Region:Middle East

Author(s):Rebecca

Product Code:KRAD6185

Pages:98

Published On:December 2025

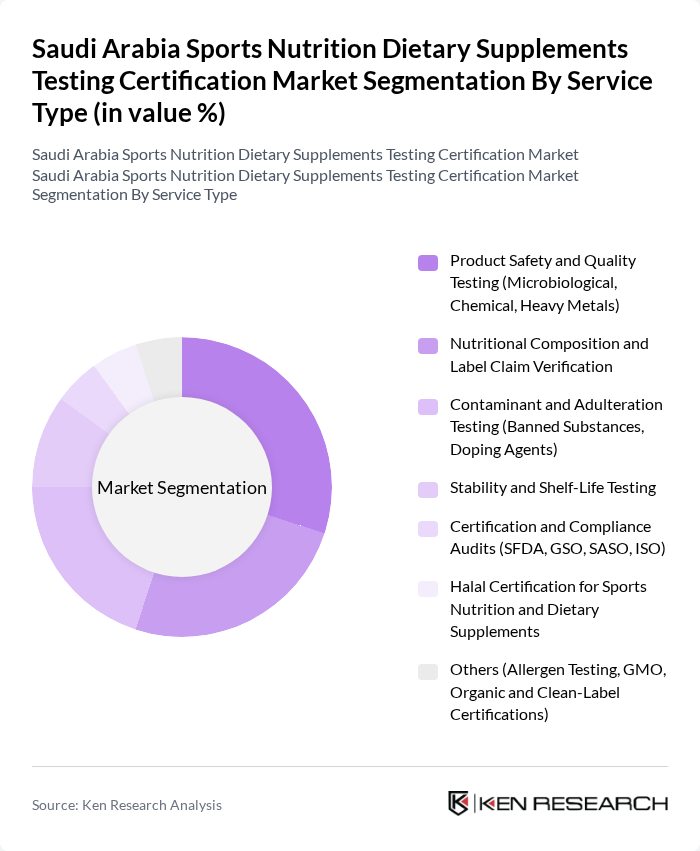

By Service Type:The service type segmentation includes various testing and certification services essential for ensuring the quality and safety of sports nutrition products. The subsegments are as follows:

The leading subsegment in the service type category is Product Safety and Quality Testing, which accounts for a significant portion of the market. This dominance is attributed to the increasing consumer awareness regarding product safety and the rising incidence of foodborne illnesses. As consumers become more health-conscious, they demand rigorous testing to ensure that the products they consume are free from harmful substances. Additionally, regulatory bodies are enforcing stricter compliance measures, further driving the need for comprehensive safety testing.

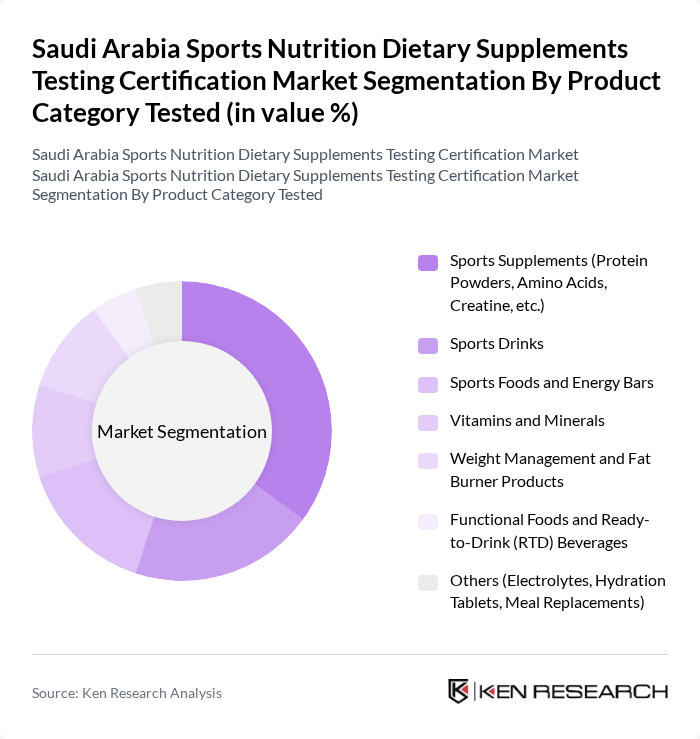

By Product Category Tested:The product category segmentation encompasses various types of sports nutrition products that require testing and certification. The subsegments are as follows:

In the product category tested, Sports Supplements dominate the market, driven by the growing trend of fitness and bodybuilding among consumers. The increasing popularity of protein powders and amino acids, particularly among athletes and fitness enthusiasts, has led to a surge in demand for these products. Furthermore, the rise of social media influencers promoting fitness and nutrition has significantly impacted consumer behavior, leading to higher sales of sports supplements.

The Saudi Arabia Sports Nutrition Dietary Supplements Testing Certification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Food & Drug Authority (SFDA) – National Laboratories, Saudi Standards, Metrology and Quality Organization (SASO), Saudi Accreditation Center (SAC), SGS Saudi Arabia Limited, Bureau Veritas Saudi Arabia, Intertek Saudi Arabia Ltd., TÜV Rheinland Saudi Arabia LLC, TÜV SÜD Saudi Arabia, UL Solutions – Middle East (Saudi Arabia Operations), Eurofins Scientific – Middle East & Saudi Arabia Operations, ALS Arabia (ALS Saudi Arabia Co. Ltd.), National Center for Environmental and Food Testing Laboratories (where applicable), King Abdulaziz City for Science and Technology (KACST) – Relevant Labs, Regional University and Government Laboratories Involved in Food & Supplement Testing, Selected Accredited Private Food & Supplement Testing Laboratories in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia sports nutrition dietary supplements testing certification market appears promising, driven by increasing health awareness and a growing fitness culture. As the government continues to promote sports and wellness initiatives, the demand for certified dietary supplements is expected to rise. Innovations in product formulations and a shift towards organic options will likely attract health-conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of products, enhancing market growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Product Safety and Quality Testing (Microbiological, Chemical, Heavy Metals) Nutritional Composition and Label Claim Verification Contaminant and Adulteration Testing (Banned Substances, Doping Agents) Stability and Shelf-Life Testing Certification and Compliance Audits (SFDA, GSO, SASO, ISO) Halal Certification for Sports Nutrition and Dietary Supplements Others (Allergen Testing, GMO, Organic and Clean-Label Certifications) |

| By Product Category Tested | Sports Supplements (Protein Powders, Amino Acids, Creatine, etc.) Sports Drinks Sports Foods and Energy Bars Vitamins and Minerals Weight Management and Fat Burner Products Functional Foods and Ready-to-Drink (RTD) Beverages Others (Electrolytes, Hydration Tablets, Meal Replacements) |

| By End-User Client | Sports Nutrition and Dietary Supplement Manufacturers Importers, Distributors and Private Label Brand Owners Retailers, Pharmacies and E?commerce Platforms Gyms, Fitness Centers and Sports Clubs Hospitals, Clinics and Diet/Nutrition Centers Government and Regulatory Bodies (SFDA, Municipalities, Labs) Others (Research Institutes, Universities, Sports Federations) |

| By Certification Standard | SFDA Compliance Certification GSO and SASO Standard Compliance ISO/IEC 17025 and ISO 22000 Certifications Informed-Sport and Anti-Doping Certifications Halal Certification (Local and International Bodies) Organic, Non-GMO and Clean-Label Certifications Others (HACCP, GMP and Facility Audits) |

| By Testing Method | Chemical and Instrumental Analysis (HPLC, GC-MS, ICP-MS, etc.) Microbiological Testing Physical and Sensory Testing In?house / On?site Testing Services Outsourced Laboratory Testing Services Rapid Test Kits and Screening Methods Others |

| By Client Size | Large Multinational Brands Regional and Mid?Sized Companies Start?ups and Private Label / Contract Manufacturers Public Sector and Institutional Clients Others |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Al Khobar, Dhahran) Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Nutrition Outlets | 100 | Store Managers, Sales Representatives |

| Fitness Centers and Gyms | 80 | Gym Owners, Personal Trainers |

| Health and Wellness Clinics | 60 | Nutritionists, Health Coaches |

| Online Supplement Retailers | 70 | E-commerce Managers, Marketing Directors |

| Professional Sports Teams | 50 | Team Nutritionists, Athletic Trainers |

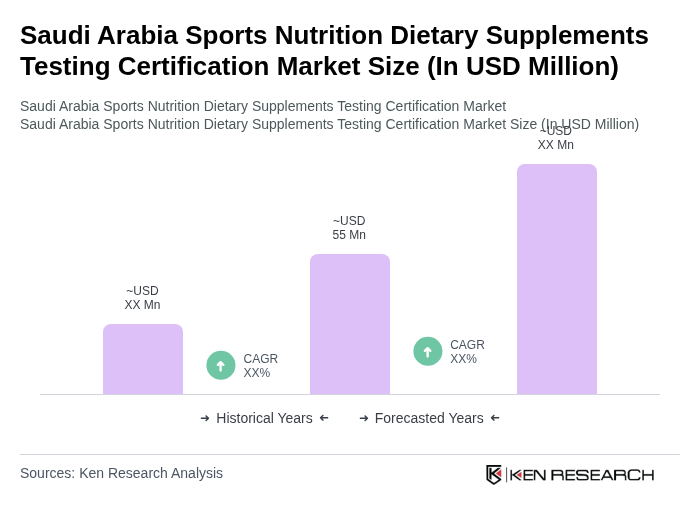

The Saudi Arabia Sports Nutrition Dietary Supplements Testing Certification Market is valued at approximately USD 55 million, reflecting a growing demand for quality assurance in dietary supplements driven by increased health consciousness and fitness activities among consumers.