Region:Middle East

Author(s):Dev

Product Code:KRAD3247

Pages:88

Published On:November 2025

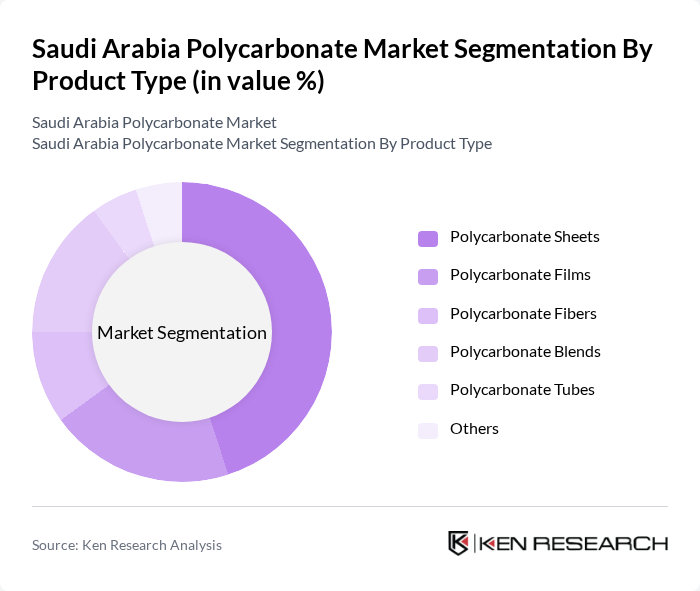

By Product Type:The product type segmentation includes various forms of polycarbonate materials, each catering to different applications and industries. The subsegments are Polycarbonate Sheets, Polycarbonate Films, Polycarbonate Fibers, Polycarbonate Blends, Polycarbonate Tubes, and Others. Among these, Polycarbonate Sheets remain the most dominant due to their extensive use in construction and architectural applications, offering durability, UV resistance, and aesthetic appeal for roofing, skylights, and facades .

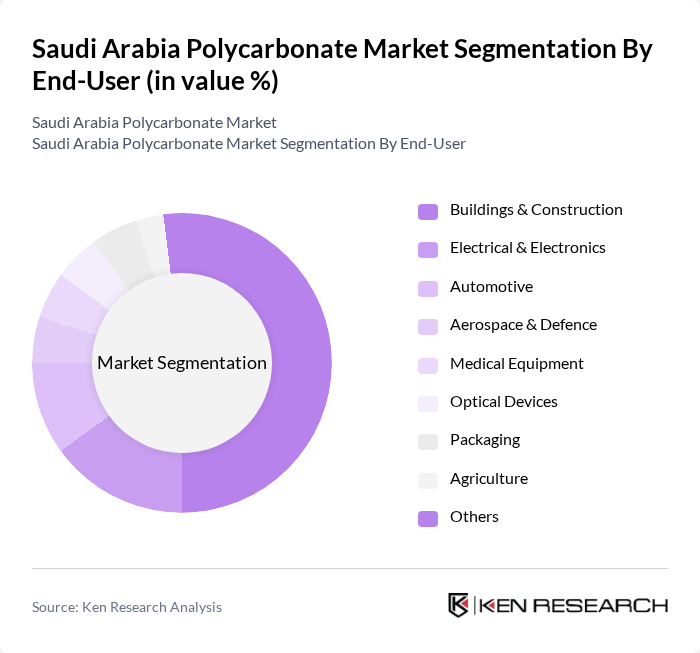

By End-User:The end-user segmentation encompasses various industries that utilize polycarbonate products, including Buildings & Construction, Electrical & Electronics, Automotive, Aerospace & Defence, Medical Equipment, Optical Devices, Packaging, Agriculture, and Others. The Buildings & Construction sector is the leading end-user, driven by the increasing demand for energy-efficient and durable building materials, as well as government mandates for sustainable construction. Electrical & Electronics and Automotive sectors also show robust demand due to the material's lightweight, flame retardant, and high-performance properties .

The Saudi Arabia Polycarbonate Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC Innovative Plastics, Covestro Saudi Arabia Company, Al-Kayan Petrochemical, Saudi Light Industries Co. Ltd, Dome Tech Factory for Plastics, Arabian Gulf Manufacturers Ltd, ROWAD National Plastic Company, Abdullah Company, SJB Plastics, LG Chem, and Sumitomo Chemical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia polycarbonate market appears promising, driven by technological advancements and increasing applications across various sectors. As the automotive and construction industries continue to expand, the demand for lightweight and durable materials will rise. Additionally, the growing emphasis on sustainability will likely lead to innovations in recycling and production processes, enhancing the market's resilience against challenges such as raw material price fluctuations and regulatory compliance.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Polycarbonate Sheets Polycarbonate Films Polycarbonate Fibers Polycarbonate Blends Polycarbonate Tubes Others |

| By End-User | Buildings & Construction Electrical & Electronics Automotive Aerospace & Defence Medical Equipment Optical Devices Packaging Agriculture Others |

| By Processing Technique | Extrusion Injection Molding Thermoforming Blow Molding Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 45 | Product Managers, Procurement Specialists |

| Construction Sector Usage | 38 | Architects, Project Managers |

| Consumer Electronics | 42 | R&D Engineers, Product Development Managers |

| Industrial Applications | 35 | Operations Managers, Supply Chain Analysts |

| Packaging Solutions | 40 | Marketing Managers, Sales Directors |

The Saudi Arabia Polycarbonate Market is valued at approximately USD 300 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for lightweight and durable materials across various industries, including construction, automotive, and electronics.