Region:Middle East

Author(s):Geetanshi

Product Code:KRAA5953

Pages:82

Published On:January 2026

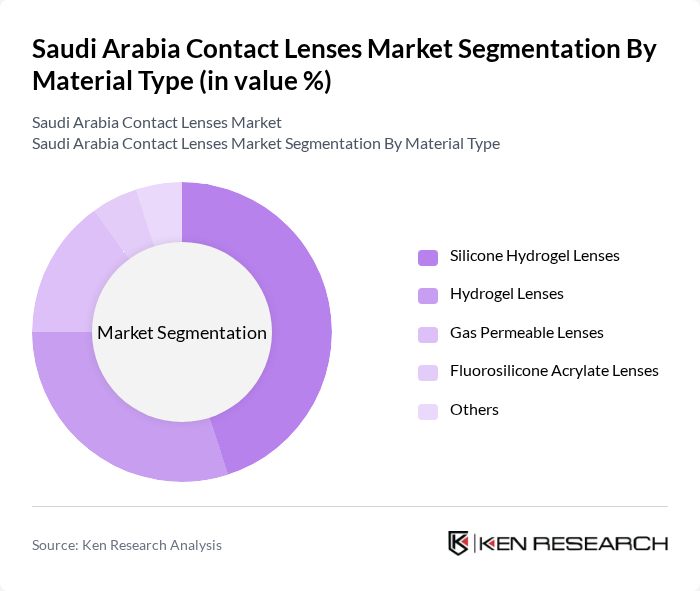

By Material Type:The market is segmented into various material types, including Silicone Hydrogel Lenses, Hydrogel Lenses, Gas Permeable Lenses, Fluorosilicone Acrylate Lenses, and Others. Among these, Silicone Hydrogel Lenses are gaining significant traction due to their superior oxygen permeability and comfort, making them the preferred choice for daily wear. Hydrogel Lenses also maintain a strong presence, particularly among budget-conscious consumers. The demand for Gas Permeable and Fluorosilicone Acrylate Lenses is growing, albeit at a slower pace, as they cater to specific vision correction needs.

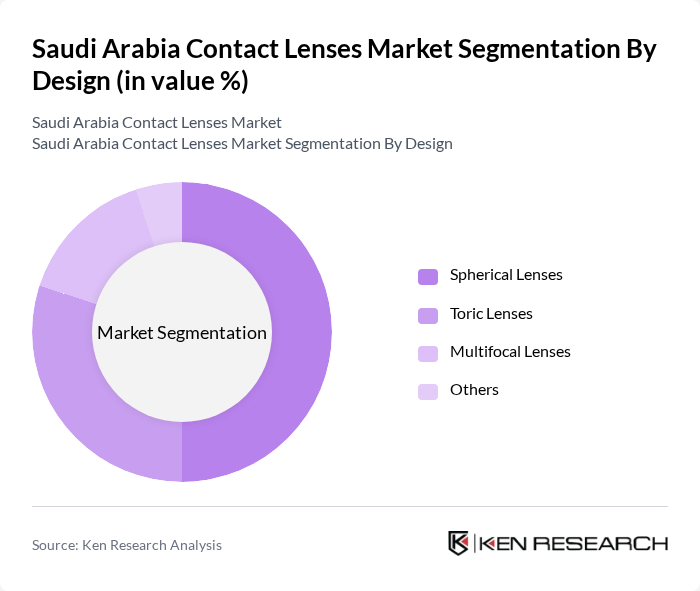

By Design:The design segmentation includes Spherical Lenses, Toric Lenses, Multifocal Lenses, and Others. Spherical Lenses dominate the market due to their widespread use for correcting myopia and hyperopia. Toric Lenses, designed for astigmatism correction, are also gaining popularity, particularly among consumers seeking specialized vision correction. Multifocal Lenses are increasingly favored by the aging population, while the "Others" category includes niche products that cater to specific consumer needs.

The Saudi Arabia Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, CooperVision, Menicon, Hoya Corporation, EssilorLuxottica, Carl Zeiss AG, SynergEyes, Acuvue (Johnson & Johnson), Aerie Pharmaceuticals, Essilor, Luxottica, Fielmann, Regional Distributors and Local Players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the contact lenses market in Saudi Arabia appears promising, driven by the rapid expansion of digital commerce and advancements in technology. With 99 percent internet penetration and high mobile speeds, online platforms for health products are set to flourish. Additionally, investments in AI and cloud infrastructure will enhance customer experiences and streamline operations, enabling personalized services in the optical sector. These trends indicate a significant potential for growth in the contact lenses market, particularly through e-commerce and digital health solutions.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Silicone Hydrogel Lenses Hydrogel Lenses Gas Permeable Lenses Fluorosilicone Acrylate Lenses Others |

| By Design | Spherical Lenses Toric Lenses Multifocal Lenses Others |

| By Usage | Daily Disposable Lenses Monthly Disposable Lenses Extended Wear Lenses Reusable Lenses |

| By Application | Corrective Lenses Therapeutic Lenses Cosmetic Lenses Prosthetic Lenses Lifestyle-Oriented Lenses |

| By Distribution Channel | Optical Stores Online Retail Hospitals and Clinics Pharmacies Beauty Centers |

| By Region | Northern & Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologists and Optometrists | 50 | Eye Care Professionals, Clinic Owners |

| Retailers of Contact Lenses | 40 | Store Managers, Sales Representatives |

| End-Users of Contact Lenses | 100 | Contact Lens Wearers, Potential Users |

| Distributors and Wholesalers | 45 | Supply Chain Managers, Distribution Heads |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

The Saudi Arabia Contact Lenses Market is valued at approximately USD 205 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of vision disorders and increased consumer awareness regarding eye health.