Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5874

Pages:80

Published On:October 2025

By Type:The market is segmented into personal loans, business loans, payroll loans (crédito consignado), auto loans, home equity loans, microloans, peer-to-peer (P2P) loans, BNPL (Buy Now Pay Later), and others. Personal loans are currently the most dominant segment, driven by consumer demand for flexible financing options for personal expenses and debt consolidation. Business loans are also significant, as small and medium enterprises (SMEs) seek funding for growth and operational needs.

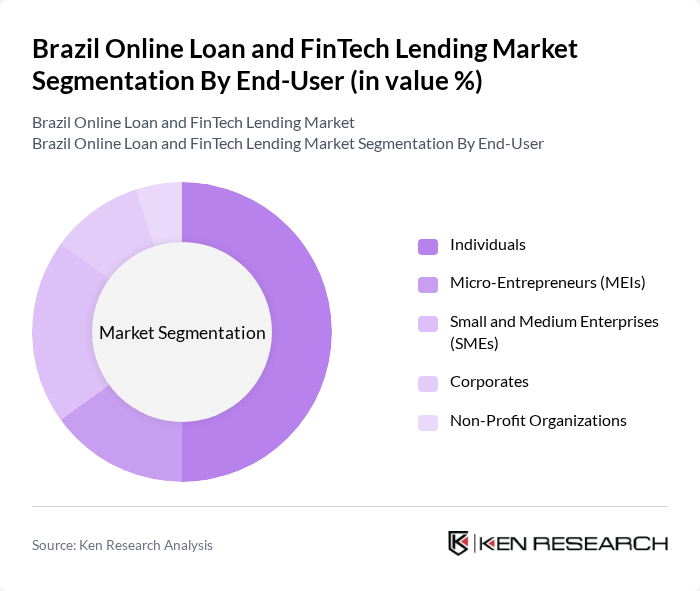

By End-User:The end-user segmentation includes individuals, micro-entrepreneurs (MEIs), small and medium enterprises (SMEs), corporates, and non-profit organizations. Individuals represent the largest segment, as they seek personal loans for various purposes, including education, home improvement, and debt consolidation. SMEs are also a significant user group, as they require financing for operational costs and expansion.

The Brazil Online Loan and FinTech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nubank, Creditas, Banco Inter, Geru, Lendico, Simplic, B3, PagSeguro, PicPay, Banco Original, Sofisa Direto, C6 Bank, Banco Pan, Koin, Acesso Bank, Rebel, Banco BMG, StoneCo, Mercado Crédito, Banco Neon contribute to innovation, geographic expansion, and service delivery in this space.

The Brazilian online loan and fintech lending market is expected to evolve significantly, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence in credit assessments will enhance risk evaluation, while the rise of peer-to-peer lending platforms will diversify funding sources. Additionally, as financial literacy improves, more consumers will engage with online lending services. These trends indicate a dynamic market landscape, where innovation and customer-centric approaches will be crucial for sustained growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payroll Loans (Crédito Consignado) Auto Loans Home Equity Loans Microloans Peer-to-Peer (P2P) Loans BNPL (Buy Now Pay Later) Others |

| By End-User | Individuals Micro-Entrepreneurs (MEIs) Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Debt Consolidation Home Improvement Medical Expenses Working Capital Education Travel Expenses |

| By Loan Amount | Small Loans (Up to R$5,000) Medium Loans (R$5,001 - R$20,000) Large Loans (Above R$20,000) |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Distribution Channel | Online Platforms Mobile Applications Digital Banks (Neobanks) Peer-to-Peer Platforms Traditional Banks |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers Unbanked/Underbanked Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 100 | Individuals aged 25-45, employed, with prior loan experience |

| Small Business Loan Applicants | 60 | Small business owners, entrepreneurs seeking funding |

| FinTech Platform Users | 80 | Users of various online lending platforms, diverse demographics |

| Financial Advisors | 50 | Certified financial planners, investment advisors in Brazil |

| Regulatory Experts | 40 | Professionals from financial regulatory bodies and compliance sectors |

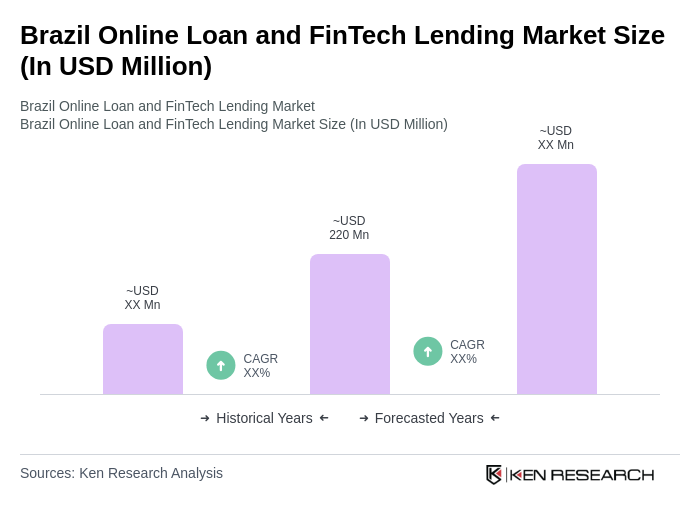

The Brazil Online Loan and FinTech Lending Market is valued at approximately USD 220 million, reflecting significant growth driven by digital banking expansion, increased internet access, and rising consumer demand for convenient credit solutions.