Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9098

Pages:88

Published On:November 2025

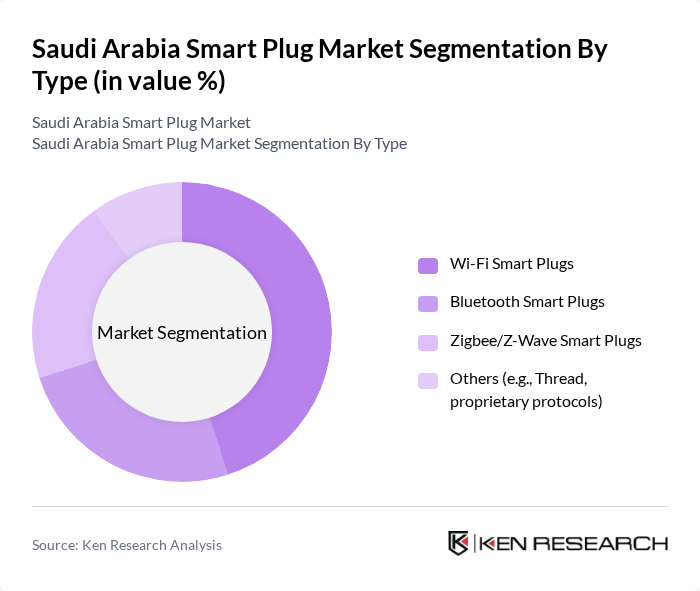

By Type:The market is segmented into various types of smart plugs, including Wi-Fi Smart Plugs, Bluetooth Smart Plugs, Zigbee/Z-Wave Smart Plugs, and Others (e.g., Thread, proprietary protocols). Among these, Wi-Fi Smart Plugs are leading the market due to their ease of use and compatibility with various smart home ecosystems. Consumers prefer Wi-Fi Smart Plugs for their ability to connect directly to home Wi-Fi networks, allowing for remote control and automation through mobile applications. The emergence of interoperability standards such as Matter is further enhancing the appeal of Wi-Fi-based solutions .

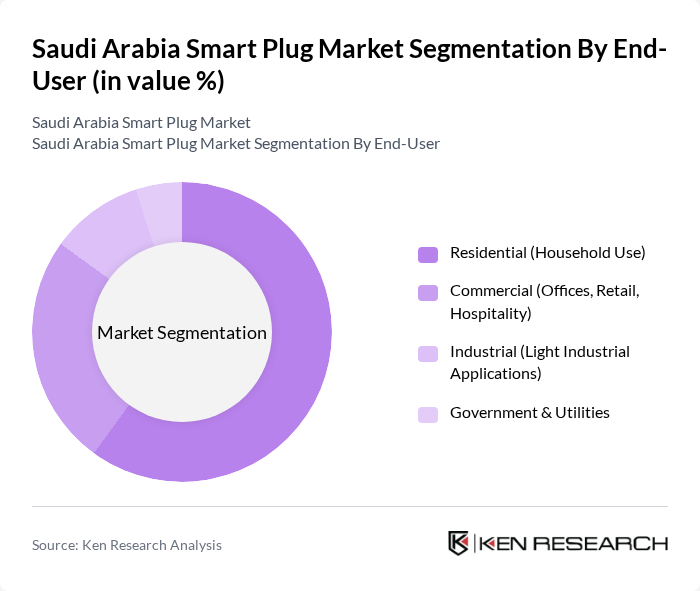

By End-User:The smart plug market is segmented by end-user into Residential (Household Use), Commercial (Offices, Retail, Hospitality), Industrial (Light Industrial Applications), and Government & Utilities. The Residential segment dominates the market, driven by the increasing trend of home automation and the growing number of smart home devices. Consumers are increasingly investing in smart home technologies to enhance convenience, security, and energy management. The commercial segment is also witnessing growth as businesses adopt smart plugs for energy management and automation in offices and hospitality environments .

The Saudi Arabia Smart Plug Market is characterized by a dynamic mix of regional and international players. Leading participants such as TP-Link Technologies, Belkin International (Wemo), Signify (Philips Hue), Amazon Basics, Xiaomi Corporation, Schneider Electric Saudi Arabia, Legrand, D-Link Corporation, Netgear, Eve Systems, Lutron Electronics, Anker Innovations, Satechi, iHome, Wyze Labs, Alfanar, ABB Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart plug market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer interest in energy efficiency. As the government continues to invest in smart city initiatives, the integration of smart plugs into urban infrastructure will likely accelerate. Additionally, the growing trend of mobile app integration and voice-activated devices will enhance user experience, making smart plugs more appealing to tech-savvy consumers. This evolving landscape presents significant opportunities for market players.

| Segment | Sub-Segments |

|---|---|

| By Type | Wi-Fi Smart Plugs Bluetooth Smart Plugs Zigbee/Z-Wave Smart Plugs Others (e.g., Thread, proprietary protocols) |

| By End-User | Residential (Household Use) Commercial (Offices, Retail, Hospitality) Industrial (Light Industrial Applications) Government & Utilities |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Home Automation Energy Management Security Systems Outdoor/High-Power Appliance Control Others |

| By Connectivity | Wired Connectivity Wireless Connectivity Hybrid Connectivity Others |

| By Brand | Local Brands (e.g., Alfanar, Schneider Electric Saudi Arabia) International Brands Private Labels Others |

| By Price Range | Budget (Entry-level) Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Plug Users | 120 | Homeowners, Renters |

| Commercial Smart Plug Implementers | 60 | Facility Managers, IT Managers |

| Retailers of Smart Home Devices | 50 | Store Managers, Sales Representatives |

| Technology Enthusiasts and Influencers | 40 | Tech Bloggers, Social Media Influencers |

| Industry Experts and Analysts | 40 | Market Analysts, Research Consultants |

The Saudi Arabia Smart Plug Market is valued at approximately USD 160 million, reflecting a significant growth trend driven by the increasing adoption of smart home technologies and consumer awareness regarding energy efficiency.