Saudi Arabia Online Loan and Fintech Lending Market Overview

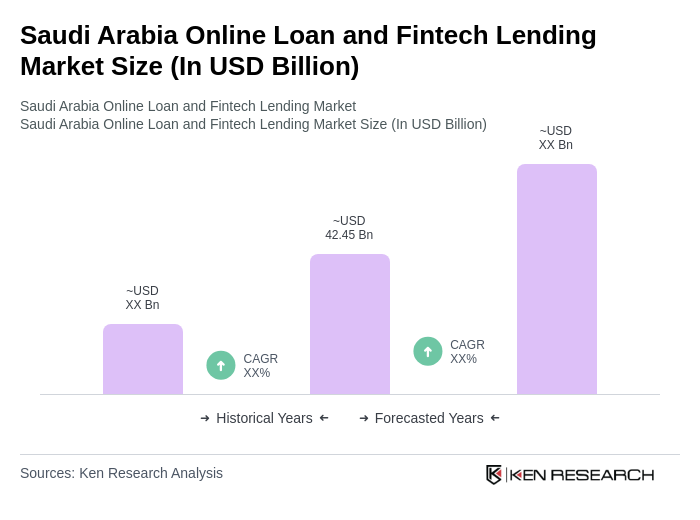

- The Saudi Arabia Online Loan and Fintech Lending Market is valued at approximately USD 42.45 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of digital financial services, a growing young and tech-savvy population, and the government’s Vision 2030 initiative, which actively promotes digital transformation and a cashless economy. The rise in smartphone penetration and high-speed internet access has enabled seamless, paperless loan applications and instant approvals, significantly expanding the market’s reach, including in rural and underserved areas where traditional banking is limited. The integration of artificial intelligence and machine learning in credit scoring and risk assessment is further accelerating the adoption of digital lending platforms, offering more personalized and efficient financial products.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their economic activities and concentration of financial institutions. Riyadh, being the capital, serves as a financial hub, while Jeddah’s port facilitates trade and commerce, leading to a higher demand for financial services. Dammam, with its industrial base, also contributes to the growing need for loans and fintech solutions.

- The Saudi Arabian Monetary Authority (SAMA) has implemented the “Regulatory Framework for Licensed Digital Banks and Digital-Only Banks” and the “Rules for Finance Companies” to enhance consumer protection in the fintech lending sector. These regulations mandate clear disclosure of loan terms and conditions, transparency in interest rates, and responsible lending practices. Compliance requirements include obtaining a SAMA license for digital lending operations, adhering to strict disclosure standards, and maintaining robust risk management frameworks. These measures are designed to foster trust, stability, and consumer confidence in the rapidly evolving fintech lending landscape.

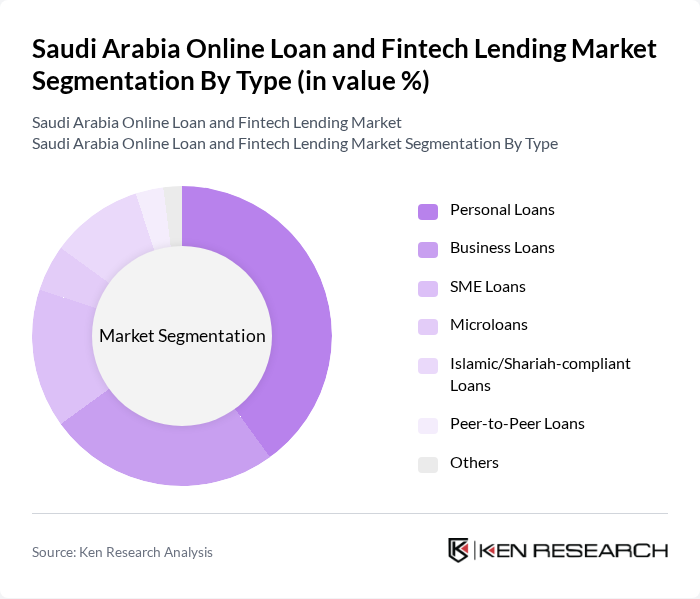

Saudi Arabia Online Loan and Fintech Lending Market Segmentation

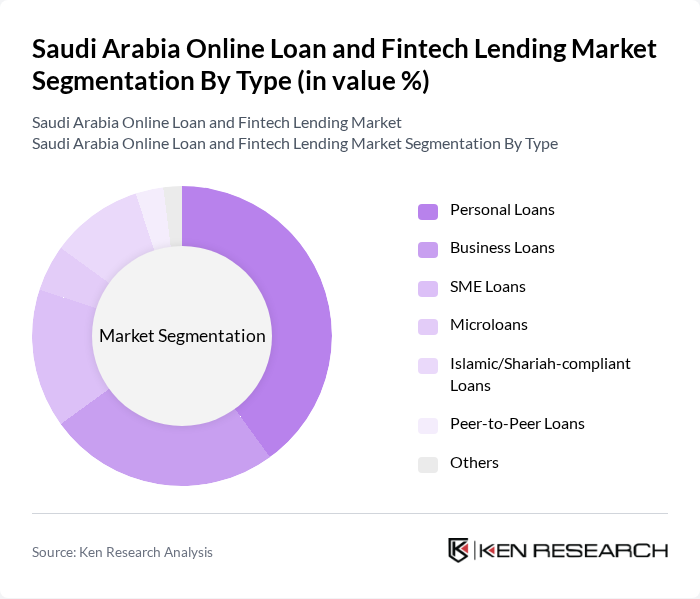

By Type:The market is segmented into various types of loans, including personal loans, business loans, SME loans, microloans, Islamic/Shariah-compliant loans, peer-to-peer loans, and others. Personal loans are currently the most dominant segment, driven by consumer demand for quick and accessible financing options. Business loans and SME loans are also significant, reflecting the growing entrepreneurial spirit in the region. The emergence of peer-to-peer lending platforms is broadening borrowing options and increasing market flexibility.

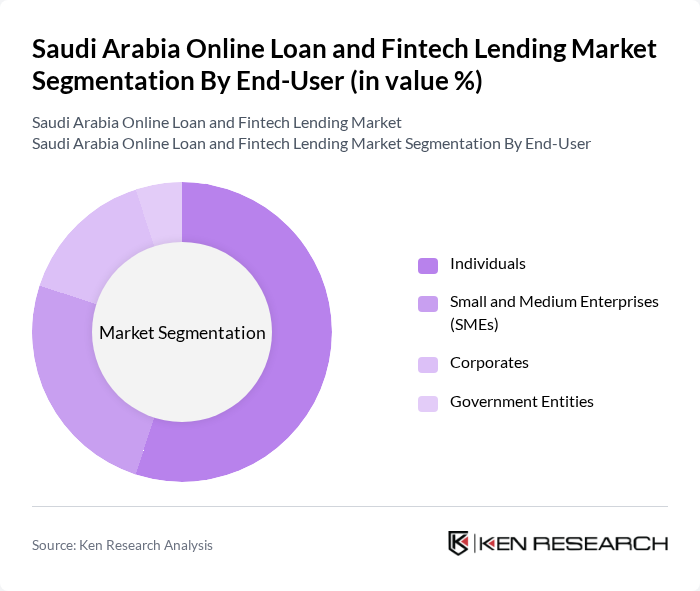

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and government entities. Individuals represent the largest segment, driven by the increasing need for personal financing solutions. SMEs are also a significant user group, as they seek funding for growth and operational needs, reflecting the entrepreneurial landscape in Saudi Arabia. Improved financial inclusion efforts are making it easier for underserved individuals and small businesses to access credit through digital platforms.

Saudi Arabia Online Loan and Fintech Lending Market Competitive Landscape

The Saudi Arabia Online Loan and Fintech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lendo, Tamam, Sulfah, Rasanah Technologies, Alinma Bank, Riyad Bank, STC Pay, Hala, Al Rajhi Bank, National Commercial Bank (NCB), Foodics, Sure, Fleap, PayTabs, Bidaya Home Finance contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Online Loan and Fintech Lending Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital economy in Saudi Arabia is estimated at approximately $15 billion, supported by an internet penetration rate of about 99%. This surge in digital engagement facilitates online loan applications, making financial services more accessible. The government’s Vision 2030 initiative aims to enhance digital infrastructure, which is expected to further boost fintech adoption. As more consumers embrace digital platforms, the demand for online loans is anticipated to grow significantly, enhancing market dynamics.

- Rising Demand for Quick Financing:The demand for quick financing solutions continues to increase, with personal loans outstanding at approximately SAR 53 billion. This growth is fueled by a young population, with about 63% under 30 years old, who prefer instant financial solutions. The convenience of online applications and rapid approval processes cater to this demographic's needs, driving the online loan market. As consumer behavior shifts towards immediacy, fintech companies are well-positioned to capitalize on this trend.

- Government Support for Fintech Innovations:The Saudi government has allocated SAR 1 billion to support fintech initiatives as part of its Vision 2030 strategy. This funding aims to foster innovation and enhance the regulatory framework for fintech companies. Additionally, the establishment of the Financial Technology Sandbox allows startups to test new products in a controlled environment. Such government backing is crucial for the growth of the online loan market, encouraging investment and innovation in financial technologies.

Market Challenges

- Regulatory Compliance Issues:Fintech companies in Saudi Arabia face stringent regulatory compliance requirements, which can hinder operational efficiency. The Central Bank of Saudi Arabia has implemented rigorous licensing processes, requiring companies to meet specific capital and operational standards. Compliance costs are reported to be increasing, impacting profitability. Navigating these regulations can be challenging for new entrants, potentially stifling innovation and market growth.

- Consumer Trust and Security Concerns:Security breaches and data privacy issues remain significant challenges for the fintech sector. A notable percentage of consumers expressed concerns about the safety of their financial data with online lenders. This lack of trust can deter potential customers from utilizing online loan services. As the market grows, fintech companies must invest in robust cybersecurity measures to build consumer confidence and ensure the protection of sensitive information.

Saudi Arabia Online Loan and Fintech Lending Market Future Outlook

The future of the online loan and fintech lending market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals are likely to engage with fintech solutions. Additionally, the integration of artificial intelligence in loan processing is expected to enhance efficiency and customer experience. The market is poised for growth as fintech companies innovate and adapt to meet the changing needs of consumers, fostering a more inclusive financial ecosystem.

Market Opportunities

- Untapped Rural Markets:Approximately 16% of Saudi Arabia's population resides in rural areas, presenting a significant opportunity for fintech companies. By offering tailored online loan products to these underserved communities, companies can expand their customer base. The increasing penetration of mobile internet in these regions further supports this opportunity, enabling access to financial services that were previously unavailable.

- Partnerships with Traditional Banks:Collaborations between fintech firms and traditional banks can enhance service offerings and customer reach. Partnerships are expected to increase significantly, allowing fintechs to leverage established banking infrastructure. This synergy can lead to innovative financial products that cater to diverse consumer needs, ultimately driving growth in the online loan market and improving financial inclusion.