Region:Europe

Author(s):Shubham

Product Code:KRAA0907

Pages:82

Published On:August 2025

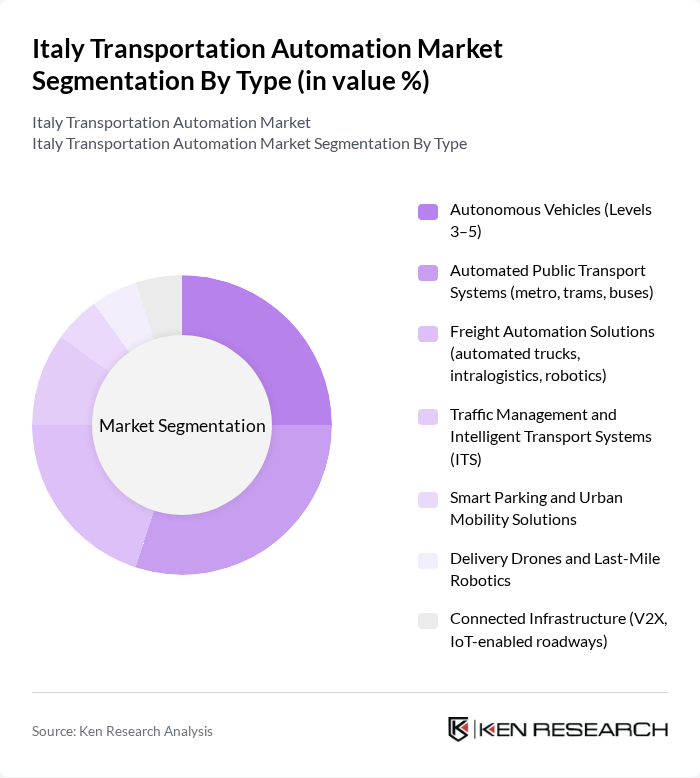

By Type:The market is segmented into Autonomous Vehicles (Levels 3–5), Automated Public Transport Systems, Freight Automation Solutions, Traffic Management and Intelligent Transport Systems, Smart Parking and Urban Mobility Solutions, Delivery Drones and Last-Mile Robotics, and Connected Infrastructure. Each segment is shaped by rapid technological innovation and the need for greater operational efficiency. Autonomous vehicles and automated public transport systems are particularly prominent, supported by Italy’s strong automotive and logistics sectors. Freight automation solutions, including robotics and automated trucks, are increasingly adopted to address labor shortages and improve supply chain resilience. Traffic management and ITS are being modernized with AI-driven analytics and IoT connectivity, while smart parking, last-mile robotics, and connected infrastructure are expanding in urban environments to support seamless mobility and sustainability .

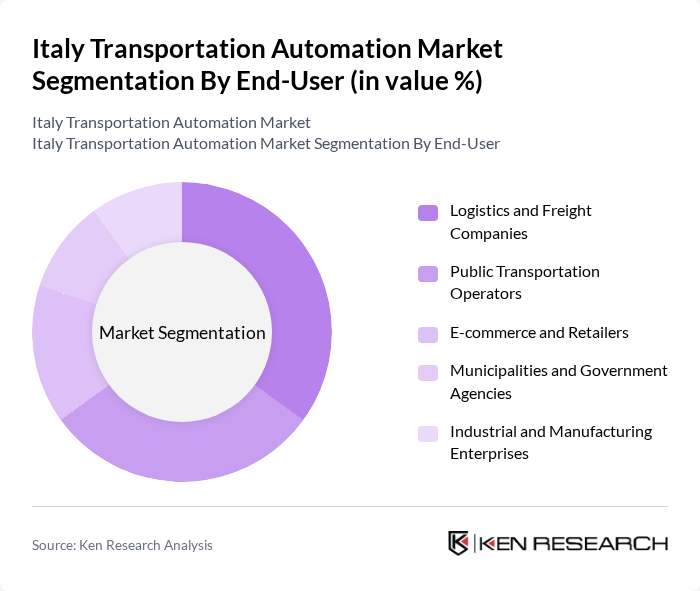

By End-User:The end-user segmentation includes Logistics and Freight Companies, Public Transportation Operators, E-commerce and Retailers, Municipalities and Government Agencies, and Industrial and Manufacturing Enterprises. Logistics and freight companies are the largest adopters, leveraging automation to optimize supply chains and meet the demands of e-commerce growth. Public transportation operators are investing in automation to enhance service reliability and passenger experience. E-commerce and retailers are driving demand for last-mile automation and warehouse robotics, while municipalities and government agencies focus on smart mobility solutions to improve urban transport efficiency. Industrial and manufacturing enterprises are integrating automation to streamline internal logistics and production processes .

The Italy Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Leonardo S.p.A., Ansaldo STS (now Hitachi Rail STS), Hitachi Rail, Alstom Transport, Siemens Mobility, Thales Group, ABB Ltd., Kapsch TrafficCom, Ferrovie dello Stato Italiane (FS Italiane Group), RFI (Rete Ferroviaria Italiana), TPER (Trasporto Passeggeri Emilia-Romagna), Trenitalia, Autostrade per l'Italia, Generix Group S.A., System Logistics S.p.A., and Zucchetti S.p.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Italy transportation automation market appears promising, driven by ongoing technological advancements and increasing government support. As urbanization continues, cities are likely to invest more in smart transportation solutions, enhancing efficiency and sustainability. The integration of AI and IoT technologies will further optimize logistics operations, while the shift towards electric and autonomous vehicles will reshape the industry landscape. Overall, these trends indicate a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Vehicles (Levels 3–5) Automated Public Transport Systems (metro, trams, buses) Freight Automation Solutions (automated trucks, intralogistics, robotics) Traffic Management and Intelligent Transport Systems (ITS) Smart Parking and Urban Mobility Solutions Delivery Drones and Last-Mile Robotics Connected Infrastructure (V2X, IoT-enabled roadways) |

| By End-User | Logistics and Freight Companies Public Transportation Operators E-commerce and Retailers Municipalities and Government Agencies Industrial and Manufacturing Enterprises |

| By Application | Urban Mobility and Public Transit Freight and Cargo Transport Emergency and Security Services Infrastructure and Traffic Management Warehouse and Intralogistics Automation |

| By Distribution Channel | Direct Sales (OEMs, integrators) Online Platforms and Digital Marketplaces Strategic Partnerships with Transport Operators |

| By Component | Hardware (sensors, cameras, controllers) Software (AI, fleet management, analytics) Services (maintenance, integration, consulting) |

| By Investment Source | Private Investments (VC, corporate) Government and EU Funding Public-Private Partnerships |

| By Policy Support | Subsidies for Electric and Autonomous Vehicles Tax Incentives for Automation Technologies Grants for R&D and Pilot Projects Regulatory Support for Innovation and Testing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Automation | 120 | Fleet Managers, Logistics Coordinators |

| Rail Automation Solutions | 60 | Rail Operations Managers, Technology Implementers |

| Maritime Automation Technologies | 50 | Port Authorities, Shipping Line Executives |

| Smart Logistics Systems | 80 | Supply Chain Analysts, IT Managers |

| Regulatory Compliance in Automation | 40 | Policy Makers, Compliance Officers |

The Italy Transportation Automation Market is valued at approximately USD 2.2 billion, driven by advancements in robotics, artificial intelligence, and IoT integration, alongside urbanization and sustainability efforts in transportation.