Region:Middle East

Author(s):Dev

Product Code:KRAD7682

Pages:83

Published On:December 2025

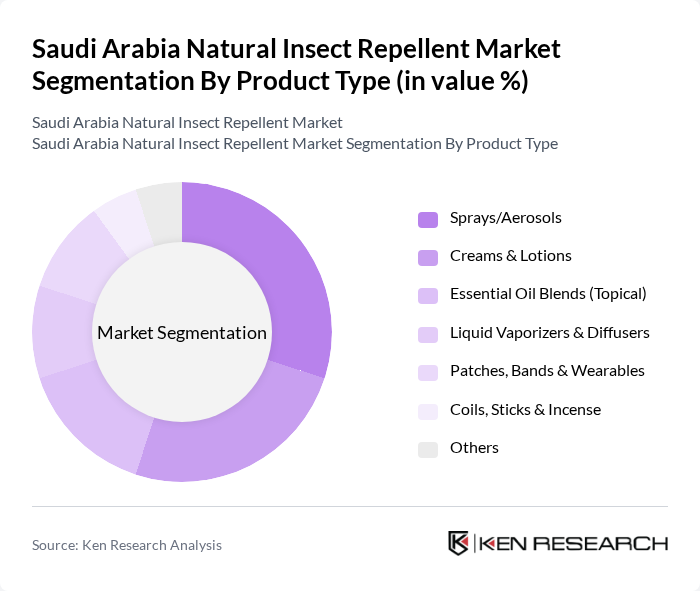

By Product Type:The product type segmentation includes various forms of natural insect repellents that cater to different consumer preferences and usage scenarios. The subsegments are as follows:

The product type segmentation reveals that sprays/aerosols dominate the market due to their convenience, quick coverage, and suitability for both households and travel use. Consumers prefer these formats for outdoor activities and travel, as they provide immediate protection against insects. Creams and lotions follow closely, appealing to those seeking longer-lasting effects, skin-conditioning benefits, and child-friendly options. Essential oil blends are gaining traction among health-conscious consumers looking for DEET?free and plant-based alternatives, while liquid vaporizers and diffusers are popular for indoor, overnight, and family environments. The market is witnessing a gradual increase in demand for innovative formats like patches and wearables, driven by consumer interest in hands-free, on-the-go solutions and by e?commerce visibility for imported brands.

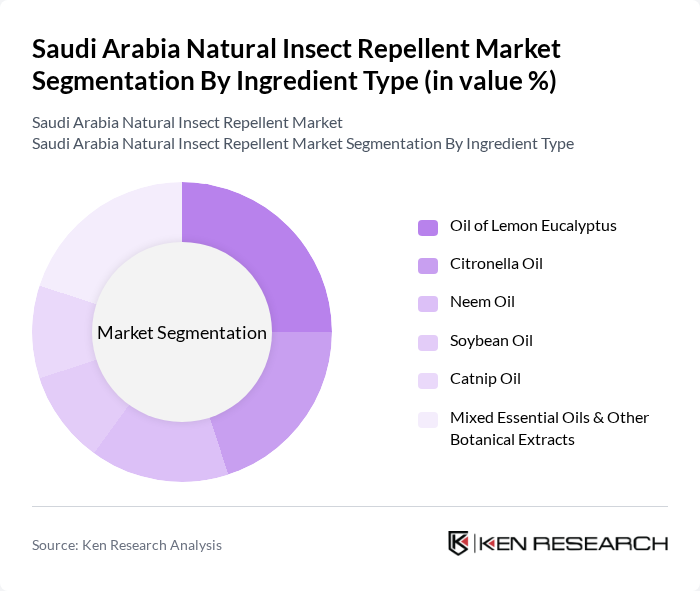

By Ingredient Type:The ingredient type segmentation focuses on the natural components used in insect repellents, which are crucial for attracting health-conscious consumers. The subsegments are as follows:

The ingredient type segmentation indicates that oil of lemon eucalyptus is the leading component due to its proven efficacy in repelling mosquitoes and ticks and its recognition in international public health guidance as a plant-based active, appealing to consumers looking for effective yet safe options. Citronella oil follows closely, known for its characteristic scent and effectiveness against mosquitoes in candles, sprays, and diffusers. Neem oil is gaining popularity for its multifunctional insecticidal and skincare properties, while mixed essential oils (such as eucalyptus, peppermint, lavender, and lemongrass) are favored for their versatility, aromatherapy value, and holistic appeal. The market is also seeing a rise in the use of soybean and catnip oils, reflecting consumer interest in diverse natural ingredients and in formulations perceived as gentler for children and sensitive skin.

The Saudi Arabia Natural Insect Repellent Market is characterized by a dynamic mix of regional and international players. Leading participants such as SC Johnson & Son Inc. (OFF! & Other Natural Lines), Reckitt Benckiser Group plc (Mortein NaturGard & Related Lines), Godrej Consumer Products Ltd. (Goodknight Naturals), Dabur India Ltd. (Dabur Odomos Natural Range), Himalaya Wellness Company (Herbal Personal Care & Repellents), Pigeon Corporation, Johnson & Johnson (Inc. Natural Baby & Family Repellent Products), Beiersdorf AG (NIVEA & Related Personal Care with Natural Repellent Lines), Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Jamjoom Pharma, Nahdi Medical Co. (Private Label & Distributed Natural Repellents), online pharmacies like Al-Dawaa Medical Services Co. (Private Label & Distributed Natural Repellents), Life Pharmacy (Gulf-based Chain Active in Saudi Arabia), Key Local Organic & Natural Personal Care Brands (e.g., Sukoon, Nature’s Gate Distributors, Others), Leading E-commerce Platforms for Natural Repellents (e.g., Noon, Amazon.sa, local specialty sites) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural insect repellent market in Saudi Arabia appears promising, driven by increasing consumer demand for health-conscious and environmentally friendly products. As awareness grows, manufacturers are likely to invest in innovative formulations that cater to consumer preferences. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, allowing for increased market penetration and consumer engagement, ultimately fostering a more sustainable market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sprays/Aerosols Creams & Lotions Essential Oil Blends (Topical) Liquid Vaporizers & Diffusers Patches, Bands & Wearables Coils, Sticks & Incense Others |

| By Ingredient Type | Oil of Lemon Eucalyptus Citronella Oil Neem Oil Soybean Oil Catnip Oil Mixed Essential Oils & Other Botanical Extracts |

| By Application | Personal Care (Skin-Applied) Household Indoor Use Outdoor & Recreational Use Healthcare & Public Health Programs Others |

| By End-User | Residential Households Hospitality & Tourism (Hotels, Resorts, Camps, Hajj & Umrah Facilities) Commercial & Retail Establishments Healthcare Facilities & Clinics Government & Municipal Bodies Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drug Stores Specialty Organic & Health Stores Online Retail & E-commerce Platforms Convenience Stores & Grocery Stores Others |

| By Target Insect | Mosquitoes Flies Ticks Sandflies & Midges Others |

| By Region | Central Region (Including Riyadh) Western Region (Including Makkah, Madinah, Jeddah) Eastern Region (Including Dammam, Al Khobar) Southern Region (Including Asir, Jizan, Najran) Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Household Decision Makers, Eco-conscious Consumers |

| Manufacturer Feedback | 80 | Production Managers, R&D Heads |

| Distribution Channel Analysis | 70 | Logistics Coordinators, Supply Chain Managers |

| Market Trend Evaluation | 90 | Market Analysts, Industry Experts |

The Saudi Arabia Natural Insect Repellent Market is valued at approximately USD 35 million, reflecting a growing consumer preference for natural and organic products over synthetic alternatives.