Region:Middle East

Author(s):Dev

Product Code:KRAD5245

Pages:82

Published On:December 2025

By Mineral Type:The mineral supplements market is segmented into various types, including Calcium Supplements, Magnesium Supplements, Zinc Supplements, Iron Supplements, Potassium Supplements, Selenium & Chromium Supplements, Trace Mineral Blends (Multimineral), and Others (e.g., Phosphorus, Copper, Manganese). This structure is consistent with common single?mineral and multi?mineral classifications used in Saudi Arabia’s vitamin and mineral supplement reports. Among these, Calcium Supplements dominate the market due to their essential role in bone health and the increasing prevalence of osteoporosis and osteopenia among the aging and post?menopausal population. The growing awareness of the importance of calcium in daily nutrition, supported by physician recommendations and fortified dairy consumption, has led to a significant rise in demand for these supplements.

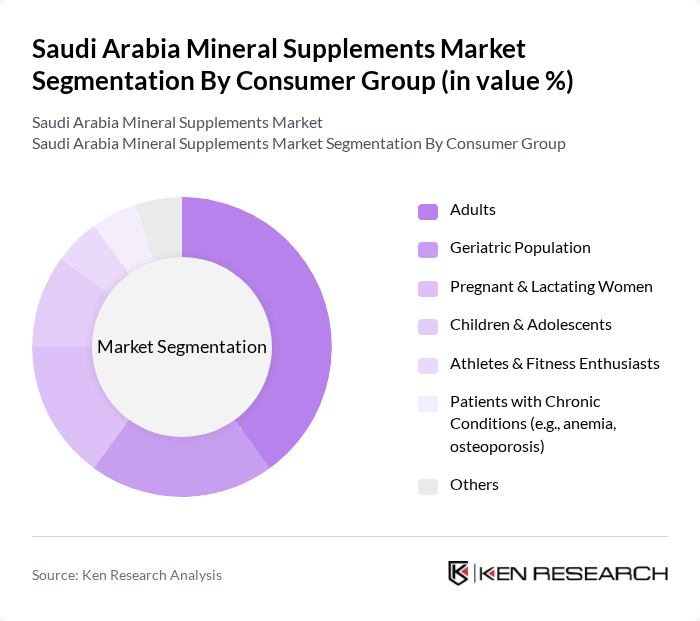

By Consumer Group:The consumer group segmentation includes Adults, Geriatric Population, Pregnant & Lactating Women, Children & Adolescents, Athletes & Fitness Enthusiasts, Patients with Chronic Conditions (e.g., anemia, osteoporosis), and Others. This segmentation aligns with typical application splits (adults and children) used in Saudi Arabia vitamin and mineral supplement market analyses. The Adult segment leads the market, driven by a growing focus on health and wellness, high prevalence of overweight and obesity, and wider adoption of preventive supplementation to address energy, immunity, and metabolic concerns. Adults are more likely to seek out supplements to fill nutritional gaps related to busy urban lifestyles and suboptimal diets, making this segment a key driver of market growth.

The Saudi Arabia Mineral Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jamjoom Pharma, SAJA Pharmaceuticals (Saudi Arabian Japanese Pharmaceutical Co.), Tabuk Pharmaceuticals, Spimaco Addwaeih (Saudi Pharmaceutical Industries & Medical Appliances Corp.), Almarai Co. (Fortified Dairy & Nutritional Products), Abbott Laboratories, Bayer AG, Pfizer Inc. (Centrum and Mineral Supplements Portfolio), GSK plc (Vitamins & Minerals Range), Nature’s Bounty Co. (The Bountiful Company), NOW Foods, Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, LLC, Vitabiotics Ltd. contribute to innovation, geographic expansion, and service delivery in this space through diversified mineral and multivitamin?mineral portfolios, localized marketing, and strong pharmacy and modern trade reach.

The Saudi Arabia mineral supplements market is poised for significant growth, driven by increasing health awareness and a focus on preventive healthcare. As consumers become more educated about nutrition, the demand for personalized and organic supplements is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that innovate and adapt to these trends will likely capture a larger share of the market in future.

| Segment | Sub-Segments |

|---|---|

| By Mineral Type | Calcium Supplements Magnesium Supplements Zinc Supplements Iron Supplements Potassium Supplements Selenium & Chromium Supplements Trace Mineral Blends (Multimineral) Others (e.g., Phosphorus, Copper, Manganese) |

| By Consumer Group | Adults Geriatric Population Pregnant & Lactating Women Children & Adolescents Athletes & Fitness Enthusiasts Patients with Chronic Conditions (e.g., anemia, osteoporosis) Others |

| By Distribution Channel | Hospital & Clinic Pharmacies Retail Pharmacies & Drugstores Supermarkets/Hypermarkets Specialty Health & Nutrition Stores Online Pharmacies & E-commerce Platforms Direct Selling Others |

| By Formulation | Tablets Capsules & Softgels Powders & Effervescent Granules Liquids Gummies & Chewables Others |

| By Packaging Type | Bottles & Jars Blister Packs & Strips Sachets & Stick Packs Pouches Others |

| By Price Range | Economy Mid-Range Premium Super Premium / Imported Niche Brands |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle & Health Orientation (e.g., fitness-focused, disease-management) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Healthcare Professional Perspectives | 100 | Nutritionists, General Practitioners |

| Consumer Behavior Analysis | 150 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channel Evaluation | 80 | Wholesalers, Distributors |

| Market Trend Insights | 90 | Market Analysts, Industry Experts |

The Saudi Arabia Mineral Supplements Market is valued at approximately USD 55 million, reflecting a growing trend driven by increased health awareness and the demand for nutritional supplements among consumers.