Region:Middle East

Author(s):Shubham

Product Code:KRAC4305

Pages:99

Published On:October 2025

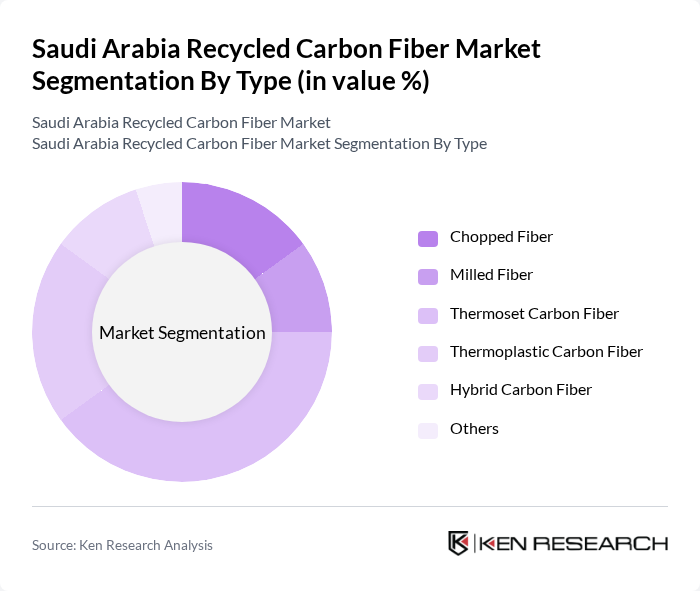

By Type:The market is segmented into various types of recycled carbon fiber, including Chopped Fiber, Milled Fiber, Thermoset Carbon Fiber, Thermoplastic Carbon Fiber, Hybrid Carbon Fiber, and Others. Thermoset Carbon Fiber is currently the leading subsegment, driven by its superior mechanical properties and widespread application in high-performance industries. The demand for lightweight and durable materials in automotive and aerospace sectors continues to drive the preference for thermoset options, as they offer excellent strength and reliability.

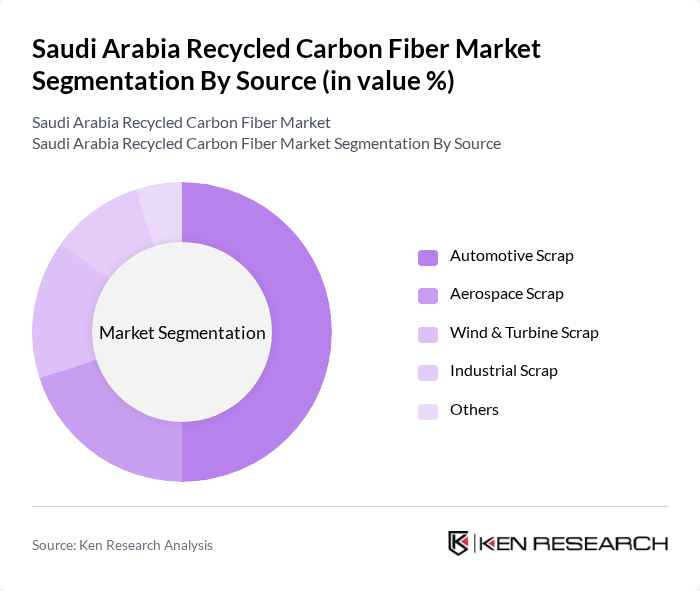

By Source:The market is also segmented based on the source of recycled carbon fiber, including Automotive Scrap, Aerospace Scrap, Wind & Turbine Scrap, Industrial Scrap, and Others. Automotive Scrap is the dominant source, supported by the high volume of end-of-life vehicles and the automotive industry's commitment to sustainability. The increasing focus on recycling and reusing materials in automotive manufacturing significantly contributes to the growth of this subsegment.

The Saudi Arabia Recycled Carbon Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toray Industries, Inc., SGL Carbon SE, Hexcel Corporation, Mitsubishi Chemical Corporation, Teijin Limited, Solvay S.A., Zoltek Companies, Inc., Carbon Conversions, Inc., ELG Carbon Fibre Ltd., Carbon Fiber Recycling, LLC, Saudi Basic Industries Corporation (SABIC), Advanced Composites Company (ACC), Saudi Arabia, Global Carbon Fiber Solutions, Composites Evolution Ltd., Recycled Carbon Fiber, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the recycled carbon fiber market in Saudi Arabia appears promising, driven by increasing government support and technological advancements. As the nation progresses towards its Vision 2030 goals, the emphasis on sustainability will likely lead to enhanced recycling capabilities and infrastructure. Furthermore, the automotive and aerospace sectors are expected to adopt recycled materials more widely, creating a robust demand. This evolving landscape presents significant opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chopped Fiber Milled Fiber Thermoset Carbon Fiber Thermoplastic Carbon Fiber Hybrid Carbon Fiber Others |

| By Source | Automotive Scrap Aerospace Scrap Wind & Turbine Scrap Industrial Scrap Others |

| By End-User | Automotive & Transportation Aerospace & Defense Construction Marine Sporting Goods Consumer Goods Industrial Equipment Others |

| By Application | Structural Components Interior Components Exterior Components Composite Panels Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Carbon Fiber Applications | 45 | Manufacturing Engineers, Quality Assurance Managers |

| Automotive Industry Recycling Practices | 40 | Production Managers, Sustainability Coordinators |

| Construction Sector Material Recovery | 40 | Project Managers, Environmental Compliance Officers |

| Research Institutions Focused on Carbon Fiber | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies on Recycling | 35 | Policy Makers, Environmental Analysts |

The Saudi Arabia Recycled Carbon Fiber Market is valued at approximately USD 5 million, reflecting a growing demand for sustainable materials, particularly in the automotive and aerospace industries, driven by environmental awareness and government initiatives.