Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9105

Pages:85

Published On:November 2025

By Type:The mobile robotics market can be segmented into various types, including Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Collaborative Robots (Cobots), Service Robots, Industrial Robots, Humanoid Robots, Robotic Process Automation (RPA), and Others. Each of these subsegments plays a crucial role in addressing specific needs across different industries. AMRs are widely adopted for material handling and logistics, AGVs are prominent in manufacturing and warehousing, Cobots are increasingly used for collaborative tasks in production lines, and Service Robots are gaining traction in healthcare and hospitality. Industrial Robots remain central to automated manufacturing, while Humanoid Robots and RPA are emerging in customer service and administrative automation .

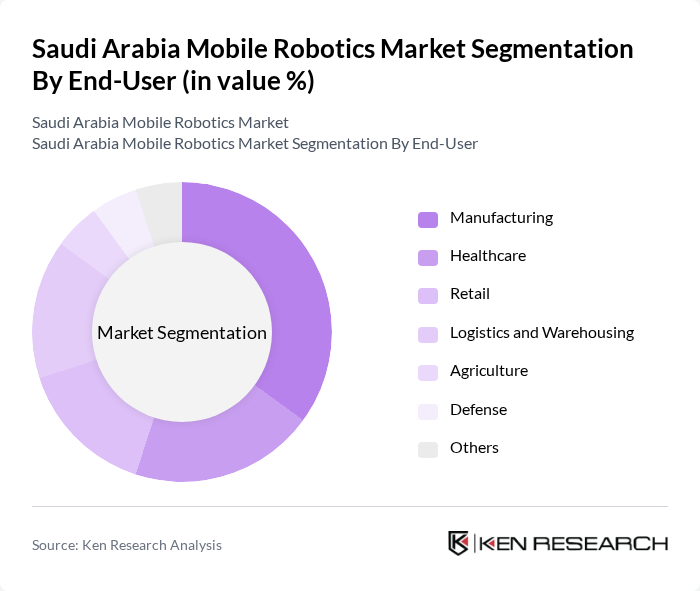

By End-User:The end-user segmentation of the mobile robotics market includes Manufacturing, Healthcare, Retail, Logistics and Warehousing, Agriculture, Defense, and Others. Each sector utilizes mobile robotics to enhance productivity, safety, and operational efficiency. Manufacturing leads adoption due to the need for automation in production and assembly, healthcare increasingly deploys service robots for patient care and surgical assistance, logistics and warehousing benefit from AMRs and AGVs for inventory management, and retail uses robots for customer service and inventory tracking. Agriculture and defense sectors are adopting robotics for precision tasks and security operations .

The Saudi Arabia Mobile Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Robotics, KUKA Robotics, FANUC Corporation, Yaskawa Electric Corporation, Omron Adept Technologies, Clearpath Robotics, Mobile Industrial Robots (MiR), Fetch Robotics, Boston Dynamics, iRobot Corporation, DJI Technology, SoftBank Robotics, Aethon, Savioke, Robotnik Automation, GMT Robotics, SIASUN Robot & Automation Co., Ltd., PAL Robotics, Neolix, OTSAW Digital, Saudi Technology Development and Investment Company (TAQNIA), Advanced Electronics Company (AEC), Al Salem Johnson Controls (YORK), SABB Tech, Alfanar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile robotics market in Saudi Arabia appears promising, driven by technological advancements and increasing automation across various sectors. As the government continues to invest in infrastructure and technology, the integration of robotics with IoT is expected to enhance operational efficiencies. Additionally, the rise of smart cities will create new avenues for mobile robotics applications, fostering innovation and collaboration between established firms and tech startups, ultimately shaping a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Mobile Robots (AMRs) Automated Guided Vehicles (AGVs) Collaborative Robots (Cobots) Service Robots Industrial Robots Humanoid Robots Robotic Process Automation (RPA) Others |

| By End-User | Manufacturing Healthcare Retail Logistics and Warehousing Agriculture Defense Others |

| By Application | Material Handling Assembly Line Automation Inspection and Quality Control Cleaning and Sanitation Surveillance and Security Surgical Assistance Customer Service Others |

| By Technology | AI and Machine Learning Computer Vision Sensor Technologies Navigation Systems Others |

| By Industry Vertical | Automotive Electronics Food and Beverage Pharmaceuticals Chemicals Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Automation | 50 | Warehouse Managers, Operations Directors |

| Healthcare Robotics | 40 | Healthcare Administrators, Robotics Engineers |

| Manufacturing Robotics | 45 | Production Managers, Quality Control Supervisors |

| Agricultural Robotics | 40 | Agronomists, Farm Equipment Managers |

| Retail Robotics | 40 | Store Managers, Supply Chain Analysts |

The Saudi Arabia Mobile Robotics Market is valued at approximately USD 1.2 billion, driven by advancements in automation technology and increased demand for efficiency across various sectors, including manufacturing, healthcare, and logistics.