Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7225

Pages:90

Published On:December 2025

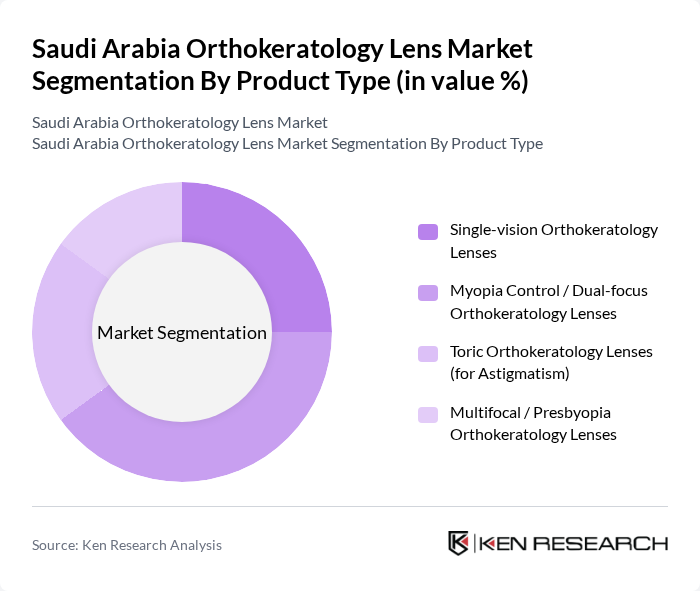

By Product Type:The product type segmentation includes various categories of orthokeratology lenses, each catering to different vision correction needs. The dominant subsegment is the Myopia Control / Dual-focus Orthokeratology Lenses, which are increasingly preferred due to their effectiveness in managing myopia progression in children and teenagers. The growing awareness among parents about the importance of early intervention in myopia management is driving this trend. Other notable subsegments include Single-vision Orthokeratology Lenses, which remain popular for general vision correction, and Multifocal / Presbyopia Orthokeratology Lenses, which cater to the aging population.

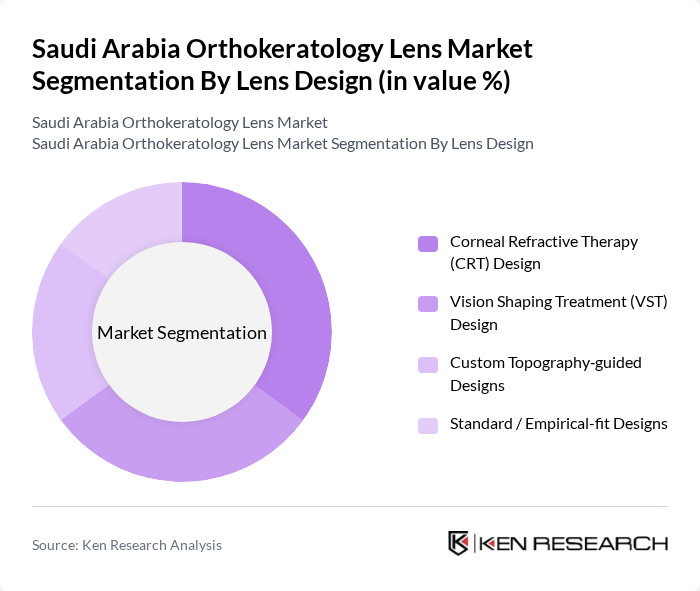

By Lens Design:The lens design segmentation encompasses various designs tailored to specific vision correction needs. The Corneal Refractive Therapy (CRT) Design is the leading subsegment, favored for its proven efficacy in reshaping the cornea overnight to correct myopia. This design is particularly popular among children and young adults. The Vision Shaping Treatment (VST) Design is also gaining traction due to its customizable features, while Custom Topography-guided Designs are preferred for patients with unique corneal shapes. Standard / Empirical-fit Designs remain relevant for their ease of use and accessibility.

The Saudi Arabia Orthokeratology Lens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Menicon Co., Ltd. (Including Menicon Bloom and Global Ortho?K Portfolio), Johnson & Johnson Vision Care, Inc. (Saudi Arabia Operations), CooperVision, Inc. (Including Paragon CRT and Myopia Management Range), Bausch + Lomb Incorporated, Alcon Inc., SEED Co., Ltd., Euclid Systems Corporation, Brighten Optix Co., Ltd., GOV Co., Ltd. (Ortho?K Lens Manufacturer), Contex, Inc. (OK?Lens Portfolio), Zeiss Vision Care (Carl Zeiss AG), EssilorLuxottica (Saudi Arabia Vision?care Distribution), Ultra Vision CLPL (Specialty GP and Ortho?K Lenses), Interojo Inc., Local Saudi Distributors & Specialty Optical Chains (Nayel Optic, Magrabi, Al Jaber Opticians) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia orthokeratology lens market is poised for significant growth, driven by increasing myopia rates and heightened consumer awareness. As technological advancements continue to improve lens quality and comfort, more individuals are likely to consider these options. Additionally, the expansion of distribution channels and collaborations with healthcare providers will enhance accessibility. The market is expected to evolve with a focus on personalized solutions and sustainable practices, aligning with global trends in healthcare and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Single-vision Orthokeratology Lenses Myopia Control / Dual-focus Orthokeratology Lenses Toric Orthokeratology Lenses (for Astigmatism) Multifocal / Presbyopia Orthokeratology Lenses |

| By Lens Design | Corneal Refractive Therapy (CRT) Design Vision Shaping Treatment (VST) Design Custom Topography?guided Designs Standard / Empirical-fit Designs |

| By Indication | Myopia Astigmatism Hyperopia Presbyopia |

| By Material | Silicone Acrylate Gas?Permeable Materials Fluoro?silicone Acrylate Gas?Permeable Materials Other High Dk GP Materials |

| By End?User | Hospital Ophthalmology Departments Private Eye Clinics & Optometry Centers Optical Retail Chains Others (Standalone Practitioners, Specialty Myopia Clinics) |

| By Patient Age Group | Children (?12 Years) Teenagers (13–19 Years) Young Adults (20–39 Years) Adults (40 Years and Above) |

| By Distribution Channel | Hospital Pharmacies & In?house Optical Units Independent Optical Stores Optical Retail Chains Online Platforms & Tele?optometry Channels |

| By Geographic Region | Riyadh & Central Region Makkah & Western Region Eastern Province Northern & Southern Regions |

| By Price Range | Entry?level / Budget Orthokeratology Packages Mid?range Orthokeratology Packages Premium Customized Orthokeratology Packages Subscription & Managed?care Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologists and Optometrists | 80 | Eye Care Professionals, Clinic Owners |

| Current Orthokeratology Lens Users | 120 | Patients, Parents of Pediatric Users |

| Healthcare Policy Makers | 40 | Government Officials, Health Administrators |

| Industry Experts and Consultants | 40 | Market Analysts, Vision Care Consultants |

| Retail and Distribution Channels | 70 | Optical Retail Managers, Supply Chain Coordinators |

The Saudi Arabia Orthokeratology Lens Market is valued at approximately USD 5 million, reflecting a five-year historical analysis. This growth is driven by increasing myopia prevalence, advancements in lens technology, and rising awareness of vision correction options.