Region:Middle East

Author(s):Dev

Product Code:KRAC2083

Pages:92

Published On:October 2025

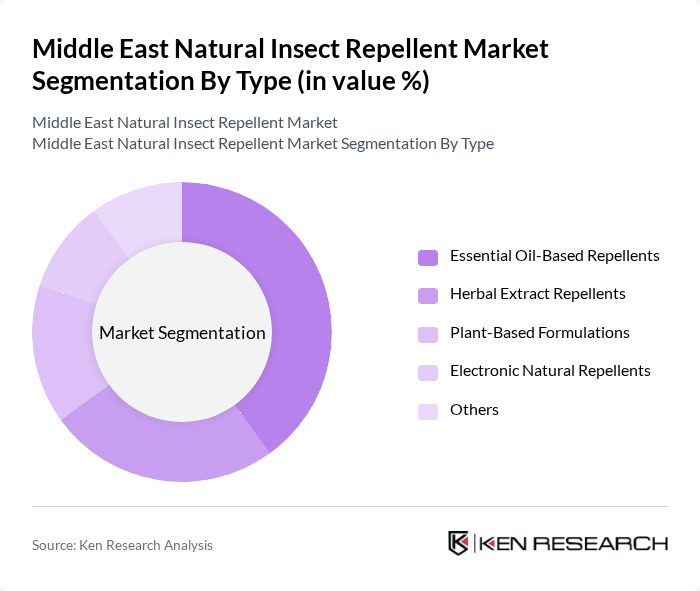

By Type:The market is segmented into various types of natural insect repellents, including essential oil-based repellents, herbal extract repellents, plant-based formulations, electronic natural repellents, and others. Among these, essential oil-based repellents are gaining significant traction due to their effectiveness and consumer preference for natural ingredients such as citronella, eucalyptus, peppermint, and neem. Herbal extract repellents remain popular in regions where traditional remedies are favored. The electronic natural repellents segment is emerging as a modern solution, appealing to tech-savvy consumers seeking non-chemical alternatives .

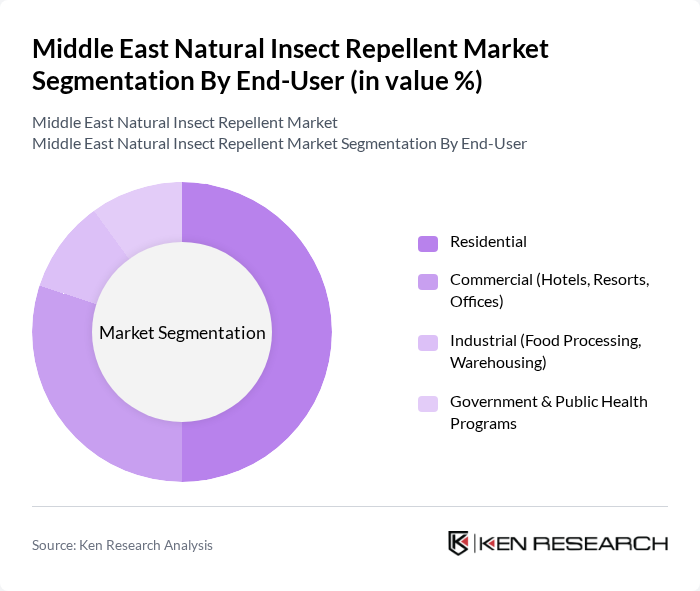

By End-User:The end-user segmentation includes residential, commercial (hotels, resorts, offices), industrial (food processing, warehousing), and government & public health programs. The residential segment is the largest, driven by increasing consumer awareness of health risks associated with insect bites and the convenience of home-use products. The commercial segment is significant, as hotels and resorts prioritize guest safety and comfort. Industrial users, such as food processing and warehousing, focus on compliance and hygiene standards. Government programs increasingly emphasize vector control and public health initiatives, further driving demand .

The Middle East Natural Insect Repellent Market is characterized by a dynamic mix of regional and international players. Leading participants such as SC Johnson & Son (OFF! Botanicals), Godrej Consumer Products Ltd. (Goodknight Naturals), Reckitt Benckiser Group plc (Mortein NaturGard), Dabur International Ltd. (Odomos Natural), Spectrum Brands Holdings, Inc. (Repel Naturals), Herbal Armor (All Terrain Company), Murphy's Naturals, Green Cross Inc. (Green Cross Herbal), Quantum Health (Buzz Away Extreme), EcoSMART Technologies, Enesis Group (Soffell), Al Ain National Factory for Insecticides (UAE), Saudi Modern Factory Co. (Saudi Arabia), BASF SE (Mosquito Stop), Bayer AG (Baygon Natural Line) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East natural insect repellent market appears promising, driven by increasing consumer demand for health-conscious products and sustainable practices. As awareness of the adverse effects of synthetic chemicals grows, companies are likely to innovate and expand their product lines. Additionally, the rise of e-commerce platforms will facilitate greater access to natural products, enabling brands to reach a broader audience. Collaborations with eco-friendly organizations will further enhance market visibility and credibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Essential Oil-Based Repellents Herbal Extract Repellents Plant-Based Formulations Electronic Natural Repellents Others |

| By End-User | Residential Commercial (Hotels, Resorts, Offices) Industrial (Food Processing, Warehousing) Government & Public Health Programs |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales (B2B, Institutional) |

| By Packaging Type | Spray Bottles Roll-Ons Wipes Sachets & Pouches Others |

| By Price Range | Economy Mid-Range Premium |

| By Formulation | Liquid Gel Cream Solid (Sticks, Bars) |

| By Brand Positioning | Eco-Friendly Brands Luxury Brands Mass Market Brands Local/Regional Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | End Consumers, Health-Conscious Shoppers |

| Manufacturer Feedback | 80 | Product Managers, R&D Specialists |

| Distribution Channel Analysis | 60 | Logistics Coordinators, Supply Chain Analysts |

| Environmental Impact Assessment | 40 | Environmental Scientists, Regulatory Affairs Experts |

The Middle East Natural Insect Repellent Market is valued at approximately USD 1.0 billion, reflecting a significant growth trend driven by consumer preferences for natural products and increasing awareness of health and environmental issues.