Region:Asia

Author(s):Shubham

Product Code:KRAA0695

Pages:93

Published On:August 2025

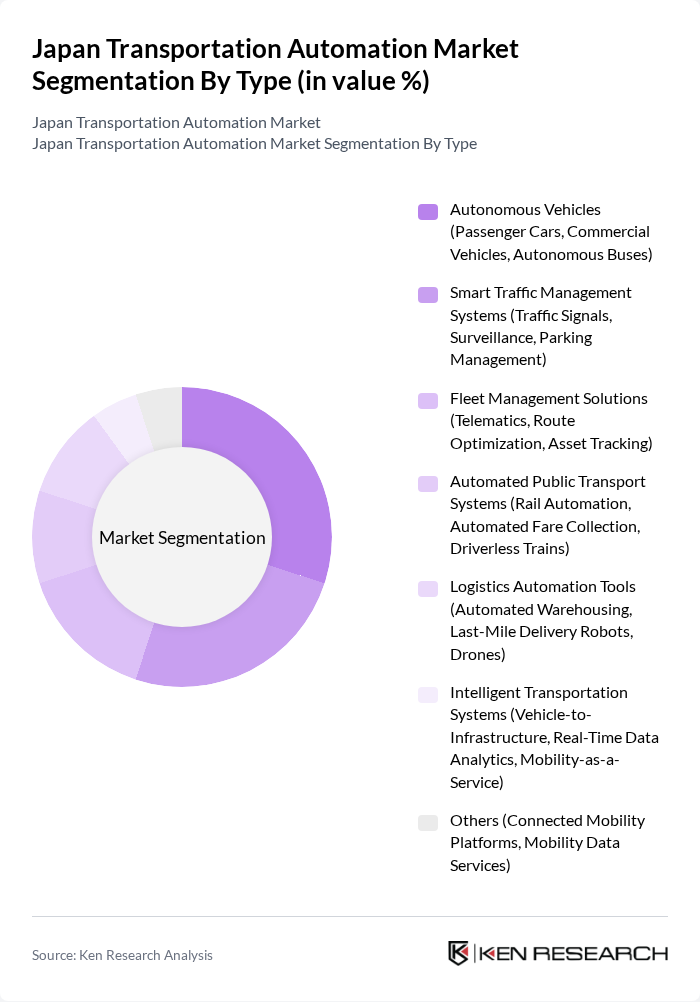

By Type:The market is segmented into Autonomous Vehicles, Smart Traffic Management Systems, Fleet Management Solutions, Automated Public Transport Systems, Logistics Automation Tools, Intelligent Transportation Systems, and Others. Each segment contributes to the modernization, safety, and efficiency of Japan’s transportation ecosystem by leveraging digital technologies, real-time analytics, and automation for both passenger and freight mobility .

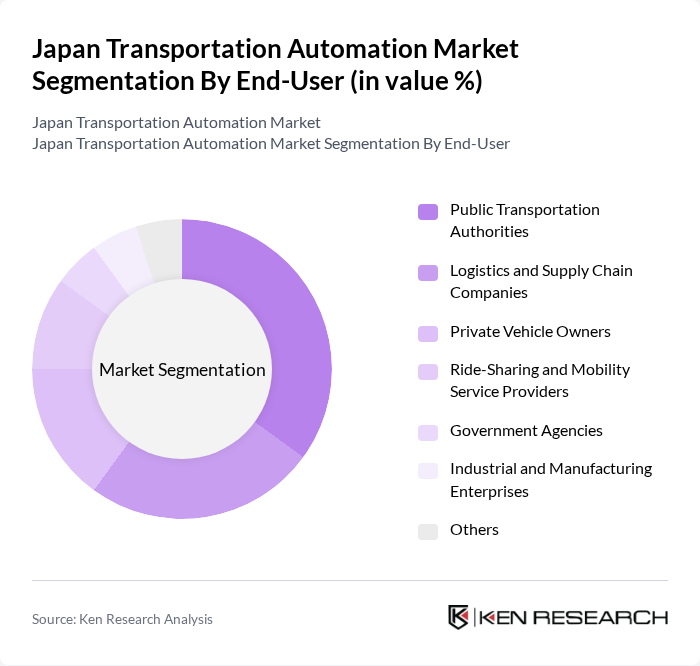

By End-User:The end-user segmentation includes Public Transportation Authorities, Logistics and Supply Chain Companies, Private Vehicle Owners, Ride-Sharing and Mobility Service Providers, Government Agencies, Industrial and Manufacturing Enterprises, and Others. These segments reflect the broad adoption of automation across public transit, logistics, private mobility, government, and industrial sectors, each leveraging automation to improve service delivery, safety, and operational efficiency .

The Japan Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Hitachi, Ltd., Mitsubishi Electric Corporation, Denso Corporation, SoftBank Group Corp., Panasonic Corporation, Fujitsu Limited, NEC Corporation, ZMP Inc., Aisin Corporation, Renesas Electronics Corporation, Cyberdyne Inc., JapanTaxi Co., Ltd., Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Seino Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan transportation automation market appears promising, driven by technological advancements and government support. As urbanization continues, the demand for efficient and sustainable transportation solutions will grow. The integration of AI and IoT technologies will enhance operational efficiencies, while smart city initiatives will create a conducive environment for innovation. Companies that embrace automation will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Vehicles (Passenger Cars, Commercial Vehicles, Autonomous Buses) Smart Traffic Management Systems (Traffic Signals, Surveillance, Parking Management) Fleet Management Solutions (Telematics, Route Optimization, Asset Tracking) Automated Public Transport Systems (Rail Automation, Automated Fare Collection, Driverless Trains) Logistics Automation Tools (Automated Warehousing, Last-Mile Delivery Robots, Drones) Intelligent Transportation Systems (Vehicle-to-Infrastructure, Real-Time Data Analytics, Mobility-as-a-Service) Others (Connected Mobility Platforms, Mobility Data Services) |

| By End-User | Public Transportation Authorities Logistics and Supply Chain Companies Private Vehicle Owners Ride-Sharing and Mobility Service Providers Government Agencies Industrial and Manufacturing Enterprises Others |

| By Application | Urban Mobility Solutions (Smart City Transit, Shared Mobility) Freight and Cargo Transportation (Automated Logistics, Port Automation) Emergency Services (Automated Dispatch, Intelligent Routing) Infrastructure Management (Predictive Maintenance, Asset Monitoring) Others |

| By Component | Hardware (Sensors, Cameras, Controllers) Software (AI Platforms, Fleet Management Software, Traffic Analytics) Services (System Integration, Maintenance, Consulting) |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Automation | 100 | Fleet Managers, Technology Officers |

| Railway Automation Solutions | 60 | Operations Directors, Safety Compliance Managers |

| Maritime Automation Technologies | 50 | Port Authorities, Shipping Line Executives |

| Logistics and Supply Chain Automation | 80 | Logistics Coordinators, Supply Chain Analysts |

| Smart City Transportation Initiatives | 40 | Urban Planners, Government Officials |

The Japan Transportation Automation Market is valued at approximately USD 7 billion, driven by advancements in autonomous vehicle technology, government initiatives for smart cities, and a focus on safety and operational efficiency in transportation systems.