Region:Middle East

Author(s):Shubham

Product Code:KRAD6693

Pages:99

Published On:December 2025

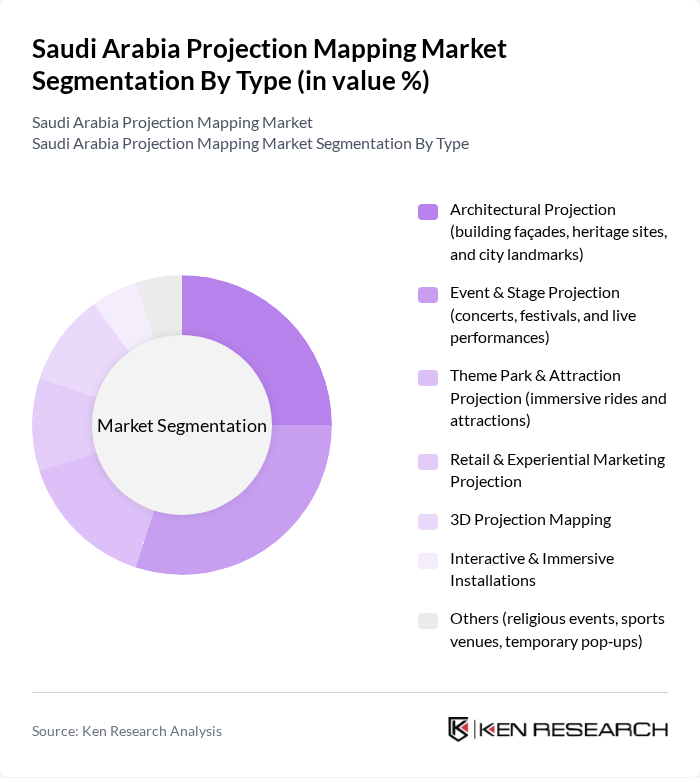

By Type:The segmentation of the market by type includes various subsegments that cater to different applications and consumer needs. The primary subsegments are Architectural Projection, Event & Stage Projection, Theme Park & Attraction Projection, Retail & Experiential Marketing Projection, 3D Projection Mapping, Interactive & Immersive Installations, and Others. Each of these subsegments plays a crucial role in shaping the overall market dynamics, with architectural and event?driven projection mapping heavily supported by cultural tourism, mega?festivals, and national celebrations across Saudi Arabia and the wider Middle East and Africa region.

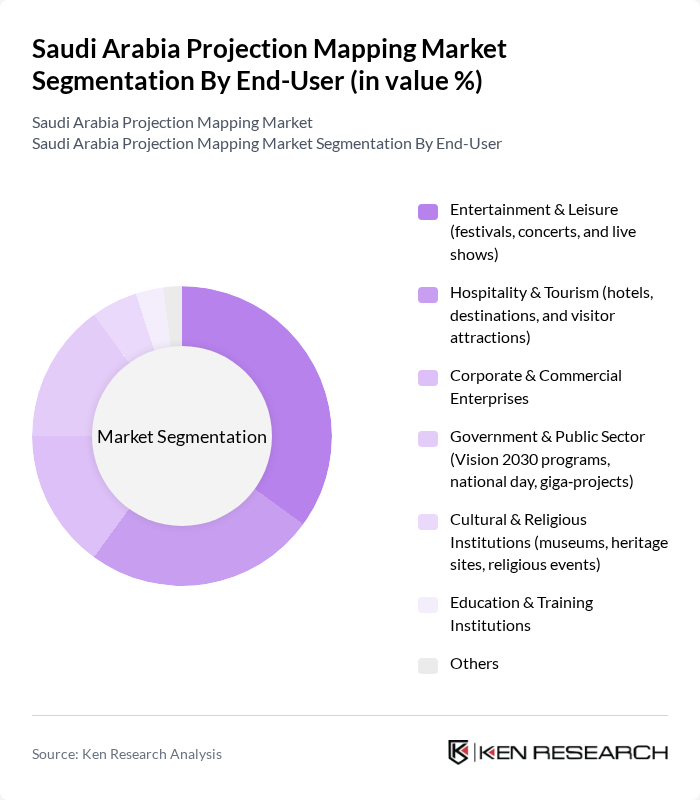

By End-User:The market is segmented by end-user categories, which include Entertainment & Leisure, Hospitality & Tourism, Corporate & Commercial Enterprises, Government & Public Sector, Cultural & Religious Institutions, Education & Training Institutions, and Others. Each end-user segment has distinct requirements and applications for projection mapping technologies, with entertainment, tourism, and government?backed mega?events accounting for a substantial share of demand in Saudi Arabia as they integrate projection mapping into festivals, destination marketing, and large?venue experiences.

The Saudi Arabia Projection Mapping Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barco NV, Christie Digital Systems (Ushio Inc.), Epson Middle East FZCO (Seiko Epson Corporation), Panasonic Marketing Middle East & Africa FZE, Sony Professional Solutions Middle East & Africa (Sony Group Corporation), NEC Display Solutions / Sharp NEC Display Solutions, Digital Projection Ltd. (A Delta Group Company), Xiaomi Light & Magic (ROE Visual / Unilumin and other LED canvas partners active in KSA), Blink Experience, Midwam, SACO (Azkadenya/SACO World – AV & Events Division), Access Event Solutions, Craft (Craft Creative Studio, Riyadh), Balich Wonder Studio (activities in Saudi Arabia), NEOM & Giga?Project In?House Experience Teams (as key demand shapers and collaborators) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia projection mapping market appears promising, driven by ongoing technological advancements and increasing investments in the entertainment sector. As the government continues to support digital transformation initiatives, businesses are likely to adopt projection mapping for various applications, including advertising and cultural events. The integration of augmented reality and interactive elements will further enhance user engagement, positioning projection mapping as a vital tool for businesses aiming to captivate audiences in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Architectural Projection (building façades, heritage sites, and city landmarks) Event & Stage Projection (concerts, festivals, and live performances) Theme Park & Attraction Projection (immersive rides and attractions) Retail & Experiential Marketing Projection D Projection Mapping Interactive & Immersive Installations Others (religious events, sports venues, temporary pop?ups) |

| By End-User | Entertainment & Leisure (festivals, concerts, and live shows) Hospitality & Tourism (hotels, destinations, and visitor attractions) Corporate & Commercial Enterprises Government & Public Sector (Vision 2030 programs, national day, giga?projects) Cultural & Religious Institutions (museums, heritage sites, religious events) Education & Training Institutions Others |

| By Application | Live Events & Festivals (Riyadh Season, MDLBEAST, Noor Riyadh, etc.) Brand & Marketing Activations Themed Attractions & Experiential Venues Public Art & City Beautification Installations Corporate Shows, Product Launches & Conferences Others |

| By Technology | Laser Phosphor Projection LED & Micro?LED Display?Based Mapping DLP Projection Technology LCD Projection Technology Others (LCoS, hybrid engines, ultra?short?throw) |

| By Region | Central Region (Riyadh and surrounding areas) Western Region (Makkah, Madinah, Jeddah, Red Sea coast) Eastern Region (Dammam, Khobar, Dhahran, industrial hubs) Northern & North?Western Region (NEOM, Tabuk and surrounds) Southern Region (Asir, Jazan, Najran, Al?Bahah) |

| By Investment Source | Private Sector Investments (local and regional integrators) Government & Sovereign Funding (Vision 2030 programs, giga?projects) International AV & Technology Vendors Public?Private Partnerships (PPPs) Others (sponsorships, event organizers, foundations) |

| By Policy Support | Government Grants & Cultural Funding Programs Tax & Fee Incentives for Entertainment and Tourism Investments Regulatory Facilitation for Events and Outdoor Installations Public?Private Partnership Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Planners | 120 | Event Managers, Marketing Directors |

| Entertainment Venues | 90 | Venue Managers, Technical Directors |

| Advertising Agencies | 80 | Creative Directors, Account Managers |

| Public Sector Events | 70 | Government Officials, Event Coordinators |

| Technology Providers | 60 | Product Managers, Sales Executives |

The Saudi Arabia Projection Mapping Market is valued at approximately USD 1.9 billion, representing a significant share of the broader Middle East and Africa projection mapping market, which is estimated to be around USD 4.95.0 billion.