France Online Loan and Fintech Lending Market Overview

- The France Online Loan and Fintech Lending Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the proliferation of fintech companies offering innovative lending solutions. The market has seen a significant shift towards online platforms, making borrowing more convenient for consumers.

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their high population density, economic activity, and the presence of numerous fintech startups. These urban centers are hubs for technology and finance, fostering an environment conducive to the growth of online lending services. The concentration of tech-savvy consumers in these areas further accelerates the adoption of fintech solutions.

- In 2023, the French government implemented regulations requiring all online lenders to adhere to strict transparency standards, ensuring that borrowers are fully informed about loan terms and conditions. This regulation aims to protect consumers from predatory lending practices and enhance the overall integrity of the online lending market.

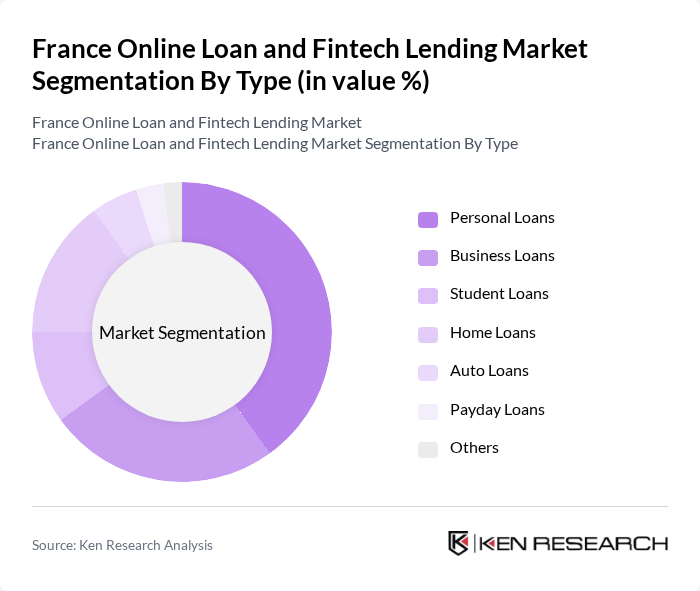

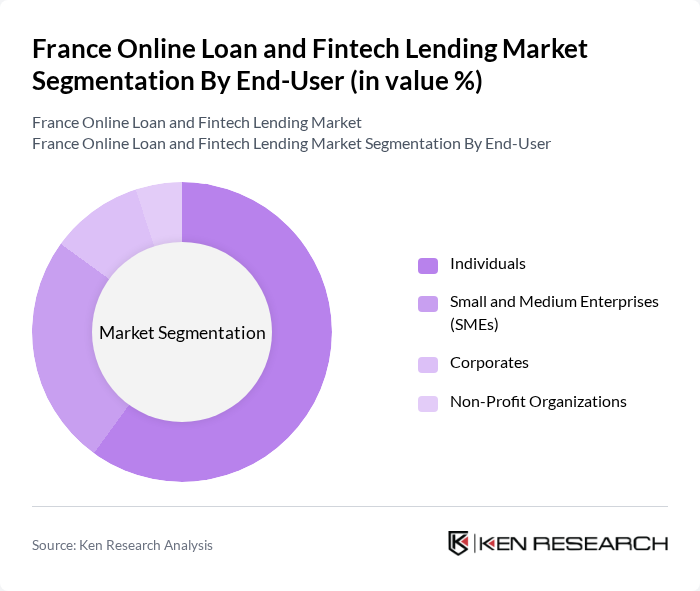

France Online Loan and Fintech Lending Market Segmentation

By Type:The market can be segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Home Loans, Auto Loans, Payday Loans, and Others. Each type serves different consumer needs, with personal loans being the most popular due to their flexibility and ease of access. Business loans are also significant, driven by the growing number of startups and SMEs seeking funding for expansion.

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Non-Profit Organizations. Individuals dominate the market, driven by the increasing need for personal financing options. SMEs are also significant contributors, as they seek loans for operational costs and growth initiatives. Corporates and non-profits represent a smaller share but are essential for the overall market dynamics.

France Online Loan and Fintech Lending Market Competitive Landscape

The France Online Loan and Fintech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, Lendix, Younited Credit, October, Pret d'Union, Hello Bank!, Boursorama Banque, N26, Revolut, Lydia, Cashper, Anytime, Finfrog contribute to innovation, geographic expansion, and service delivery in this space.

France Online Loan and Fintech Lending Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital economy in France is projected to reach €100 billion in the future, driven by a 15% annual increase in internet penetration. This surge in digital engagement facilitates online loan applications, with 60% of consumers preferring digital channels for financial services. The rise of smartphones, with over 85% of the population owning one, further supports this trend, enabling seamless access to fintech platforms and enhancing user experience in loan processing.

- Demand for Quick Loan Processing:In the future, the average time to process a loan application in France is expected to drop to 24 hours, down from 48 hours previously. This rapid processing is driven by consumer demand for immediate financial solutions, particularly among millennials, who represent 40% of loan applicants. The convenience of instant credit decisions is reshaping the lending landscape, making quick access to funds a critical growth driver for fintech companies.

- Rise of Alternative Lending Platforms:The alternative lending sector in France is anticipated to grow to €15 billion in the future, fueled by the increasing number of peer-to-peer lending platforms, which have seen a 30% rise in user registrations. These platforms cater to underserved demographics, including small businesses and freelancers, who often face challenges with traditional banks. This shift towards alternative lending is reshaping the competitive landscape and expanding access to credit.

Market Challenges

- Regulatory Compliance Issues:The French fintech sector faces stringent regulatory frameworks, with compliance costs estimated at €1 billion annually for the industry. The implementation of the PSD2 directive has increased operational complexities, requiring fintechs to invest heavily in compliance technologies. This regulatory burden can hinder innovation and slow down the growth of new entrants in the online loan market, posing a significant challenge for existing players.

- Consumer Trust and Security Concerns:A survey indicated that 45% of French consumers express concerns about data security when using online lending platforms. With cybercrime costs projected to reach €6 billion in the future, fintech companies must prioritize robust security measures to build consumer trust. Failure to address these concerns could lead to a decline in user adoption and hinder the overall growth of the online lending market.

France Online Loan and Fintech Lending Market Future Outlook

The future of the online loan and fintech lending market in France appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, fintech companies are likely to enhance their service offerings, focusing on personalized lending solutions. Additionally, the integration of artificial intelligence in credit scoring and risk assessment will streamline processes, making lending more efficient. However, maintaining compliance with evolving regulations will be crucial for sustainable growth in this dynamic landscape.

Market Opportunities

- Expansion into Underserved Regions:There is a significant opportunity for fintechs to expand their services into rural areas, where access to traditional banking is limited. Approximately 20% of the French population lives in these regions, representing a potential market of €5 billion in untapped lending opportunities. Targeting these demographics can enhance financial inclusion and drive growth for online lenders.

- Leveraging AI for Credit Scoring:The adoption of AI technologies in credit scoring can improve risk assessment accuracy, potentially reducing default rates by 15%. By utilizing alternative data sources, fintechs can better evaluate creditworthiness, particularly for individuals with limited credit histories. This innovation not only enhances lending efficiency but also opens up new customer segments, driving market growth.