Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5181

Pages:88

Published On:October 2025

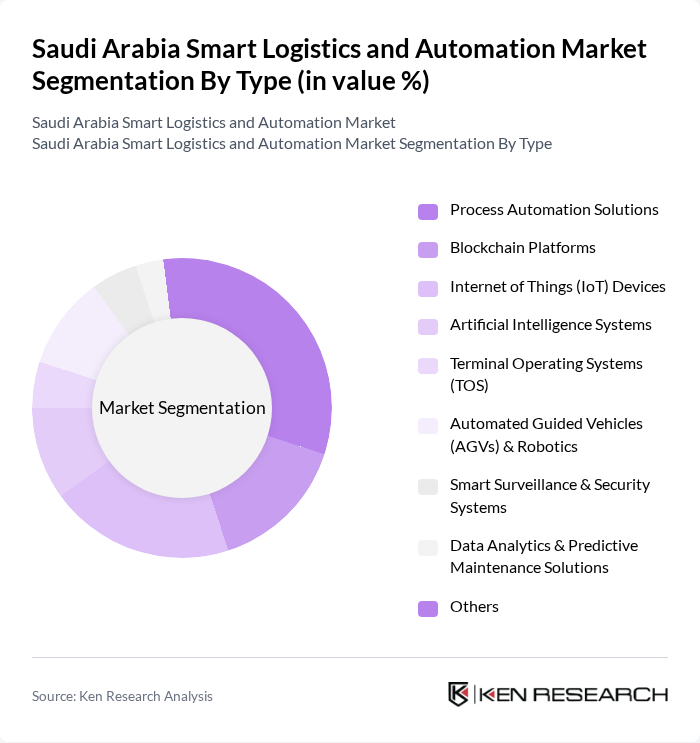

By Type:The market is segmented into Process Automation Solutions, Blockchain Platforms, Internet of Things (IoT) Devices, Artificial Intelligence Systems, Terminal Operating Systems (TOS), Automated Guided Vehicles (AGVs) & Robotics, Smart Surveillance & Security Systems, Data Analytics & Predictive Maintenance Solutions, and Others. Among these, Process Automation Solutions are leading the market due to their ability to streamline operations, minimize manual errors, and support the integration of digital supply chain management, which is essential for productivity and scalability in logistics .

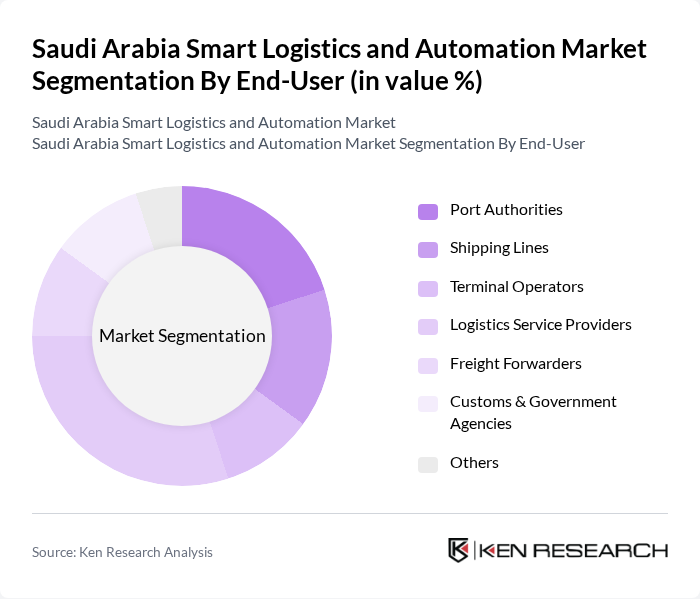

By End-User:The end-user segmentation includes Port Authorities, Shipping Lines, Terminal Operators, Logistics Service Providers, Freight Forwarders, Customs & Government Agencies, and Others. The Logistics Service Providers segment is currently dominating the market, driven by the rising demand for third-party logistics (3PL) services, digital freight solutions, and integrated supply chain management, as businesses seek to optimize efficiency and scalability .

The Saudi Arabia Smart Logistics and Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Logistics Company (SAL), Bahri (The National Shipping Company of Saudi Arabia), Saudi Post (SPL), Red Sea Gateway Terminal (RSGT), DP World, Aramex, Agility Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, DSV, FedEx, UPS, Gulftainer, Maersk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart logistics and automation market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As the e-commerce sector continues to expand, logistics companies are likely to invest in innovative solutions to enhance efficiency and customer satisfaction. Furthermore, the integration of AI and IoT technologies will play a crucial role in optimizing supply chain operations, while the focus on sustainability will drive the adoption of green logistics practices, ensuring long-term growth and resilience in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Process Automation Solutions Blockchain Platforms Internet of Things (IoT) Devices Artificial Intelligence Systems Terminal Operating Systems (TOS) Automated Guided Vehicles (AGVs) & Robotics Smart Surveillance & Security Systems Data Analytics & Predictive Maintenance Solutions Others |

| By End-User | Port Authorities Shipping Lines Terminal Operators Logistics Service Providers Freight Forwarders Customs & Government Agencies Others |

| By Application | Container Terminal Automation Bulk Cargo Management Yard & Gate Automation Vessel Traffic Management Warehousing & Inventory Solutions Customs Clearance & Compliance Real-time Tracking & Monitoring Others |

| By Distribution Mode | Direct Sales System Integrators Distributors & Channel Partners Online Platforms Others |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support for Automation Others |

| By Technology | Process Automation Blockchain IoT Artificial Intelligence Big Data Analytics Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Automation in Retail | 100 | Logistics Managers, Supply Chain Analysts |

| Warehouse Automation Solutions | 70 | Operations Managers, IT Managers |

| Transportation Management Systems | 60 | Fleet Managers, Logistics Coordinators |

| Cold Chain Logistics Automation | 50 | Quality Assurance Managers, Supply Chain Directors |

| Smart Logistics Technologies Adoption | 80 | Business Development Managers, Technology Managers |

The Saudi Arabia Smart Logistics and Automation Market is valued at approximately USD 52.7 billion, driven by the demand for efficient supply chain solutions, rapid digitalization, and government investments in logistics infrastructure and technology.