Region:Middle East

Author(s):Shubham

Product Code:KRAC4291

Pages:92

Published On:October 2025

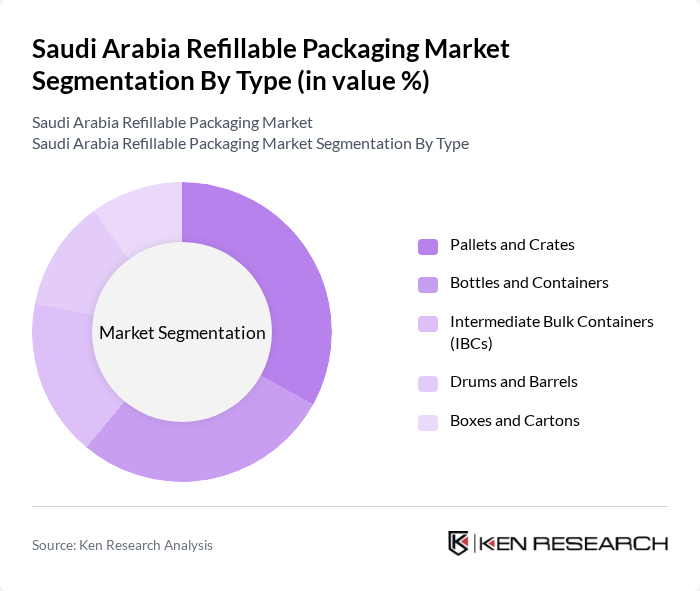

By Type:The refillable packaging market is segmented into pallets and crates, bottles and containers, intermediate bulk containers (IBCs), drums and barrels, and boxes and cartons. Among these, pallets and crates represent the largest revenue-generating segment, reflecting their extensive use in logistics and industrial applications. However, bottles and containers are the fastest-growing sub-segment, driven by their widespread adoption in the food and beverage sector and increasing consumer demand for sustainable, convenient packaging. The versatility and convenience of refillable bottles and containers make them a preferred choice for both manufacturers and consumers .

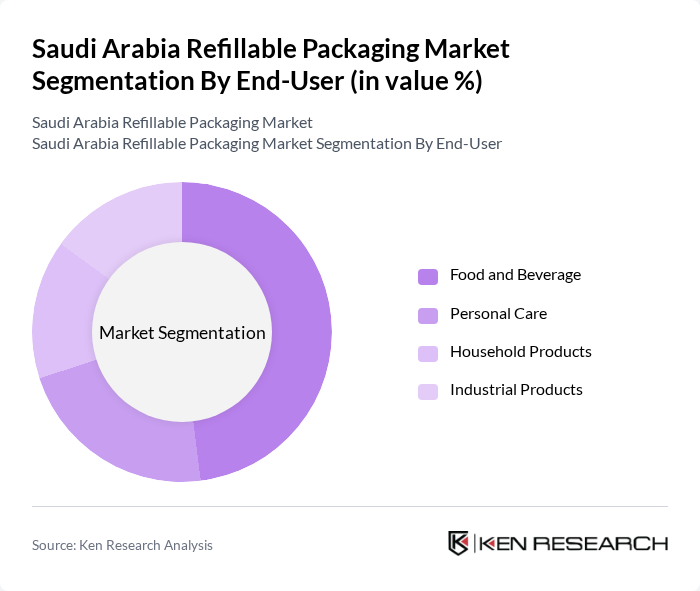

By End-User:The market is segmented by end-user into food and beverage, personal care, household products, and industrial products. The food and beverage sector remains the leading segment, driven by the increasing consumer preference for sustainable packaging options and the sector’s rapid adoption of refillable solutions. Growth in this segment is further supported by the expansion of ready-to-eat and convenience food offerings, which align with health and environmental consciousness among consumers .

The Saudi Arabia Refillable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor PLC, Double H Plastics, Inc., Greiner Packaging, Tek Pak, RPC Group, Reynolds Group, ORBIS Corp., Plastipak Holdings, Al-Jazeera Plastics, and Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the refillable packaging market in Saudi Arabia appears promising, driven by increasing environmental awareness and supportive government policies. As consumer preferences shift towards sustainability, businesses are likely to innovate and adopt eco-friendly packaging solutions. The expansion of e-commerce will further facilitate the growth of refillable packaging, as online retailers seek to meet consumer demand for sustainable options. Overall, the market is poised for significant transformation, aligning with global sustainability trends and local initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Pallets and Crates Bottles and Containers Intermediate Bulk Containers (IBCs) Drums and Barrels Boxes and Cartons |

| By End-User | Food and Beverage Personal Care Household Products Industrial Products |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Convenience Stores Direct Sales |

| By Material | Biodegradable Materials Recycled Materials Virgin Materials |

| By Application | Refillable Bottles Refillable Containers Refillable Pouches |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refillable Packaging | 150 | General Consumers, Eco-conscious Shoppers |

| Retailer Insights on Refillable Packaging Adoption | 100 | Store Managers, Procurement Officers |

| Manufacturers' Perspectives on Refillable Solutions | 80 | Production Managers, R&D Heads |

| Government and Regulatory Insights | 50 | Policy Makers, Environmental Regulators |

| Sustainability Advocates and NGOs | 40 | Environmental Activists, Sustainability Consultants |

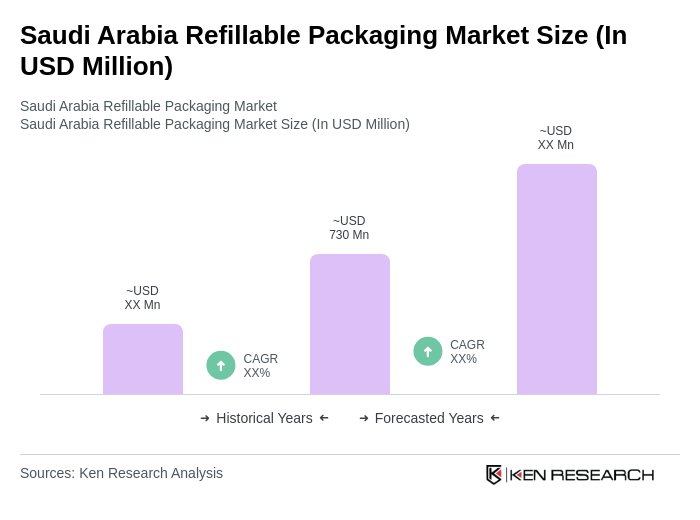

The Saudi Arabia Refillable Packaging Market is valued at approximately USD 730 million, reflecting a significant growth trend driven by increasing environmental awareness and consumer demand for sustainable packaging solutions across various sectors, particularly food and beverage.