Region:Middle East

Author(s):Dev

Product Code:KRAB5412

Pages:90

Published On:October 2025

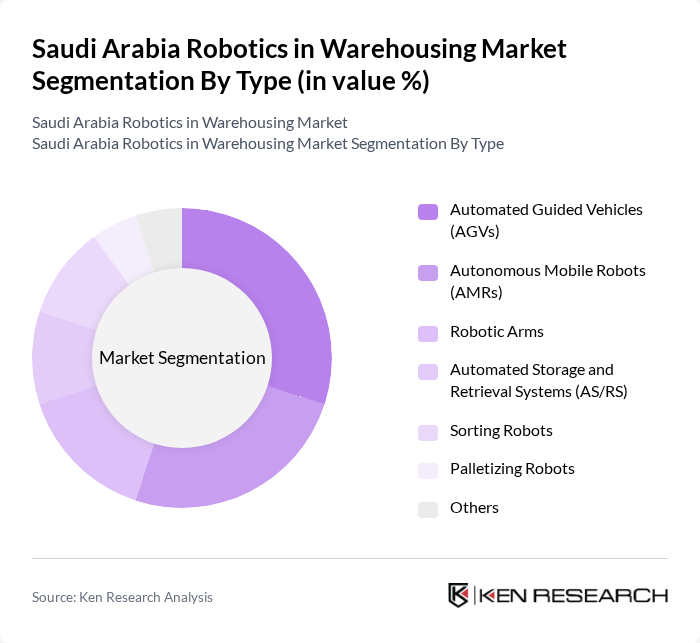

By Type:The market is segmented into various types of robotic solutions, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms, Automated Storage and Retrieval Systems (AS/RS), Sorting Robots, Palletizing Robots, and Others. Among these, Automated Guided Vehicles (AGVs) are leading the market due to their versatility and efficiency in transporting goods within warehouses. The increasing need for automation in logistics is driving the adoption of these technologies.

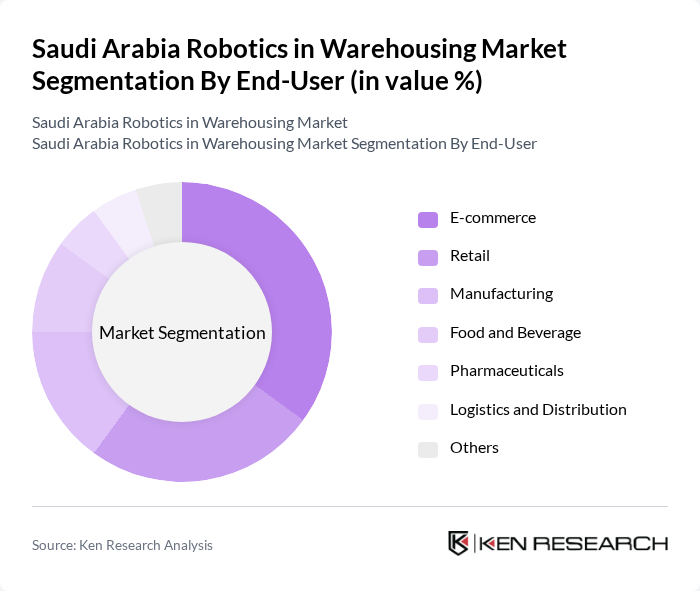

By End-User:The end-user segmentation includes E-commerce, Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Logistics and Distribution, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment processes. Retailers are increasingly investing in robotic solutions to streamline their warehousing operations and meet consumer demands for faster delivery.

The Saudi Arabia Robotics in Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Daifuku Co., Ltd., Honeywell Intelligrated, Siemens AG, Omron Corporation, Zebra Technologies Corporation, Fetch Robotics, GreyOrange, Seegrid Corporation, Clearpath Robotics, Mobile Industrial Robots (MIR), 6 River Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotics in warehousing market in Saudi Arabia appears promising, driven by technological advancements and increasing investments in automation. As companies seek to enhance operational efficiency, the integration of AI and machine learning into robotic systems will become more prevalent. Additionally, the focus on sustainability will push businesses to adopt energy-efficient solutions, aligning with global trends. The market is expected to evolve rapidly, with innovative solutions addressing specific industry needs and challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms Automated Storage and Retrieval Systems (AS/RS) Sorting Robots Palletizing Robots Others |

| By End-User | E-commerce Retail Manufacturing Food and Beverage Pharmaceuticals Logistics and Distribution Others |

| By Application | Inventory Management Order Fulfillment Packaging Shipping and Receiving Quality Control Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Component | Hardware Software Services Others |

| By Investment Source | Private Investment Government Funding Venture Capital Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies Tax Incentives Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Automation | 100 | Warehouse Managers, Operations Executives |

| Manufacturing Robotics Integration | 80 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 90 | Logistics Coordinators, IT Managers |

| Cold Storage Robotics Solutions | 70 | Facility Managers, Procurement Specialists |

| Technology Providers in Robotics | 60 | Product Development Managers, Sales Directors |

The Saudi Arabia Robotics in Warehousing Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for automation in logistics and warehousing, particularly due to the rise of e-commerce and the need for faster delivery times.