Region:Europe

Author(s):Geetanshi

Product Code:KRAA6275

Pages:81

Published On:September 2025

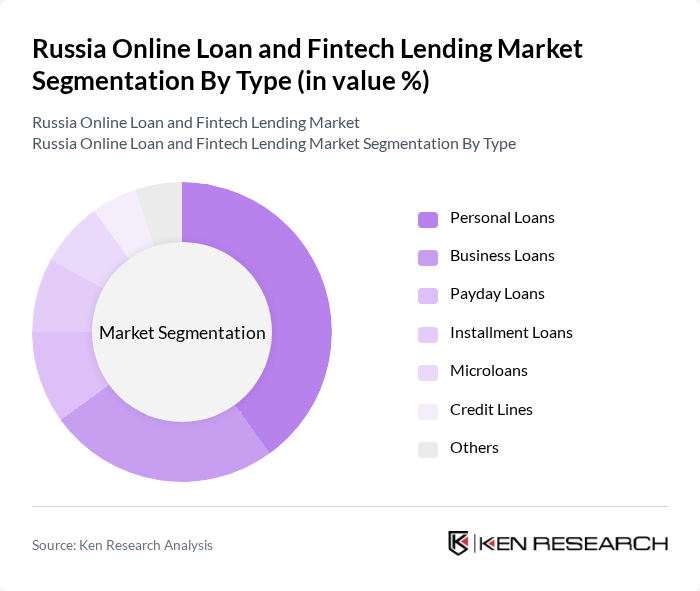

By Type:The online loan and fintech lending market is segmented into various types, including personal loans, business loans, payday loans, installment loans, microloans, credit lines, and others. Among these, personal loans dominate the market due to their versatility and the increasing number of consumers seeking financial assistance for personal expenses. The convenience of online applications and quick disbursement of funds further drives the popularity of personal loans.

By End-User:The market is also segmented by end-user categories, including individual consumers, small and medium enterprises (SMEs), large corporations, and non-profit organizations. Individual consumers represent the largest segment, driven by the increasing need for personal financing solutions. The rise of e-commerce and digital services has also led SMEs to seek online loans for business expansion and operational costs.

The Russia Online Loan and Fintech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tinkoff Bank, Yandex.Money, WebBankir, Home Credit Bank, VTB Bank, Sberbank, Qiwi, Alfa-Bank, Otkritie Bank, Raiffeisenbank, MTS Bank, Russian Standard Bank, Sovcombank, Tinkoff Credit Systems, and Bank Saint Petersburg contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and fintech lending market in Russia appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, lenders are expected to leverage artificial intelligence and machine learning for enhanced credit assessments. Additionally, the integration of open banking will facilitate seamless financial transactions, fostering competition and innovation. However, addressing regulatory challenges and building consumer trust will be crucial for sustainable growth in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payday Loans Installment Loans Microloans Credit Lines Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Profit Organizations |

| By Loan Purpose | Home Improvement Education Medical Expenses Debt Consolidation |

| By Loan Amount | Small Loans (up to 50,000 RUB) Medium Loans (50,001 - 200,000 RUB) Large Loans (over 200,000 RUB) |

| By Repayment Term | Short-Term (up to 1 year) Medium-Term (1-3 years) Long-Term (over 3 years) |

| By Distribution Channel | Online Platforms Mobile Applications Traditional Banks Credit Unions |

| By Customer Segment | First-Time Borrowers Repeat Borrowers High-Risk Borrowers Low-Risk Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 150 | Consumers aged 18-65 who have taken personal loans online |

| Small Business Loan Recipients | 100 | Small business owners who have utilized fintech lending services |

| Fintech Industry Experts | 50 | Financial analysts and consultants specializing in fintech |

| Regulatory Bodies Representatives | 30 | Officials from financial regulatory authorities in Russia |

| Online Lending Platform Executives | 40 | CEOs and senior management from leading online loan providers |

The Russia Online Loan and Fintech Lending Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer demand for accessible credit options.