Region:North America

Author(s):Geetanshi

Product Code:KRAB1620

Pages:86

Published On:January 2026

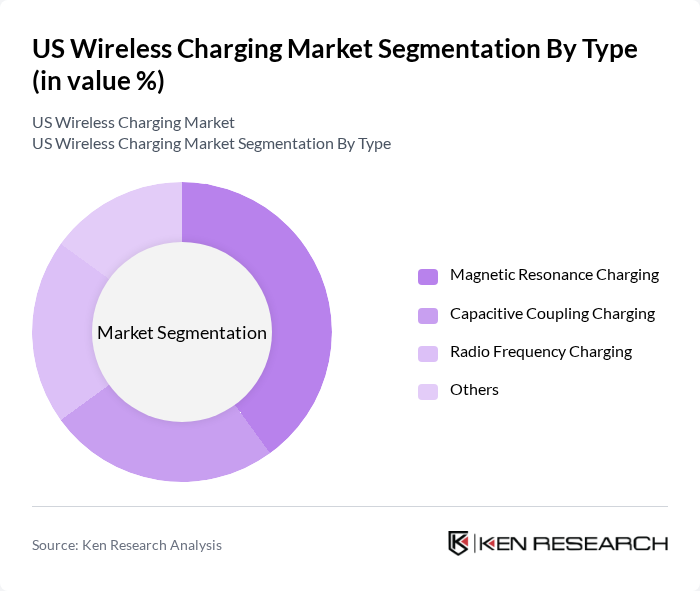

By Type:The market can be segmented into various types of wireless charging technologies, including Inductive Charging, Resonant Charging, Radio Frequency Charging, Magnetic Field Charging, and Others. Inductive Charging is currently the most widely adopted technology due to its efficiency and compatibility with a range of devices. Resonant Charging is gaining traction for its ability to charge multiple devices simultaneously, while Radio Frequency Charging is emerging in niche applications. Magnetic Field Charging and other technologies are also being explored for specific use cases.

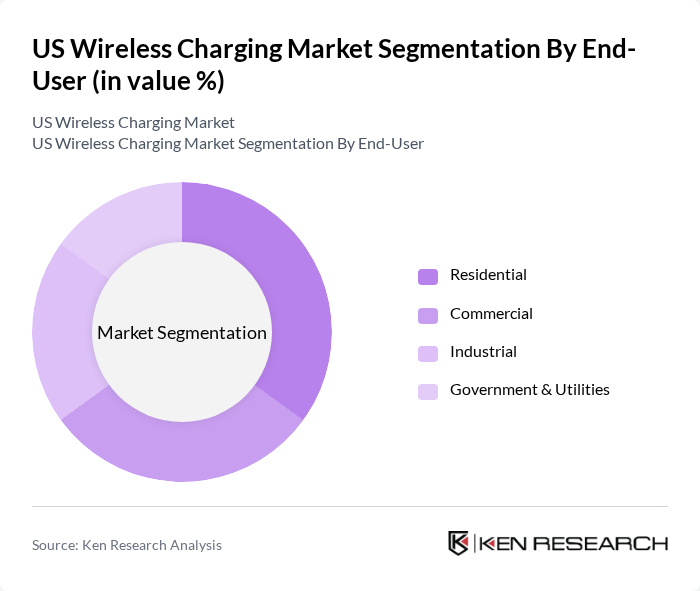

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Healthcare, Industrial Applications, and Others. The Consumer Electronics segment leads the market, driven by the widespread use of smartphones and wearable devices that support wireless charging. The Automotive sector is rapidly adopting wireless charging for electric vehicles, while the Healthcare sector utilizes this technology for medical devices. Industrial applications are also emerging as a significant user of wireless charging solutions.

The US Wireless Charging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Energous Corporation, Powermat Technologies, Qualcomm Technologies, Inc., WiTricity Corporation, Samsung Electronics, Apple Inc., Belkin International, Inc., Anker Innovations, Sony Corporation, Philips Lighting, Tesla, Inc., IKEA, Dell Technologies, Microsoft Corporation, and LG Electronics contribute to innovation, geographic expansion, and service delivery in this space.

The US wireless charging market is poised for significant growth, driven by technological advancements and increasing consumer demand for convenience. As electric vehicle adoption accelerates and consumer electronics continue to proliferate, the integration of wireless charging solutions will become more prevalent. Additionally, the expansion of public charging infrastructure and smart home devices will further enhance market dynamics, creating a robust ecosystem for wireless charging technologies. Companies that invest in innovation and consumer education will likely lead the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inductive Charging Resonant Charging Radio Frequency Charging Magnetic Field Charging Others |

| By End-User | Consumer Electronics Automotive Healthcare Industrial Applications Others |

| By Application | Mobile Devices Wearable Technology Electric Vehicles Home Appliances Others |

| By Charging Distance | Short-Range Charging Medium-Range Charging Long-Range Charging Others |

| By Technology | Magnetic Resonance Technology Capacitive Coupling Technology Laser Charging Technology Others |

| By Market Segment | B2B B2C Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Adoption | 120 | Product Managers, Marketing Directors |

| Automotive Wireless Charging Integration | 100 | Automotive Engineers, R&D Managers |

| Public Infrastructure Deployment | 80 | City Planners, Infrastructure Managers |

| Retail Consumer Insights | 100 | Retail Managers, Consumer Behavior Analysts |

| Wireless Charging Technology Developers | 90 | Technology Developers, Innovation Leads |

The US Wireless Charging Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by the adoption of wireless charging technologies across consumer electronics, automotive, and healthcare sectors.