Saudi Arabia Packaging Market Overview

- The Saudi Arabia Packaging Market is valued at USD 11.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for packaged goods, particularly in the food and beverage sectors, rapid urbanization, expansion of e-commerce, and a rising focus on sustainability and eco-friendly packaging solutions. The market has seen significant investments in technology and innovation, including smart packaging technologies such as QR codes and NFC tags, which enhance efficiency, product authenticity, and consumer engagement .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the Saudi Arabia Packaging Market due to their strategic locations, robust infrastructure, and concentration of industries. Riyadh, as the capital, serves as a commercial hub, while Jeddah's port facilitates international trade, making these cities pivotal for packaging operations and distribution networks .

- The Executive Regulation for the Management of Plastic Products, issued by the Saudi Standards, Metrology and Quality Organization (SASO) in 2020, mandates that all plastic packaging products must be recyclable and bear the appropriate eco-labels. This regulation applies to manufacturers and importers, requiring compliance with recyclability standards, eco-labeling, and periodic reporting to authorities .

Saudi Arabia Packaging Market Segmentation

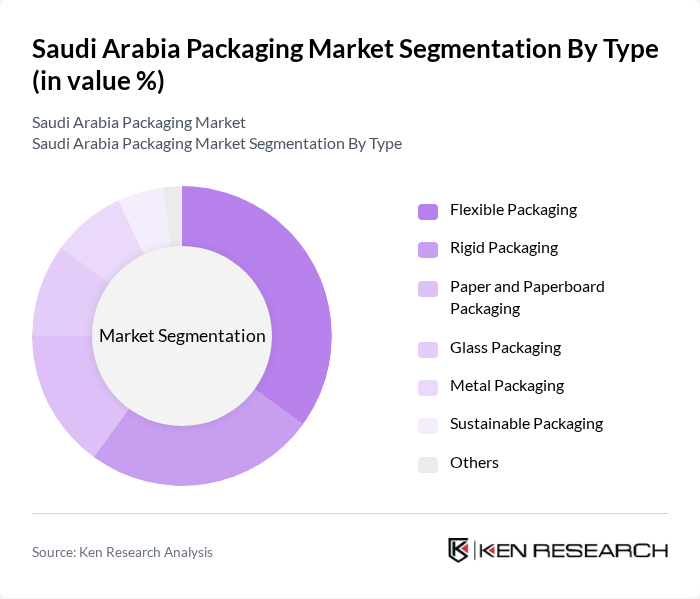

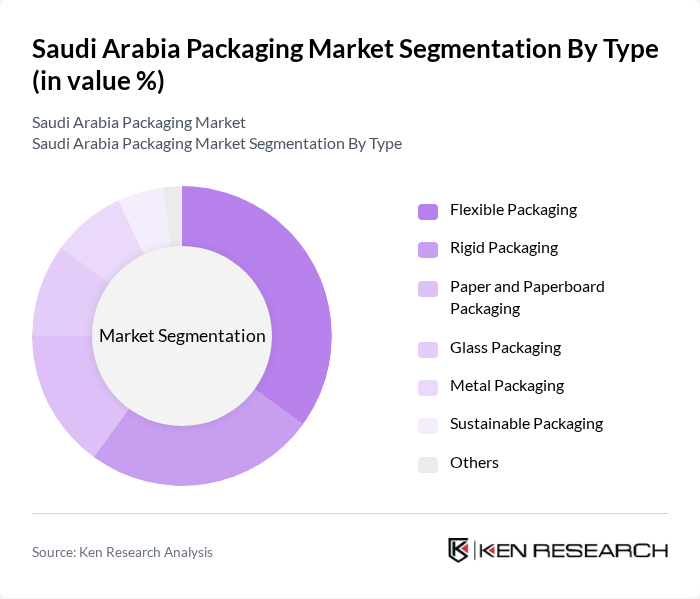

By Type:The packaging market can be segmented into various types, including Flexible Packaging, Rigid Packaging, Paper and Paperboard Packaging, Glass Packaging, Metal Packaging, Sustainable Packaging, and Others. Flexible packaging leads the market due to its lightweight, cost-effectiveness, and adaptability for food, beverage, and personal care products. The demand for sustainable and recyclable packaging is also rising as companies respond to regulatory and consumer pressures for eco-friendly solutions .

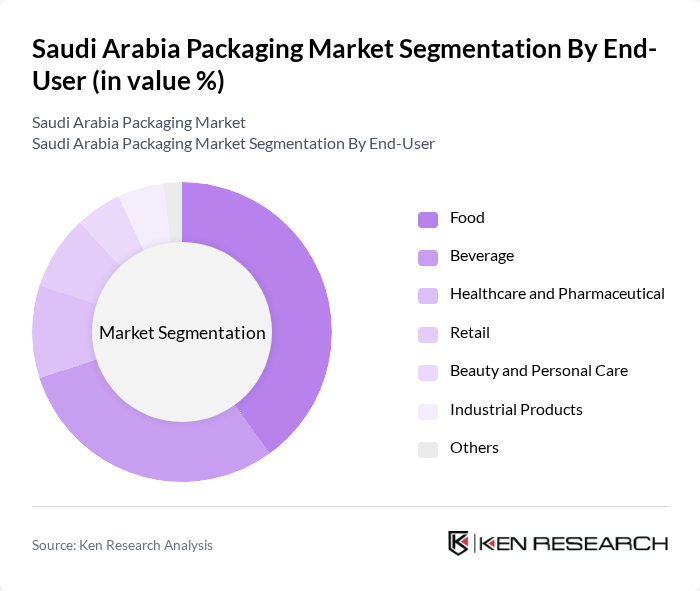

By End-User:The end-user segmentation includes Food, Beverage, Healthcare and Pharmaceutical, Retail, Beauty and Personal Care, Industrial Products, and Others. The food and beverage sectors are the largest consumers of packaging solutions, accounting for more than half of total demand, driven by population growth, changing consumer lifestyles, and the expansion of domestic and export-oriented food processing industries. E-commerce and retail are also significant contributors, with increased demand for durable and attractive packaging .

Saudi Arabia Packaging Market Competitive Landscape

The Saudi Arabia Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Packaging Industries, Al Bayader International, National Factory for Plastic Industry, Al Faisaliah Group, Napco National, Obeikan Investment Group, Al-Jazira Factory for Plastic Products, Saudi Paper Manufacturing Company, Al Watania for Industries, Al Suwaidi Paper Factory, Arabian Packaging Co. Ltd., Al Qassim Packaging, United Carton Industries Company (UCIC), Elopak Arabia, and Almarai Company contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Packaging Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging:The Saudi Arabian packaging market is witnessing a significant shift towards sustainable solutions, driven by a growing consumer preference for eco-friendly products. In the future, the demand for biodegradable packaging materials is projected to reach 150,000 tons, reflecting a 20% increase from the previous year. This trend is supported by government initiatives aimed at reducing plastic waste, with the Ministry of Environment targeting a 30% reduction in single-use plastics, fostering a robust market for sustainable packaging options.

- Growth in E-commerce and Online Retail:The e-commerce sector in Saudi Arabia is expected to grow to SAR 50 billion (approximately USD 13.3 billion) in the future, up from SAR 40 billion in the previous year. This surge is driving demand for innovative packaging solutions that ensure product safety during transit. As online shopping becomes increasingly popular, packaging companies are adapting to provide protective, lightweight, and cost-effective solutions, which is essential for maintaining product integrity and enhancing customer satisfaction in the competitive online retail landscape.

- Expansion of Food and Beverage Sector:The food and beverage industry in Saudi Arabia is projected to reach SAR 200 billion (approximately USD 53.3 billion) in the future, up from SAR 180 billion in the previous year. This growth is fueling demand for packaging solutions that meet safety and quality standards. With a focus on convenience and freshness, manufacturers are increasingly investing in advanced packaging technologies, such as vacuum sealing and modified atmosphere packaging, to extend shelf life and enhance product appeal, thereby driving the overall packaging market forward.

Market Challenges

- High Raw Material Costs:The packaging industry in Saudi Arabia faces significant challenges due to rising raw material costs, particularly for plastics and paper. In the future, the price of polyethylene is expected to increase by 15%, driven by global supply chain disruptions and increased demand. This escalation in costs can lead to higher production expenses for packaging manufacturers, potentially impacting profit margins and pricing strategies, which may hinder market growth and competitiveness in the region.

- Stringent Environmental Regulations:The implementation of stringent environmental regulations in Saudi Arabia poses a challenge for packaging manufacturers. In the future, compliance costs related to waste management and recycling initiatives are projected to rise by 25%. These regulations require companies to invest in sustainable practices and technologies, which can strain financial resources, particularly for smaller firms. Adapting to these regulations while maintaining profitability is a critical challenge for the packaging sector in the region.

Saudi Arabia Packaging Market Future Outlook

The Saudi Arabian packaging market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As sustainability becomes a core focus, companies are expected to invest in innovative materials and smart packaging solutions. The integration of IoT technologies will enhance supply chain efficiency and product tracking. Additionally, the expansion of the food and beverage sector will continue to drive demand for specialized packaging, ensuring that the market remains dynamic and responsive to emerging trends and consumer needs in the coming years.

Market Opportunities

- Adoption of Smart Packaging Technologies:The rise of smart packaging technologies presents a significant opportunity for growth in the Saudi Arabian market. In the future, the smart packaging segment is expected to grow to SAR 1.5 billion (approximately USD 400 million), driven by consumer demand for enhanced product information and tracking capabilities. This innovation can improve supply chain transparency and reduce waste, positioning companies favorably in a competitive landscape.

- Increasing Focus on Eco-friendly Materials:The shift towards eco-friendly materials is creating new opportunities for packaging manufacturers. In the future, the market for sustainable packaging materials is projected to reach SAR 3 billion (approximately USD 800 million), as businesses seek to align with consumer preferences for environmentally responsible products. This trend not only supports regulatory compliance but also enhances brand loyalty among environmentally conscious consumers, driving long-term growth.