Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6036

Pages:90

Published On:December 2025

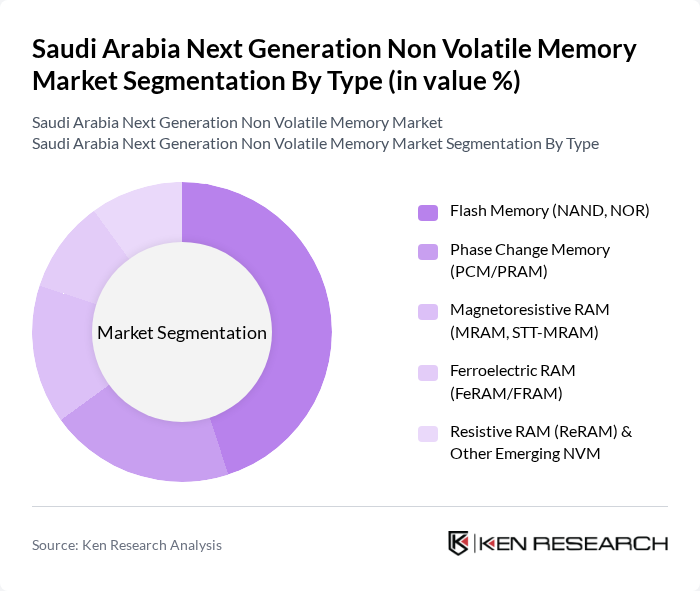

By Type:The market is segmented into various types of non-volatile memory technologies, including Flash Memory (NAND, NOR), Phase Change Memory (PCM/PRAM), Magnetoresistive RAM (MRAM, STT-MRAM), Ferroelectric RAM (FeRAM/FRAM), and Resistive RAM (ReRAM) & Other Emerging NVM. Among these, Flash Memory remains the most widely used due to its cost-effectiveness, maturity of the ecosystem, and high storage density, making it a preferred choice for consumer electronics, solid-state drives in data centers, and embedded storage in industrial and automotive applications.

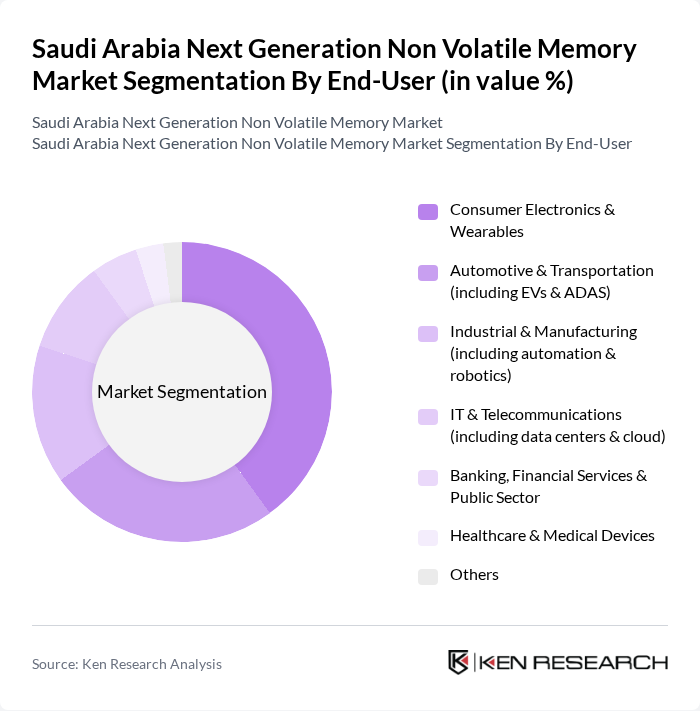

By End-User:The end-user segmentation includes Consumer Electronics & Wearables, Automotive & Transportation (including EVs & ADAS), Industrial & Manufacturing (including automation & robotics), IT & Telecommunications (including data centers & cloud), Banking, Financial Services & Public Sector, Healthcare & Medical Devices, and Others. The Consumer Electronics segment leads the market, driven by the increasing adoption of smartphones, tablets, gaming devices, and wearables that require efficient, low?power, and high-capacity memory solutions, while rapid cloud, 5G, and smart manufacturing rollouts in Saudi Arabia are accelerating demand from IT, telecom, and industrial segments.

The Saudi Arabia Next Generation Non Volatile Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., SK hynix Inc., Micron Technology, Inc., Kioxia Corporation, Western Digital Corporation, Intel Corporation (including legacy Optane/3D XPoint portfolio), Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Texas Instruments Incorporated, Winbond Electronics Corporation, Macronix International Co., Ltd., Microchip Technology Inc., Fujitsu Semiconductor Memory Solution Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia next-generation non-volatile memory market appears promising, driven by technological advancements and government support. As the Kingdom continues to invest in digital infrastructure, the integration of memory with processing units is expected to enhance performance across various sectors. Additionally, the focus on energy-efficient solutions will likely lead to innovations that address both performance and sustainability, positioning Saudi Arabia as a regional leader in memory technology in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Flash Memory (NAND, NOR) Phase Change Memory (PCM/PRAM) Magnetoresistive RAM (MRAM, STT?MRAM) Ferroelectric RAM (FeRAM/FRAM) Resistive RAM (ReRAM) & Other Emerging NVM |

| By End-User | Consumer Electronics & Wearables Automotive & Transportation (including EVs & ADAS) Industrial & Manufacturing (including automation & robotics) IT & Telecommunications (including data centers & cloud) Banking, Financial Services & Public Sector Healthcare & Medical Devices Others |

| By Application | Enterprise & Cloud Data Storage Embedded Systems & Microcontrollers High-Performance Computing & AI Accelerators IoT Devices & Edge Computing Nodes Mobile & Client Computing (smartphones, tablets, PCs) Others |

| By Technology | D NAND & 3D XPoint-Class Technologies D/Planar NAND Embedded NVM (eMMC, UFS, eMRAM, ePCM) Other Emerging Memory Technologies |

| By Distribution Channel | Direct Sales to OEMs & Hyperscalers Global & Regional Distributors Online B2B Platforms Retail & System Integrators |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Dhahran, Khobar) Western Region (including Jeddah, Makkah, Madinah, NEOM) Southern Region Northern Region |

| By Policy Support | Government Subsidies & Investment Funds (e.g., PIF, SIDF) Tax Incentives & Customs Exemptions Research Grants & Innovation Programs (e.g., Vision 2030, SDAIA, KAUST) Local Content & Localization Programs (e.g., NIDLP, IKTVA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Managers, Technology Directors |

| Automotive Sector Suppliers | 100 | Supply Chain Managers, Engineering Leads |

| Industrial Automation Firms | 90 | Operations Managers, Technical Directors |

| Telecommunications Equipment Providers | 80 | Network Engineers, Product Development Managers |

| Research Institutions and Universities | 60 | Academic Researchers, Technology Analysts |

The Saudi Arabia Next Generation Non Volatile Memory Market is valued at approximately USD 140 million, reflecting its share within the global market, which is estimated at around USD 67 billion. This growth is driven by various technological advancements and sector demands.