Portugal Online Loan and Fintech Lending Market Overview

- The Portugal Online Loan and Fintech Lending Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the expansion of fintech companies offering innovative lending solutions.

- Lisbon and Porto are the dominant cities in the market, primarily due to their status as economic hubs with a high concentration of fintech startups and established financial institutions. The urban population's tech-savvy nature and the presence of a supportive regulatory environment further enhance their market dominance.

- In 2023, the Portuguese government implemented the "Digital Finance Strategy," aimed at promoting the digitalization of financial services. This initiative includes measures to enhance consumer protection, encourage competition among fintech firms, and ensure the security of digital transactions, thereby fostering a more robust online lending ecosystem.

Portugal Online Loan and Fintech Lending Market Segmentation

By Type:The market can be segmented into various types of loans, including personal loans, business loans, student loans, auto loans, home equity loans, peer-to-peer loans, and others. Personal loans are currently the most popular segment, driven by consumer demand for flexible financing options. Business loans are also significant, as small and medium enterprises seek funding for growth and operational needs. The increasing trend of online lending platforms has made it easier for consumers to access these financial products.

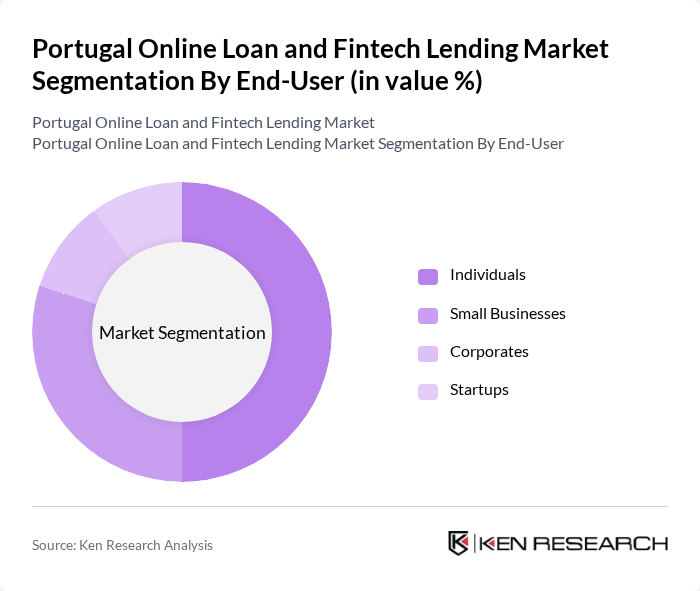

By End-User:The end-user segmentation includes individuals, small businesses, corporates, and startups. Individuals represent the largest segment, as they seek personal loans for various purposes, including home improvements and debt consolidation. Small businesses also form a significant portion of the market, as they require financing for operational costs and expansion. The increasing number of startups in Portugal is contributing to the growth of the corporate segment, as these entities often seek funding to launch and scale their operations.

Portugal Online Loan and Fintech Lending Market Competitive Landscape

The Portugal Online Loan and Fintech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BPI, Unilend, Creditea, Lendico, Banco CTT, FinanZero, Younited Credit, Revolut, N26, Monzo, Raize, Zopa, Mintos, Bondora, Kiva contribute to innovation, geographic expansion, and service delivery in this space.

Portugal Online Loan and Fintech Lending Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital economy in Portugal is projected to reach €20 billion in future, driven by a 15% annual increase in internet penetration, which currently stands at 92%. This surge in digital engagement facilitates online loan applications, making it easier for consumers to access financial services. Additionally, the rise of smartphone usage, with over 90% of the population owning a smartphone, further supports the growth of fintech lending platforms, enhancing user experience and accessibility.

- Demand for Quick Loan Processing:In future, the average time for loan approval in Portugal is expected to decrease to 24 hours, down from 48 hours in the previous period. This rapid processing time is a significant driver for consumers seeking immediate financial solutions. With over 70% of borrowers prioritizing speed in loan disbursement, fintech companies are increasingly adopting automated systems to meet this demand, thereby enhancing customer satisfaction and retention rates in the competitive lending landscape.

- Rise of Alternative Lending Platforms:The alternative lending sector in Portugal is anticipated to grow to €1.5 billion in future, reflecting a 30% increase from the previous period. This growth is fueled by the emergence of peer-to-peer lending platforms and crowdfunding initiatives, which cater to underserved segments of the population. With approximately 50% of borrowers seeking alternatives to traditional banks, these platforms are reshaping the lending landscape, providing more flexible and accessible financing options for consumers.

Market Challenges

- High Competition Among Fintech Players:The Portuguese fintech landscape is becoming increasingly saturated, with over 200 active fintech companies in future. This intense competition leads to price wars and reduced profit margins, making it challenging for new entrants to establish a foothold. Additionally, established players are investing heavily in technology and marketing, further complicating the competitive dynamics and forcing smaller firms to innovate continuously to survive.

- Regulatory Compliance Costs:Compliance with evolving regulations in Portugal is projected to cost fintech companies approximately €300 million in future. This includes expenses related to data protection, anti-money laundering measures, and consumer protection laws. As regulatory scrutiny increases, especially following the implementation of the PSD2 directive, companies must allocate significant resources to ensure compliance, which can divert funds from innovation and growth initiatives, impacting overall market agility.

Portugal Online Loan and Fintech Lending Market Future Outlook

The future of the online loan and fintech lending market in Portugal appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become integral to lending processes, companies can enhance risk assessment and customer service. Furthermore, the collaboration between fintech firms and traditional banks is expected to foster innovation, leading to more comprehensive financial solutions. This synergy will likely create a more robust lending ecosystem, catering to diverse consumer needs while ensuring regulatory compliance.

Market Opportunities

- Expansion of Digital Financial Services:The digital financial services market in Portugal is projected to grow to €5 billion in future, driven by increasing consumer demand for online banking and payment solutions. This presents a significant opportunity for fintech companies to diversify their offerings and capture a larger market share by integrating additional services such as investment and insurance products.

- Growth in Peer-to-Peer Lending:Peer-to-peer lending platforms are expected to see a 25% increase in transaction volume, reaching €500 million in future. This growth is fueled by a rising number of investors seeking alternative investment opportunities and borrowers looking for competitive rates. Fintech companies can leverage this trend to enhance their platforms and attract both lenders and borrowers, creating a win-win scenario in the lending market.