Region:Middle East

Author(s):Shubham

Product Code:KRAD6627

Pages:100

Published On:December 2025

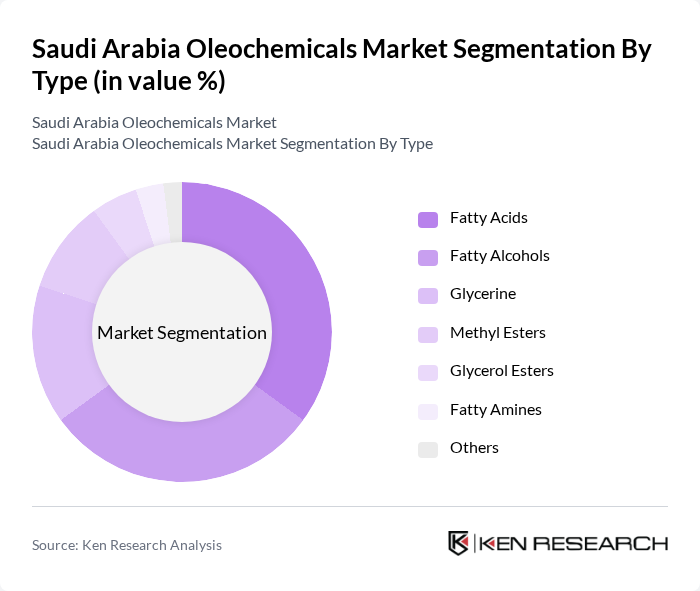

By Type:The oleochemicals market in Saudi Arabia is segmented into various types, including fatty acids, fatty alcohols, glycerine, methyl esters, glycerol esters, fatty amines, and others, in line with global product categorization for oleochemicals. Among these, fatty acids and fatty alcohols are the most prominent due to their extensive applications in soaps and detergents, personal care, cosmetics, surfactants, and a range of industrial formulations. The increasing demand for natural, plant-based, and biodegradable ingredients in home and personal care products, as well as in lubricants and plastic additives, is driving the growth of these segments.

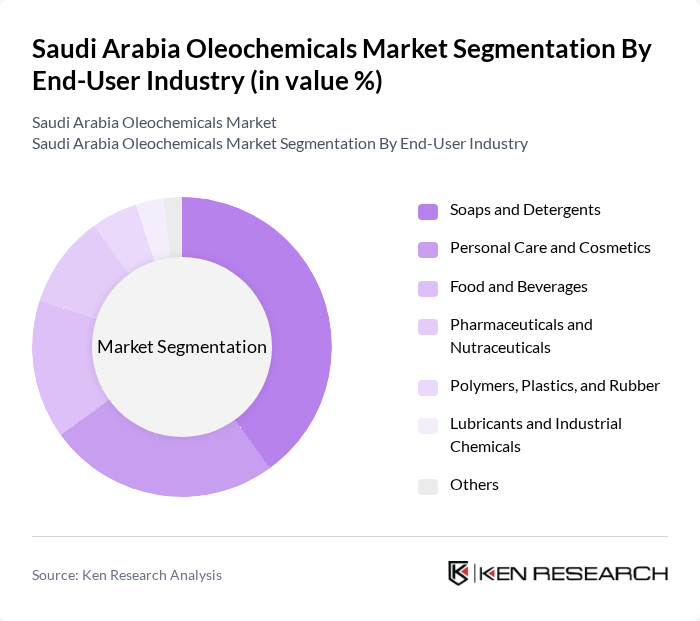

By End-User Industry:The end-user industries for oleochemicals in Saudi Arabia include soaps and detergents, personal care and cosmetics, food and beverages, pharmaceuticals and nutraceuticals, polymers, plastics, and rubber, lubricants and industrial chemicals, and others, consistent with global application patterns. The soaps and detergents segment is the largest due to the high demand for surfactants and cleaning products in both household and institutional cleaning, reinforced by heightened hygiene awareness and population growth in the region. Growing use of oleochemical-based emulsifiers, humectants, and texturizers in personal care, cosmetics, and food applications further supports downstream demand.

The Saudi Arabia Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Kayan Petrochemical Company, Saudi Arabian Oil Company (Saudi Aramco), Saudi Industrial Investment Group (SIIG), Alujain Corporation, Tasnee – National Industrialization Company, Saudi Acrylic Acid Company (SAAC), Saudi Chevron Phillips Company, Rabigh Refining and Petrochemical Company (Petro Rabigh), Wilmar International Limited, Kuala Lumpur Kepong Berhad (KLK) – Oleochemicals Division, Emery Oleochemicals, BASF SE, Croda International Plc, Cargill, Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia oleochemicals market is poised for significant transformation, driven by increasing consumer demand for sustainable products and government support for green initiatives. As the country invests in renewable energy and eco-friendly technologies, the oleochemicals sector will likely see innovations in product applications. Additionally, the rising popularity of natural ingredients in personal care and food industries will further enhance market growth, creating a robust landscape for future investments and developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Fatty Acids Fatty Alcohols Glycerine Methyl Esters Glycerol Esters Fatty Amines Others |

| By End-User Industry | Soaps and Detergents Personal Care and Cosmetics Food and Beverages Pharmaceuticals and Nutraceuticals Polymers, Plastics, and Rubber Lubricants and Industrial Chemicals Others |

| By Application | Soaps and Household Cleaning Products Industrial and Institutional Cleaners Personal Care Formulations (Emollients, Surfactants, Emulsifiers) Food Emulsifiers and Additives Lubricants, Greases, and Metalworking Fluids Plasticizers, Coatings, and Resins Biofuels and Biodiesel Others |

| By Feedstock Source | Imported Vegetable Oils (Palm, Palm Kernel, Coconut, Soy, Rapeseed, Sunflower) Local and Imported Animal Fats (Tallow and Others) Mixed / Blended Feedstock Others |

| By Sales Channel | Direct Sales to FMCG and Industrial Customers Distributors and Chemical Traders Trading Houses and Importers Online B2B Platforms Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Jubail and Dammam) Western Region (including Jeddah, Makkah, and Madinah) Southern Region Northern Region |

| By Product Form | Liquid Solid / Flakes Powder / Granules Pastes and Gels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fatty Acids Production | 100 | Production Managers, Quality Control Supervisors |

| Glycerol Market Insights | 80 | Sales Directors, Product Managers |

| Surfactants Application in Personal Care | 70 | R&D Managers, Marketing Executives |

| Bio-based Chemicals Adoption | 60 | Sustainability Officers, Regulatory Affairs Managers |

| Oleochemical Supply Chain Dynamics | 90 | Logistics Coordinators, Procurement Specialists |

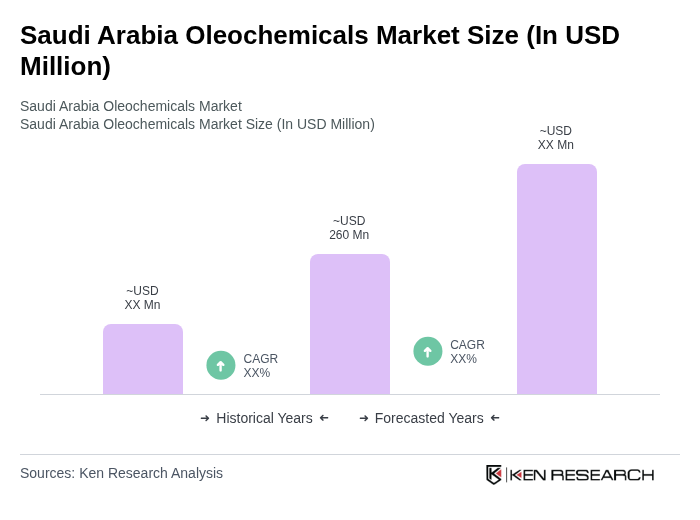

The Saudi Arabia Oleochemicals Market is valued at approximately USD 260 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by increasing demand for bio-based and biodegradable products across various industries.