Region:Europe

Author(s):Geetanshi

Product Code:KRAD0088

Pages:99

Published On:August 2025

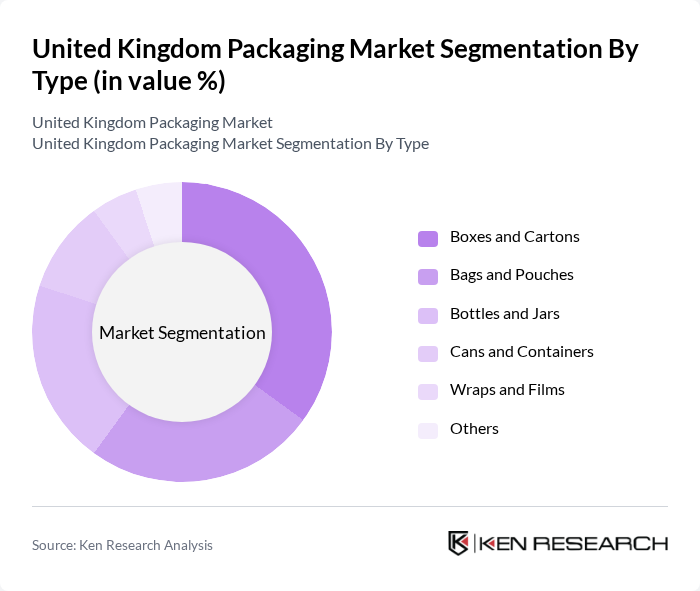

By Type:The packaging market can be segmented into various types, includingboxes and cartons, bags and pouches, bottles and jars, cans and containers, wraps and films, and others. Among these,boxes and cartonsare the most dominant due to their versatility and widespread use across multiple industries. The demand for eco-friendly packaging has also led to an increase in the use of recyclable materials in boxes and cartons, further solidifying their market leadership. Recent trends show a rise in the adoption of fiber-based and compostable packaging materials, especially in the food and beverage sector, as companies seek to meet sustainability targets and consumer expectations .

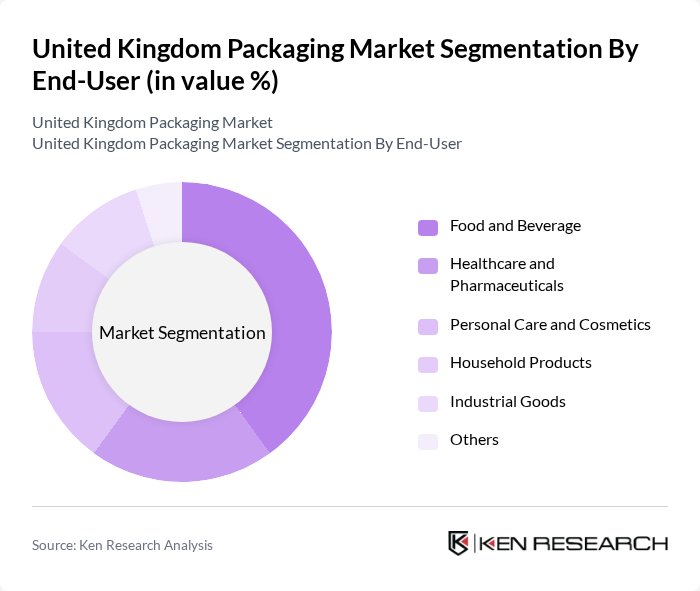

By End-User:The end-user segmentation includesfood and beverage, healthcare and pharmaceuticals, personal care and cosmetics, household products, industrial goods, and others. Thefood and beverage sectoris the largest end-user, driven by the increasing demand for packaged food products and beverages. This segment's growth is fueled by changing consumer lifestyles and the rising trend of convenience foods, which require effective packaging solutions to maintain product quality and safety. Additionally, the healthcare and pharmaceuticals segment is expanding due to stricter regulations on medical packaging and the need for tamper-evident and sterile solutions .

The United Kingdom Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, DS Smith Plc, Smurfit Kappa Group plc, Mondi Group, Berry Global, Inc., Sealed Air Corporation, Huhtamaki Oyj, WestRock Company, Crown Holdings, Inc., Tetra Pak International S.A., RPC Group Plc, Clondalkin Group Holdings B.V., International Paper Company, Graphic Packaging International, LLC, Sonoco Products Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK packaging market is poised for transformation, driven by sustainability and technological advancements. As consumer preferences shift towards eco-friendly solutions, companies will increasingly adopt circular economy practices, focusing on reducing waste and enhancing recyclability. Additionally, the integration of smart technologies in packaging will provide brands with valuable insights into consumer behavior, fostering innovation. These trends will likely create a dynamic landscape, encouraging investment and collaboration across the industry to meet evolving market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Boxes and Cartons Bags and Pouches Bottles and Jars Cans and Containers Wraps and Films Others |

| By End-User | Food and Beverage Healthcare and Pharmaceuticals Personal Care and Cosmetics Household Products Industrial Goods Others |

| By Material | Paper and Cardboard Plastic Metal Glass Others |

| By Application | Food Packaging Beverage Packaging Medical Packaging Industrial Packaging Personal Care Packaging Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Convenience Stores Direct Sales Others |

| By Price Range | Economy Mid-range Premium Others |

| By Geography | England Scotland Wales Northern Ireland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Quality Assurance Officers |

| Cosmetics and Personal Care Packaging | 60 | Product Development Managers, Brand Managers |

| Pharmaceutical Packaging Solutions | 50 | Regulatory Affairs Specialists, Supply Chain Managers |

| Industrial Packaging Trends | 40 | Operations Managers, Procurement Specialists |

| Sustainable Packaging Initiatives | 45 | Sustainability Officers, Marketing Directors |

The United Kingdom Packaging Market is valued at approximately USD 59.5 billion, reflecting a significant growth trend driven by the demand for sustainable packaging solutions and the rise of e-commerce.