Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7282

Pages:94

Published On:December 2025

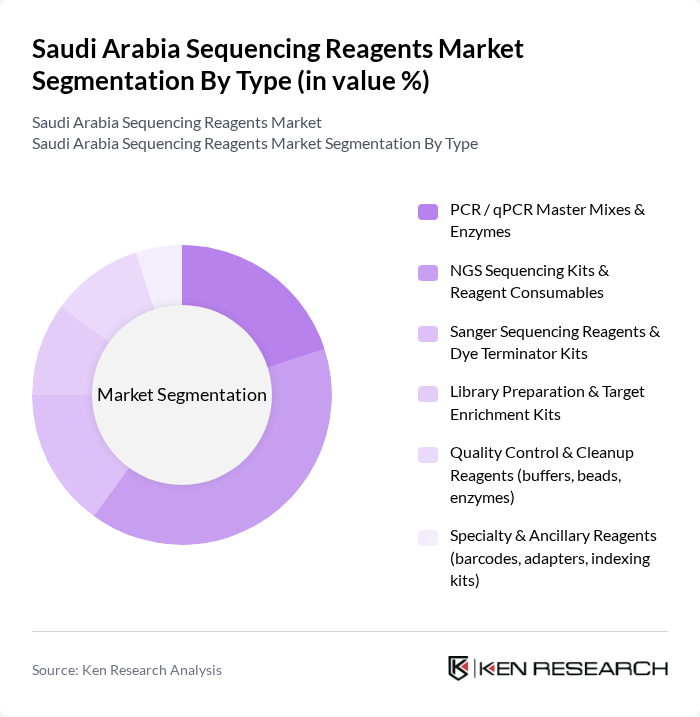

By Type:The market is segmented into various types of sequencing reagents, including PCR/qPCR Master Mixes & Enzymes, NGS Sequencing Kits & Reagent Consumables, Sanger Sequencing Reagents & Dye Terminator Kits, Library Preparation & Target Enrichment Kits, Quality Control & Cleanup Reagents, and Specialty & Ancillary Reagents. Among these, NGS Sequencing Kits & Reagent Consumables dominate the market due to their widespread application in research and clinical diagnostics, in line with evidence that consumables account for the largest share of NGS spending in Saudi Arabia. The increasing adoption of next-generation sequencing technologies in genomics research and personalized medicine, including targeted cancer panels, inherited disease testing, and infectious disease genomics, drives the demand for these reagents.

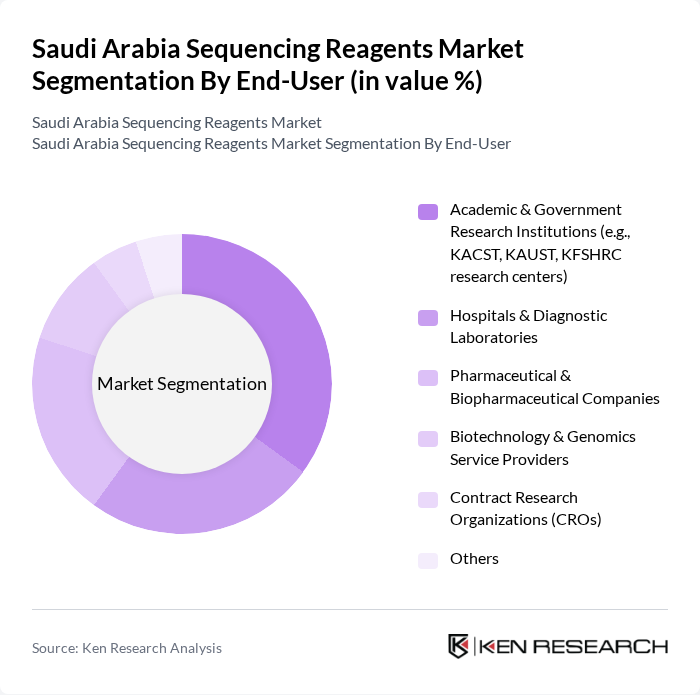

By End-User:The end-user segmentation includes Academic & Government Research Institutions, Hospitals & Diagnostic Laboratories, Pharmaceutical & Biopharmaceutical Companies, Biotechnology & Genomics Service Providers, Contract Research Organizations (CROs), and Others. Academic & Government Research Institutions are the leading end-users, driven by significant funding for genomic research, national genome and cancer research programs, and the need for advanced sequencing technologies in various studies. At the same time, hospitals and diagnostic laboratories are rapidly increasing their share as major adopters of NGS-based diagnostics under Vision 2030 initiatives to perform genetic testing locally, which further enhances the demand for sequencing reagents across clinical and translational research settings.

The Saudi Arabia Sequencing Reagents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd (Roche Sequencing), Agilent Technologies, Inc., QIAGEN N.V., BGI Genomics Co., Ltd., Oxford Nanopore Technologies plc, Pacific Biosciences of California, Inc. (PacBio), New England Biolabs, Inc., Promega Corporation, Takara Bio Inc., Integrated DNA Technologies, Inc. (IDT), Bio-Rad Laboratories, Inc., PerkinElmer, Inc. (Revvity, Inc.), Local & Regional Distributors (e.g., Abdulrehman Algosaibi G.T., Gulf Scientific Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia sequencing reagents market appears promising, driven by ongoing advancements in technology and increasing investments in healthcare infrastructure. As the government continues to support biotechnology initiatives, the market is expected to witness a rise in research collaborations and clinical applications. Furthermore, the integration of artificial intelligence in genomic analysis is anticipated to enhance the efficiency and accuracy of sequencing processes, paving the way for innovative solutions in personalized medicine.

| Segment | Sub-Segments |

|---|---|

| By Type | PCR / qPCR Master Mixes & Enzymes NGS Sequencing Kits & Reagent Consumables Sanger Sequencing Reagents & Dye Terminator Kits Library Preparation & Target Enrichment Kits Quality Control & Cleanup Reagents (buffers, beads, enzymes) Specialty & Ancillary Reagents (barcodes, adapters, indexing kits) |

| By End-User | Academic & Government Research Institutions (e.g., KACST, KAUST, KFSHRC research centers) Hospitals & Diagnostic Laboratories Pharmaceutical & Biopharmaceutical Companies Biotechnology & Genomics Service Providers Contract Research Organizations (CROs) Others |

| By Application | Clinical Diagnostics (oncology, inherited & rare diseases, infectious diseases) Research & Drug Discovery Agrigenomics & Veterinary Genomics Microbiome & Metagenomics Studies Reproductive & Newborn Screening Genomics Others |

| By Distribution Channel | Direct Sales by Global OEMs Local Authorized Distributors / Channel Partners E-commerce & Vendor Portals (B2B Online Sales) Government & Group Purchasing Organizations (GPOs) Tenders Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Dhahran) Western Region (including Jeddah, Makkah, Madinah) Southern Region Northern Region |

| By Technology | Sequencing by Synthesis (Illumina platforms) Semiconductor / Ion Torrent Sequencing Single-Molecule Real-Time (SMRT) & Long-Read Sequencing Nanopore Sequencing Others |

| By Research Funding Source | Government Grants & Vision 2030 Programs Private & Venture Capital Investments Institutional & Academic Budget Allocations Corporate R&D Sponsorships & Industry Collaborations International Collaborative Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Laboratories | 45 | Laboratory Managers, Clinical Pathologists |

| Research Institutions | 35 | Research Scientists, Lab Directors |

| Biotechnology Firms | 30 | Procurement Managers, R&D Heads |

| Pharmaceutical Companies | 25 | Product Development Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 40 | Chief Medical Officers, Genetic Counselors |

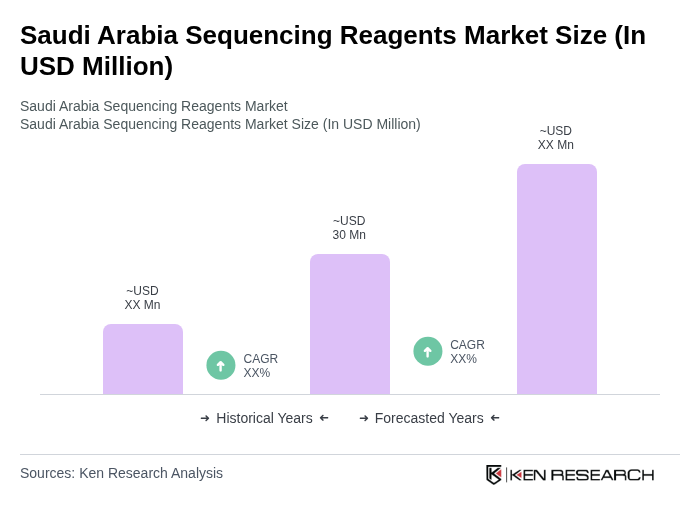

The Saudi Arabia Sequencing Reagents Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by advancements in genomic research and the increasing demand for personalized medicine.