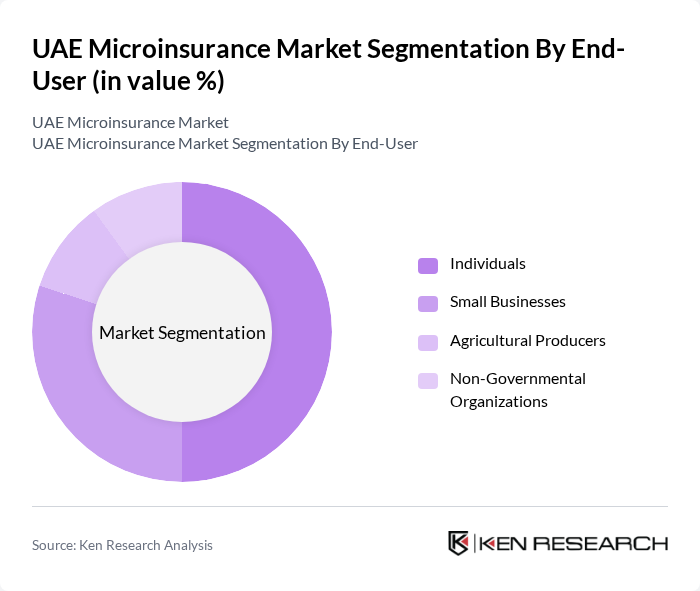

By End-User:The end-user segmentation includes Individuals, Small Businesses, Agricultural Producers, and Non-Governmental Organizations (NGOs). Individuals represent the largest segment, as many seek affordable insurance solutions to protect themselves and their families. Small businesses are also increasingly recognizing the importance of microinsurance to safeguard their operations against unforeseen events, while NGOs often play a crucial role in promoting microinsurance awareness among vulnerable populations.

The UAE Microinsurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Insurance Company, Abu Dhabi National Insurance Company, Oman Insurance Company, Al Ain Ahlia Insurance Company, Emirates Insurance Company, National General Insurance Company, Union Insurance Company, Orient Insurance Company, AXA Gulf Insurance, Qatar Insurance Company, Takaful Emarat, Daman National Health Insurance Company, Noor Takaful, Al Hilal Takaful, MetLife Alico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE microinsurance market appears promising, driven by technological advancements and increasing financial inclusion initiatives. As digital platforms expand, they will facilitate easier access to microinsurance products, particularly for low-income individuals. Furthermore, partnerships with NGOs and community organizations are expected to enhance outreach efforts, ensuring that more people are aware of and can benefit from these essential services. The integration of innovative distribution methods will likely reshape the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Microinsurance Life Microinsurance Property Microinsurance Agricultural Microinsurance Accident Microinsurance Travel Microinsurance Others |

| By End-User | Individuals Small Businesses Agricultural Producers Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Partnerships with NGOs |

| By Premium Range | Low Premium (< AED 100) Medium Premium (AED 100 - AED 500) High Premium (> AED 500) |

| By Policy Duration | Short-Term Policies (Less than 1 year) Long-Term Policies (1 year and above) |

| By Customer Segment | Low-Income Households Middle-Income Households Vulnerable Populations |

| By Product Complexity | Simple Products Moderate Complexity Products Complex Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Low-Income Households | 150 | Policyholders, Community Leaders |

| Microinsurance Providers | 100 | Product Managers, Marketing Executives |

| Financial Inclusion NGOs | 80 | Program Coordinators, Outreach Managers |

| Regulatory Bodies | 50 | Policy Analysts, Compliance Officers |

| Potential Policyholders | 120 | Low-Income Individuals, Small Business Owners |

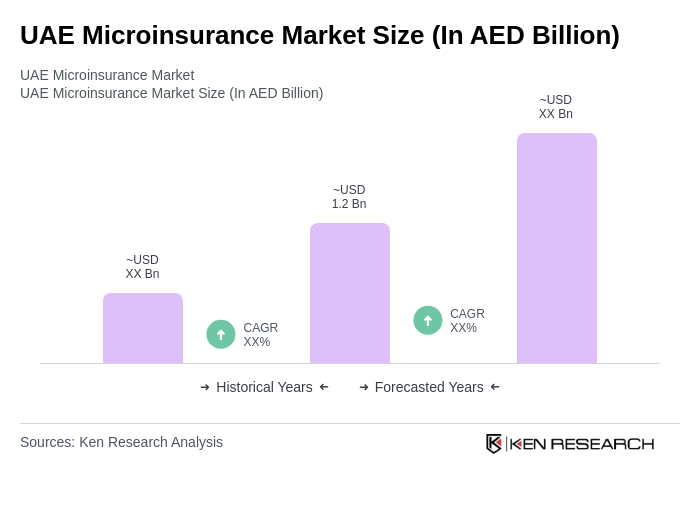

The UAE Microinsurance Market is valued at AED 1.2 billion, reflecting significant growth driven by increased awareness among low-income populations and government initiatives promoting financial inclusion.