Region:Middle East

Author(s):Dev

Product Code:KRAD5231

Pages:83

Published On:December 2025

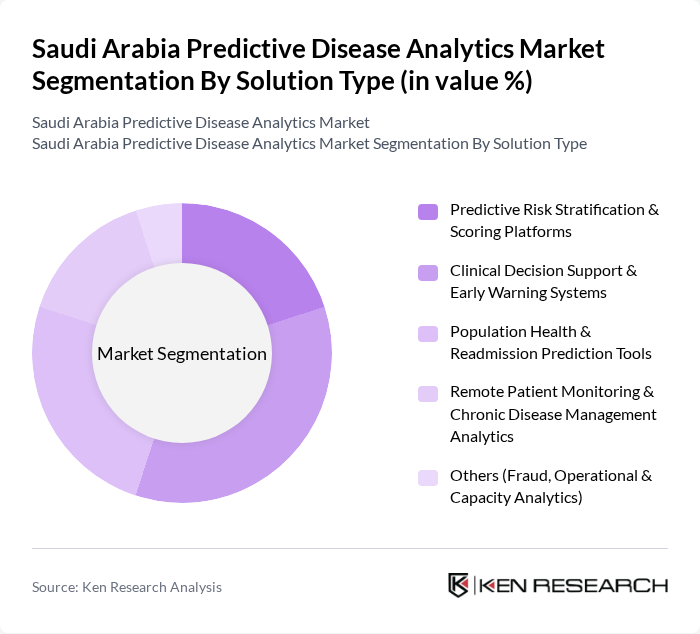

By Solution Type:The market is segmented into various solution types, including Predictive Risk Stratification & Scoring Platforms, Clinical Decision Support & Early Warning Systems, Population Health & Readmission Prediction Tools, Remote Patient Monitoring & Chronic Disease Management Analytics, and Others (Fraud, Operational & Capacity Analytics). Among these, Clinical Decision Support & Early Warning Systems are leading due to their critical role in enhancing patient safety and improving clinical outcomes. The increasing focus on preventive healthcare and the need for timely interventions are driving the demand for these solutions.

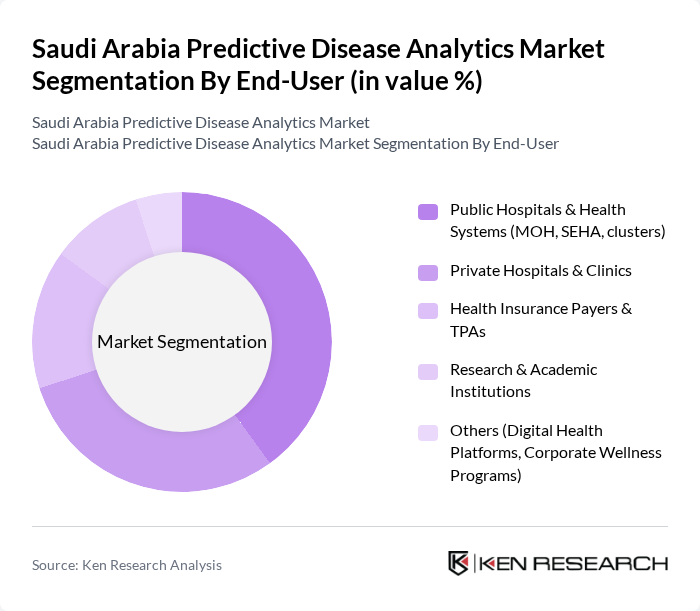

By End-User:The end-user segmentation includes Public Hospitals & Health Systems, Private Hospitals & Clinics, Health Insurance Payers & TPAs, Research & Academic Institutions, and Others (Digital Health Platforms, Corporate Wellness Programs). Public Hospitals & Health Systems are the dominant segment, driven by government initiatives to enhance healthcare delivery and the increasing adoption of predictive analytics for better resource management and patient care. The focus on improving healthcare outcomes in public facilities is a significant factor in this trend.

The Saudi Arabia Predictive Disease Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Data & Artificial Intelligence Authority (SDAIA) – health AI & analytics initiatives, Ministry of Health (MOH) & Health Holding Company – national predictive analytics programs, Lean Business Services (Lean) – healthcare data & analytics platforms, Tadawul-listed healthcare groups (Dr. Sulaiman Al Habib Medical Services Group, Mouwasat Medical Services, Saudi German Health) – in-house predictive analytics adoption, King Faisal Specialist Hospital & Research Centre (KFSH&RC) – advanced clinical & genomics predictive analytics, King Saud University Medical City / King Abdulaziz University Hospital – academic and translational predictive disease analytics, Oracle Health (Cerner in Saudi Arabia) – EHR-embedded predictive analytics solutions, IBM (IBM Watson Health & IBM Data/AI stack in KSA healthcare), Philips Middle East – imaging & monitoring-based predictive analytics, Siemens Healthineers Middle East – imaging, cardiology & population analytics, GE HealthCare Saudi Arabia – imaging, monitoring & operational analytics, SAP Saudi Arabia – healthcare analytics & population health platforms, SAS Institute – advanced analytics & predictive modeling in KSA healthcare, Lean-linked and local healthtech startups (e.g., Altibbi, Cura, Sihaty-type platforms using predictive analytics), International cloud & AI providers active in KSA healthcare (Microsoft, Google Cloud, Amazon Web Services) – enabling predictive disease analytics workloads contribute to innovation, geographic expansion, and service delivery in this space.

The future of the predictive disease analytics market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare demands. As the government continues to invest in digital health initiatives, the integration of predictive analytics into healthcare systems is expected to enhance patient care significantly. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased adoption of analytics tools, enabling healthcare providers to make data-driven decisions that improve health outcomes and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Predictive Risk Stratification & Scoring Platforms Clinical Decision Support & Early Warning Systems Population Health & Readmission Prediction Tools Remote Patient Monitoring & Chronic Disease Management Analytics Others (Fraud, Operational & Capacity Analytics) |

| By End-User | Public Hospitals & Health Systems (MOH, SEHA, clusters) Private Hospitals & Clinics Health Insurance Payers & TPAs Research & Academic Institutions Others (Digital Health Platforms, Corporate Wellness Programs) |

| By Disease Area | Cardiovascular & Hypertension Risk Analytics Diabetes & Metabolic Disorders Analytics Oncology & Rare Disease Prediction Infectious Disease & Outbreak Surveillance Others (Respiratory, Renal, Mental Health) |

| By Technology Stack | Machine Learning & Deep Learning Models Natural Language Processing & Clinical Text Analytics Big Data & Cloud-Based Analytics Platforms Edge & IoT-Enabled Predictive Monitoring Solutions Others (Statistical & Rule-Based Models) |

| By Deployment Model | On-Premise Solutions Cloud / SaaS Solutions (Public, Private, Hybrid) Managed Analytics Services Others |

| By Funding & Ownership | Government & Public Sector Projects Private Provider Investments Venture Capital & HealthTech Startups Strategic Partnerships & Joint Ventures |

| By Regulatory & Policy Alignment | Solutions Compliant with SDAIA & NCA Data Regulations Solutions Integrated with NPHIES & National Health Platforms Vision 2030 & Health Sector Transformation Aligned Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Hospital Administrators |

| Healthcare Technology Firms | 90 | Product Managers, Data Scientists |

| Insurance Companies | 70 | Underwriters, Risk Assessment Analysts |

| Government Health Agencies | 60 | Policy Makers, Health Data Analysts |

| Patient Advocacy Groups | 50 | Patient Representatives, Community Health Workers |

The Saudi Arabia Predictive Disease Analytics Market is valued at approximately USD 210 million, reflecting a significant growth driven by the increasing adoption of advanced analytics in healthcare and the rising prevalence of chronic diseases.