Region:Middle East

Author(s):Dev

Product Code:KRAD5284

Pages:87

Published On:December 2025

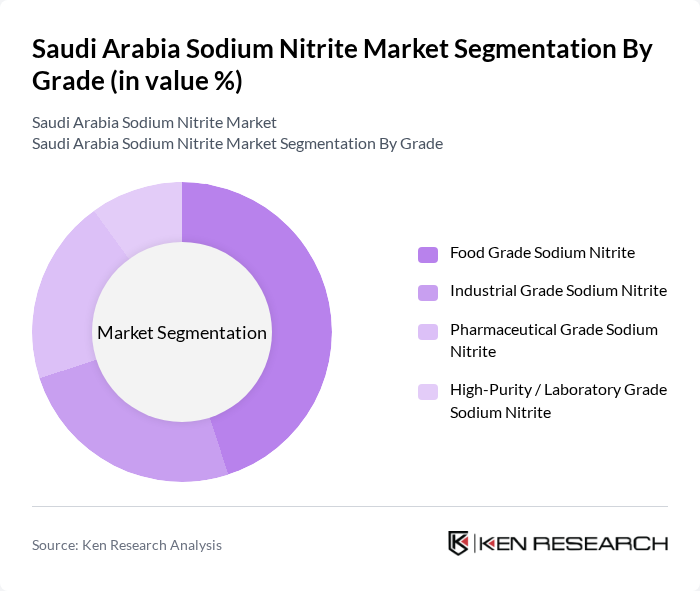

By Grade:

The sodium nitrite market is segmented by grade into Food Grade Sodium Nitrite, Industrial Grade Sodium Nitrite, Pharmaceutical Grade Sodium Nitrite, and High-Purity / Laboratory Grade Sodium Nitrite. Among these, Food Grade Sodium Nitrite is the leading subsegment, driven by its extensive use in the food and beverage industry for meat curing and preservation. The increasing consumer preference for processed and preserved foods has significantly boosted the demand for food-grade sodium nitrite, making it a dominant player in the market.

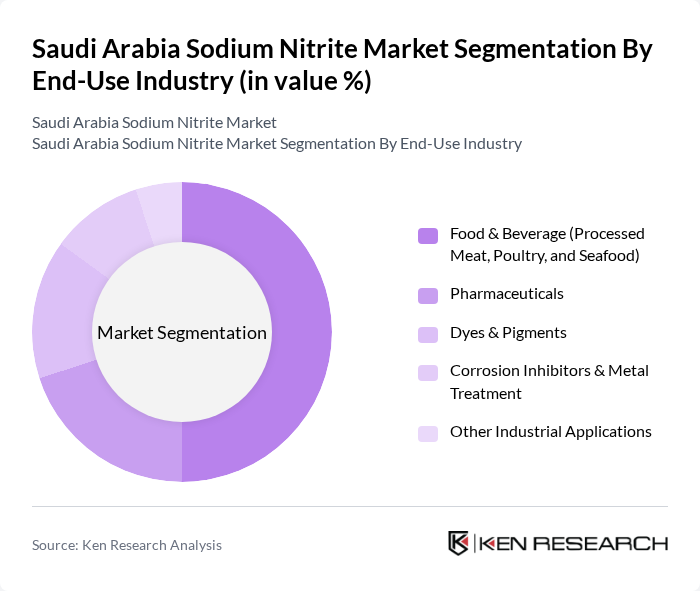

By End-Use Industry:

The market is further segmented by end-use industry into Food & Beverage (Processed Meat, Poultry, and Seafood), Pharmaceuticals, Dyes & Pigments, Corrosion Inhibitors & Metal Treatment, and Other Industrial Applications. The Food & Beverage sector is the most significant contributor, primarily due to the rising demand for processed meat products supported by increased adoption of Halal processed meats and growth in Umrah and Hajj visitors. The increasing consumer inclination towards convenience foods has led to a surge in the use of sodium nitrite for meat preservation, solidifying its position as the leading end-use industry.

The Saudi Arabia Sodium Nitrite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Chemical Company Holding, Modern Chemicals & Services Company (MCSC), Bahri Chemicals (National Shipping Company of Saudi Arabia – Chemicals Division), Saudi International Petrochemical Company (Sipchem), Nama Chemicals Company, Farabi Petrochemicals Company, Saudi Arabian Mining Company (Ma’aden), BASF SE (Saudi Arabia Operations), Deepak Nitrite Ltd. (Supply to Saudi Arabia Market), Anmol Chemicals (Supply to Saudi Arabia Market), Yara International ASA (Regional Chemicals & Industrial Solutions), Ferozsons Laboratories / Regional Pharma-Grade Importers, Local Specialized Chemical Distributors (e.g., REDA Chemicals), International Trading Houses Active in Saudi Nitrite Imports contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the sodium nitrite market in Saudi Arabia appears promising, driven by increasing demand in food preservation and the pharmaceutical sector. As the government continues to support industrial growth through initiatives like Vision 2030, the market is likely to see innovations in production processes. Additionally, the rising focus on sustainability and compliance with environmental regulations will shape the industry's landscape, encouraging manufacturers to adopt eco-friendly practices while meeting consumer demands for safety and quality.

| Segment | Sub-Segments |

|---|---|

| By Grade | Food Grade Sodium Nitrite Industrial Grade Sodium Nitrite Pharmaceutical Grade Sodium Nitrite High-Purity / Laboratory Grade Sodium Nitrite |

| By End-Use Industry | Food & Beverage (Processed Meat, Poultry, and Seafood) Pharmaceuticals Dyes & Pigments Corrosion Inhibitors & Metal Treatment Other Industrial Applications |

| By Application | Meat Curing & Food Preservation Dye & Pigment Intermediates Corrosion Inhibition in Oil & Gas and Water Systems Pharmaceutical Intermediates Other Specialty Applications |

| By Distribution Channel | Direct Sales to Large Industrial Users Chemical Distributors / Traders Online / E-Tendering Platforms Other Indirect Channels |

| By Region (Saudi Arabia) | Eastern Province (including Jubail & Dammam) Western Province (including Jeddah & Makkah) Central Region (including Riyadh) Southern & Northern Regions |

| By Packaging Format | Bulk Packaging (Drums, IBCs, Tankers) Small Industrial Bags & Sacks Specialty / Custom Packaging Others |

| By Customer Type | Large Integrated Chemical & Food Processors Medium-Sized Manufacturers Small Enterprises & Contract Processors Traders & Repackagers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 90 | Production Managers, Quality Assurance Officers |

| Pharmaceutical Sector | 70 | Regulatory Affairs Specialists, R&D Managers |

| Chemical Manufacturing | 60 | Operations Managers, Supply Chain Coordinators |

| Research Institutions | 50 | Research Scientists, Laboratory Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Saudi Arabia Sodium Nitrite market is currently valued at USD 0 million, reflecting a five-year historical analysis. The market is primarily driven by increasing demand in food preservation, pharmaceuticals, and industrial applications.