Region:North America

Author(s):Shubham

Product Code:KRAA0905

Pages:84

Published On:August 2025

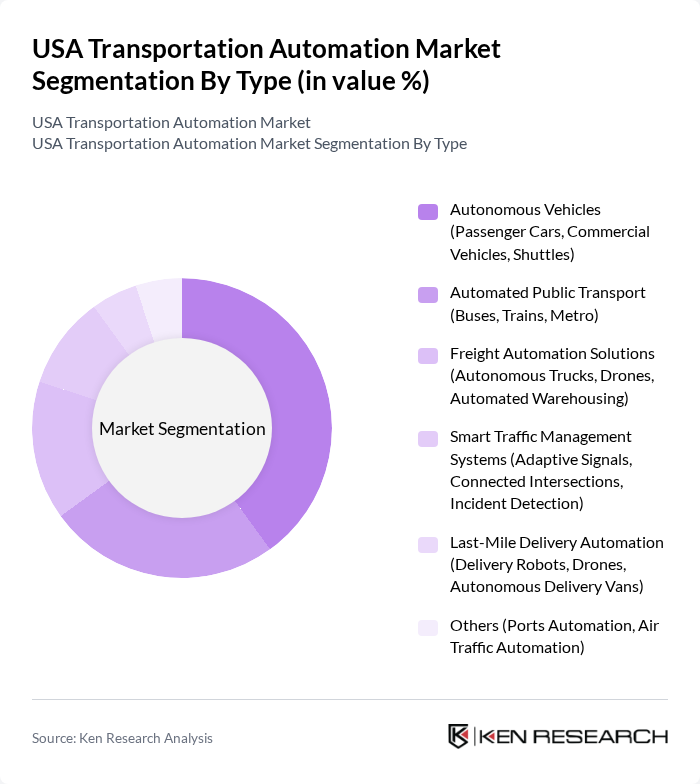

By Type:The market is segmented into various types, including Autonomous Vehicles, Automated Public Transport, Freight Automation Solutions, Smart Traffic Management Systems, Last-Mile Delivery Automation, and Others. Among these, Autonomous Vehicles are leading the market due to their increasing adoption in both passenger and commercial sectors. The demand for safer and more efficient transportation options is driving the growth of this segment, with significant investments from automotive manufacturers and technology companies. The segment is further propelled by regulatory support and pilot deployments in urban and logistics environments .

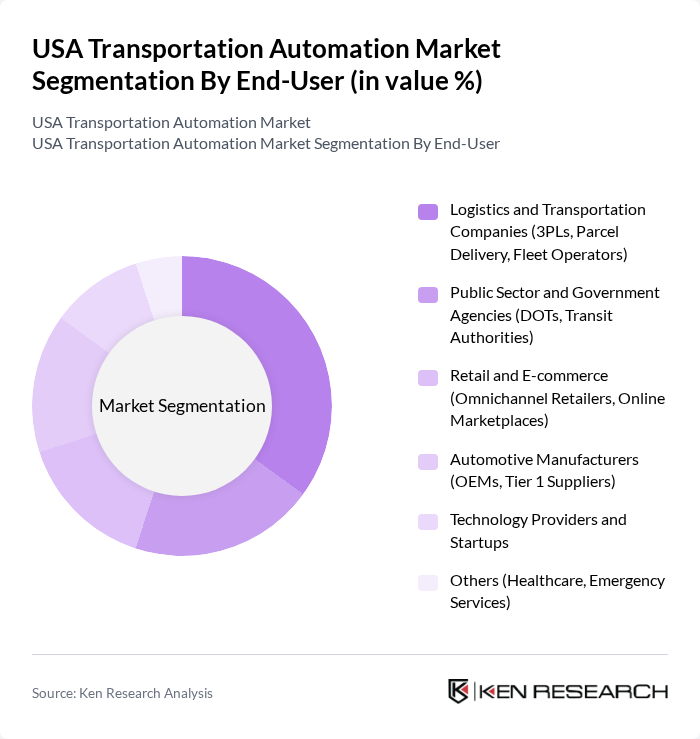

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Public Sector and Government Agencies, Retail and E-commerce, Automotive Manufacturers, Technology Providers and Startups, and Others. The Logistics and Transportation Companies segment is currently the most dominant, driven by the need for efficiency and cost reduction in supply chain operations. The increasing demand for automated solutions in logistics is propelling this segment's growth, as companies seek to enhance their operational capabilities through robotics, AI, and IoT-enabled systems .

The USA Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waymo LLC (Alphabet Inc.), Tesla, Inc., Uber Technologies, Inc. (Uber Freight, Advanced Technologies Group), Aurora Innovation, Inc., Zoox, Inc. (Amazon.com, Inc.), Cruise LLC (General Motors Company), Mobileye Global Inc. (Intel Corporation), Nuro, Inc., TuSimple Holdings Inc., Motional AD LLC (Hyundai Motor Group & Aptiv PLC JV), Embark Technology, Inc., Gatik AI, Inc., Kodiak Robotics, Inc., Amazon Robotics LLC (Amazon.com, Inc.), Starsky Robotics (Defunct, historical relevance) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA transportation automation market appears promising, driven by technological advancements and increasing demand for efficiency. As companies invest in AI and IoT, the integration of smart transportation solutions will likely enhance operational capabilities. Furthermore, the push for sustainability will drive innovations in electric and autonomous vehicles, aligning with government initiatives aimed at reducing carbon emissions. The market is expected to evolve rapidly, with significant investments in infrastructure and technology anticipated over the next few years.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Vehicles (Passenger Cars, Commercial Vehicles, Shuttles) Automated Public Transport (Buses, Trains, Metro) Freight Automation Solutions (Autonomous Trucks, Drones, Automated Warehousing) Smart Traffic Management Systems (Adaptive Signals, Connected Intersections, Incident Detection) Last-Mile Delivery Automation (Delivery Robots, Drones, Autonomous Delivery Vans) Others (Ports Automation, Air Traffic Automation) |

| By End-User | Logistics and Transportation Companies (3PLs, Parcel Delivery, Fleet Operators) Public Sector and Government Agencies (DOTs, Transit Authorities) Retail and E-commerce (Omnichannel Retailers, Online Marketplaces) Automotive Manufacturers (OEMs, Tier 1 Suppliers) Technology Providers and Startups Others (Healthcare, Emergency Services) |

| By Application | Passenger Transportation (Urban Mobility, Ride-Hailing, Public Transit) Freight and Cargo Transportation (Long-Haul, Urban Logistics, Warehousing) Emergency Services (Automated Ambulances, Disaster Response) Infrastructure Management (Smart Roads, Bridges, Tunnels) Others (Airport and Seaport Automation) |

| By Distribution Channel | Direct Sales (B2B, Enterprise Contracts) Online Platforms (Digital Marketplaces, SaaS Solutions) Partnerships with Fleet Operators and Integrators Others (System Integrators, VARs) |

| By Technology | AI and Machine Learning (Perception, Decision-Making, Predictive Analytics) IoT and Connectivity Solutions (V2X, Telematics, Edge Computing) Sensor Technologies (Lidar, Radar, Cameras, Ultrasonics) Data Analytics and Cloud Platforms Robotics and Automation Hardware Others (Cybersecurity, Digital Twins) |

| By Investment Source | Private Investments (Corporate, Institutional) Government Funding (Grants, Subsidies, R&D Programs) Public-Private Partnerships (PPP Initiatives) Venture Capital (Startups, Scaleups) Others (Crowdfunding, Strategic Alliances) |

| By Policy Support | Federal Grants and Subsidies Tax Incentives for Automation Research and Development Support Regulatory Sandboxes and Pilot Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Automation | 100 | Fleet Managers, Operations Directors |

| Rail Automation Technologies | 60 | Railway Operations Managers, Technology Officers |

| Air Cargo Automation | 40 | Logistics Coordinators, Airport Operations Managers |

| Last-Mile Delivery Automation | 80 | Delivery Managers, E-commerce Logistics Heads |

| Smart Traffic Management Systems | 50 | City Planners, Transportation Engineers |

The USA Transportation Automation Market is valued at approximately USD 60 billion, driven by advancements in automation technologies, infrastructure investments, and the demand for efficient transportation solutions.