Region:Middle East

Author(s):Rebecca

Product Code:KRAD4992

Pages:86

Published On:December 2025

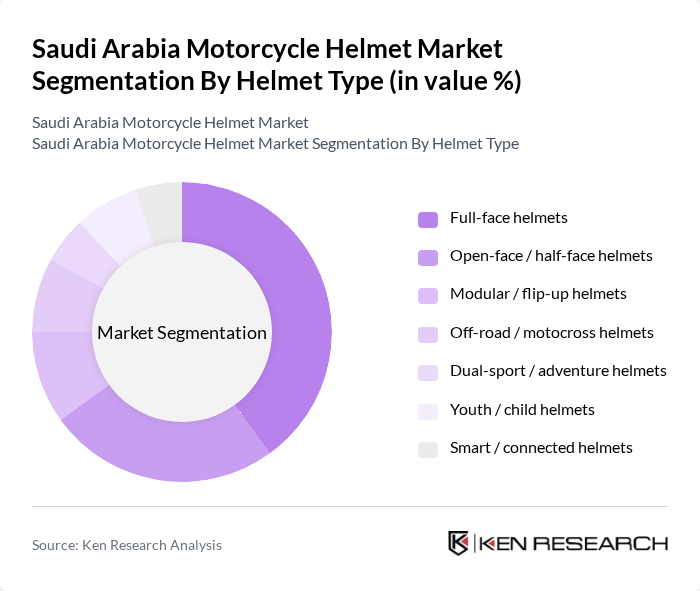

By Helmet Type:The market is segmented into various helmet types, including full-face helmets, open-face/half-face helmets, modular/flip-up helmets, off-road/motocross helmets, dual-sport/adventure helmets, youth/child helmets, and smart/connected helmets. Full-face helmets are currently the most popular choice among riders due to their comprehensive protection and aerodynamic design, making them ideal for both daily commuting and long-distance travel, consistent with regional and global patterns where full-face holds the largest share. Open-face helmets are also gaining traction, particularly among urban riders who prefer a more casual look and better ventilation for city riding. The demand for smart helmets is on the rise as technology integration—such as Bluetooth communication, navigation, and safety sensors—becomes a key factor in consumer purchasing decisions.

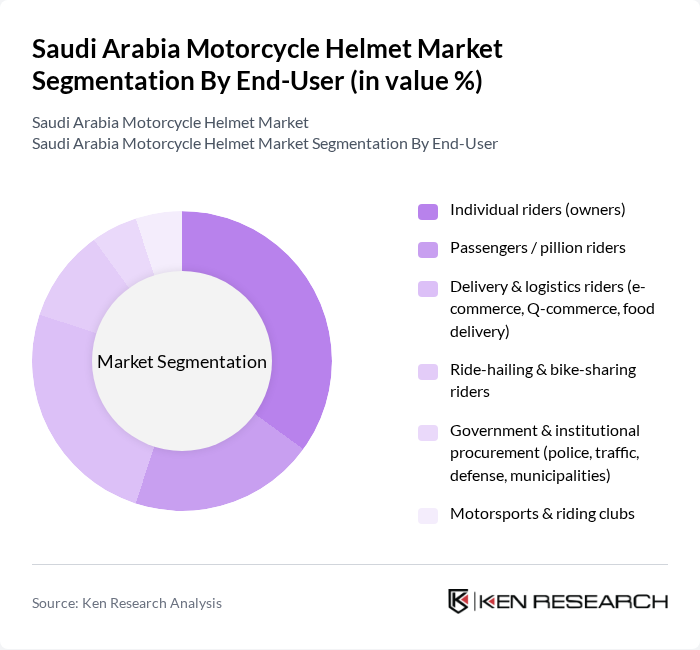

By End-User:The end-user segmentation includes individual riders (owners), passengers/pillion riders, delivery & logistics riders (e-commerce, Q-commerce, food delivery), ride-hailing & bike-sharing riders, government & institutional procurement (police, traffic, defense, municipalities), and motorsports & riding clubs. Individual riders represent the largest segment, driven by the increasing number of motorcycle owners in urban areas and rising disposable incomes. The rise of e-commerce and Q-commerce has also led to a significant increase in demand for helmets among delivery riders, as safety regulations and corporate policies for delivery platforms become more stringent. Additionally, government procurement for police and defense sectors, as well as municipal authorities responsible for traffic enforcement, contributes to the market's growth through bulk purchases of certified helmets.

The Saudi Arabia Motorcycle Helmet Market is characterized by a dynamic mix of regional and international players. Leading participants such as HJC Helmets (HJC Corp.), Shoei Co., Ltd., AGV (a brand of Dainese S.p.A.), Arai Helmet, Ltd., LS2 Helmets (Xiamen LS2 Helmet Co., Ltd.), Shark Helmets (Shark SAS), Nolan Helmets (Nolangroup S.p.A.), Bell Powersports (Vista Outdoor Inc.), ScorpionExo (Kido Sports Co., Ltd.), SMK Helmets (Studds Accessories Ltd.), MT Helmets (Manufacturas Tomás, S.A.), NEXX Helmets (NEXXPRO S.A.), KYT Helmets, Caberg S.p.A., Royal Enfield (helmet & riding gear division) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia motorcycle helmet market is poised for significant growth, driven by increasing motorcycle ownership and a cultural shift towards safety. As the government continues to promote road safety initiatives, consumer awareness will likely rise, leading to higher helmet adoption rates. Additionally, advancements in helmet technology, such as smart helmets, will attract tech-savvy consumers. The expansion of urban infrastructure will further facilitate motorcycle use, creating a favorable environment for market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Helmet Type | Full-face helmets Open-face / half-face helmets Modular / flip-up helmets Off-road / motocross helmets Dual-sport / adventure helmets Youth / child helmets Smart / connected helmets |

| By End-User | Individual riders (owners) Passengers / pillion riders Delivery & logistics riders (e-commerce, Q-commerce, food delivery) Ride-hailing & bike-sharing riders Government & institutional procurement (police, traffic, defense, municipalities) Motorsports & riding clubs |

| By Distribution Channel | Offline retail – multi-brand dealers & motorcycle showrooms Offline retail – specialty helmet & riding-gear stores Offline retail – hypermarkets & sports/outdoor stores Online marketplaces (e.g., Amazon.sa, Noon) OEM / brand webstores & apps Government / institutional procurement channels |

| By Shell Material | Thermoplastic (ABS, polycarbonate) Fiberglass composites Carbon fiber & carbon-composite Advanced composites (Kevlar, multi-composite) Others |

| By Price Range (Retail) | Economy helmets (? SAR 250) Value / mid-range helmets (SAR 251–700) Premium helmets (SAR 701–1,500) Super-premium & luxury helmets (> SAR 1,500) |

| By Certification / Standard | SASO / Gulf standards compliant helmets ECE 22.05 / ECE 22.06 certified helmets DOT / Snell & other international standards Non-certified / informal segment |

| By Usage Type | Daily commuting Recreational / weekend riding Professional & amateur racing / track use Off-road / desert & adventure touring Delivery & last-mile logistics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Motorcycle Riders | 150 | Casual Riders, Commuters, Enthusiasts |

| Helmet Retailers | 100 | Store Managers, Sales Representatives |

| Safety Regulators | 50 | Policy Makers, Safety Inspectors |

| Motorcycle Manufacturers | 75 | Product Development Managers, Marketing Executives |

| Consumer Safety Advocates | 40 | Non-profit Representatives, Community Leaders |

The Saudi Arabia Motorcycle Helmet Market is valued at approximately SAR 1.0 billion. This valuation is based on a five-year historical analysis and regional benchmarking against Middle East and Africa helmet market data, reflecting significant growth driven by increased motorcycle ownership and safety awareness.