Region:Middle East

Author(s):Shubham

Product Code:KRAA1036

Pages:82

Published On:August 2025

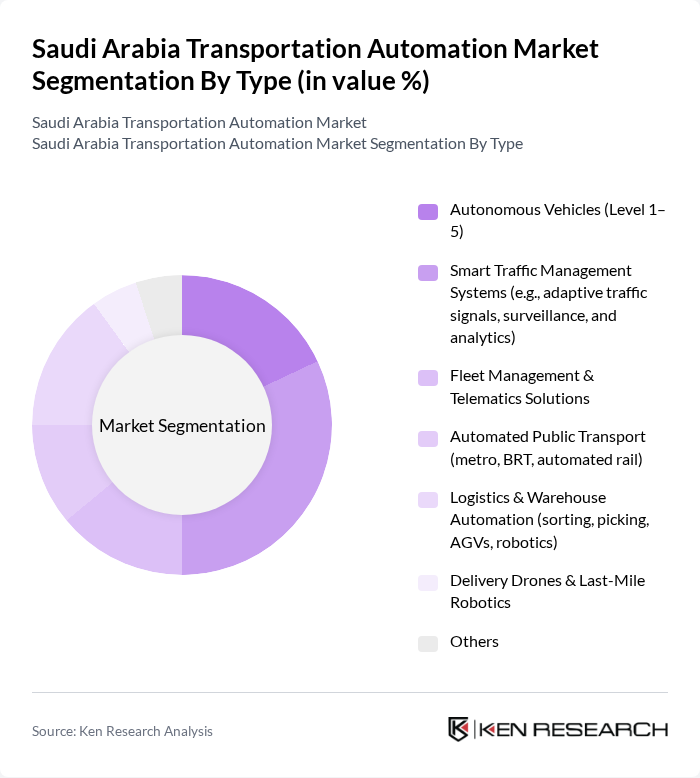

By Type:The market is segmented into Autonomous Vehicles (Level 1–5), Smart Traffic Management Systems, Fleet Management & Telematics Solutions, Automated Public Transport, Logistics & Warehouse Automation, Delivery Drones & Last-Mile Robotics, and Others. Among these, Smart Traffic Management Systems are currently leading the market, driven by the urgent need for efficient traffic flow, congestion reduction, and enhanced safety in urban areas. The integration of IoT, AI, and advanced analytics is significantly improving the performance and scalability of these systems, making them foundational to modern transportation infrastructure .

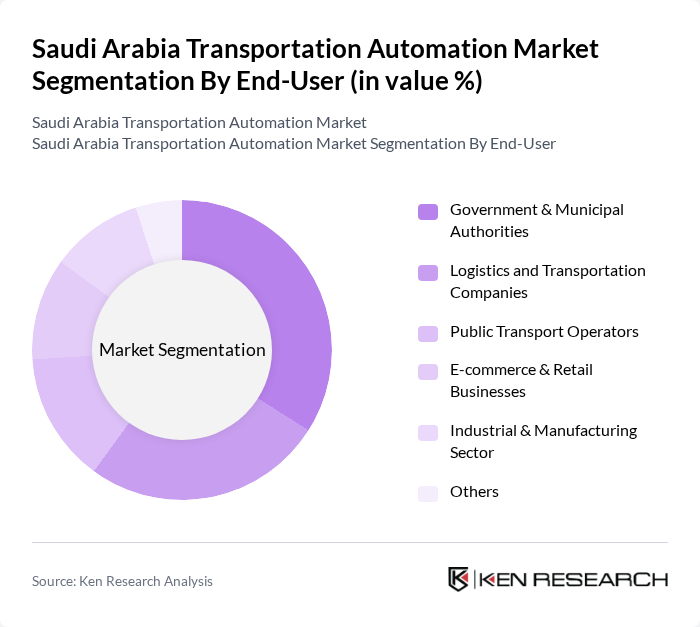

By End-User:The end-user segmentation includes Government & Municipal Authorities, Logistics and Transportation Companies, Public Transport Operators, E-commerce & Retail Businesses, Industrial & Manufacturing Sector, and Others. Government & Municipal Authorities are the leading end-users, driven by the need for improved public services, urban mobility, and infrastructure development. The strong emphasis on smart city initiatives and sustainable, technology-driven transportation solutions is motivating these authorities to prioritize automation investments .

The Saudi Arabia Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Mobility, Alstom, ABB, Thales Group, Huawei Technologies, STC (Saudi Telecom Company), SAPTCO (Saudi Public Transport Company), Kapsch TrafficCom, Cisco Systems, IBM, Oracle, Microsoft, Honeywell, ZF Friedrichshafen AG, Denso Corporation, Continental AG, Al Rajhi Transport, Cegelec Saudi Arabia, Hikvision, Bombardier (now part of Alstom) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation automation market in Saudi Arabia appears promising, driven by ongoing urbanization and government initiatives. By future, the integration of smart technologies is expected to enhance operational efficiency and safety in transportation systems. As public awareness of automated solutions grows, coupled with supportive government policies, the market is likely to witness increased investment and innovation. This evolving landscape will create a conducive environment for the development of advanced transportation solutions, aligning with the nation's Vision 2030 goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Vehicles (Level 1–5) Smart Traffic Management Systems (e.g., adaptive traffic signals, surveillance, and analytics) Fleet Management & Telematics Solutions Automated Public Transport (metro, BRT, automated rail) Logistics & Warehouse Automation (sorting, picking, AGVs, robotics) Delivery Drones & Last-Mile Robotics Others |

| By End-User | Government & Municipal Authorities Logistics and Transportation Companies Public Transport Operators E-commerce & Retail Businesses Industrial & Manufacturing Sector Others |

| By Application | Freight Transportation Automation Passenger Transportation Automation Urban Mobility & Smart City Solutions Emergency & Security Services Automation Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors and Resellers System Integrators Others |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Khobar) Western Region (incl. Jeddah, Mecca) Southern Region Northern Region Others |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Automation Technologies Tax Incentives for Green Solutions Grants for Research and Development Regulatory Sandboxes & Pilot Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Automation | 100 | Transport Authority Officials, Operations Managers |

| Freight and Logistics Automation | 80 | Logistics Directors, Fleet Managers |

| Smart Traffic Management Systems | 70 | City Planners, IT Managers in Transportation |

| Automated Delivery Solutions | 50 | E-commerce Logistics Managers, Delivery Service Operators |

| Railway Automation Technologies | 40 | Railway Operations Managers, Technology Implementers |

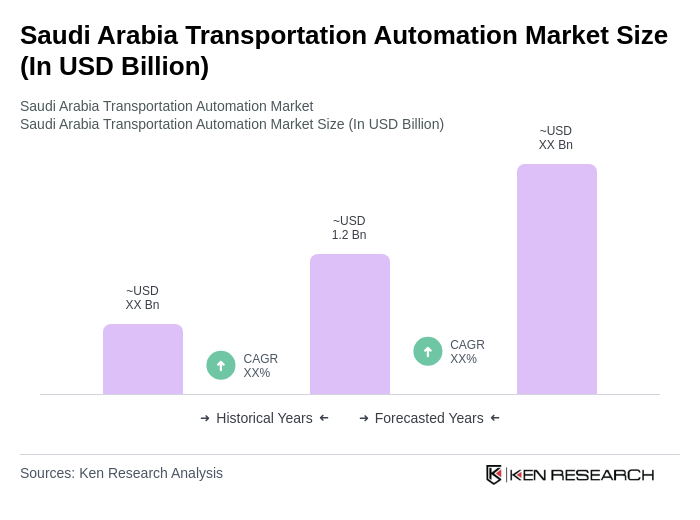

The Saudi Arabia Transportation Automation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, demand for efficient transportation solutions, and government initiatives focused on infrastructure modernization and smart city development.