Region:Africa

Author(s):Shubham

Product Code:KRAA0694

Pages:95

Published On:August 2025

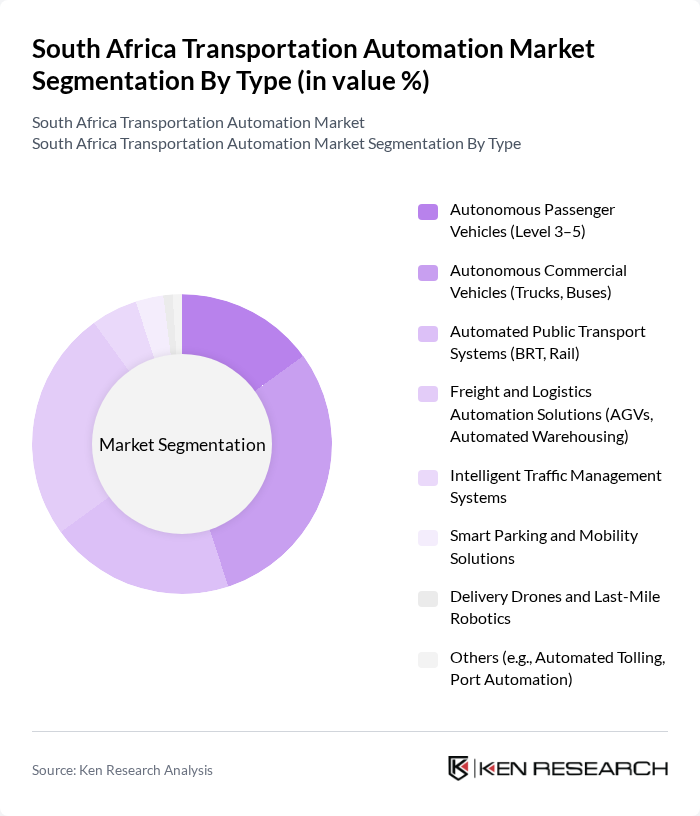

By Type:The market is segmented into Autonomous Passenger Vehicles (Level 3–5), Autonomous Commercial Vehicles (Trucks, Buses), Automated Public Transport Systems (BRT, Rail), Freight and Logistics Automation Solutions (AGVs, Automated Warehousing), Intelligent Traffic Management Systems, Smart Parking and Mobility Solutions, Delivery Drones and Last-Mile Robotics, and Others (e.g., Automated Tolling, Port Automation). Among these, the Autonomous Commercial Vehicles and Freight and Logistics Automation Solutions segments are leading the market, driven by the surge in e-commerce, the need for efficient supply chains, and the adoption of advanced robotics, AGVs, and automated warehousing solutions. The rapid expansion of logistics automation, including self-driving trucks and automated sortation, is transforming the sector .

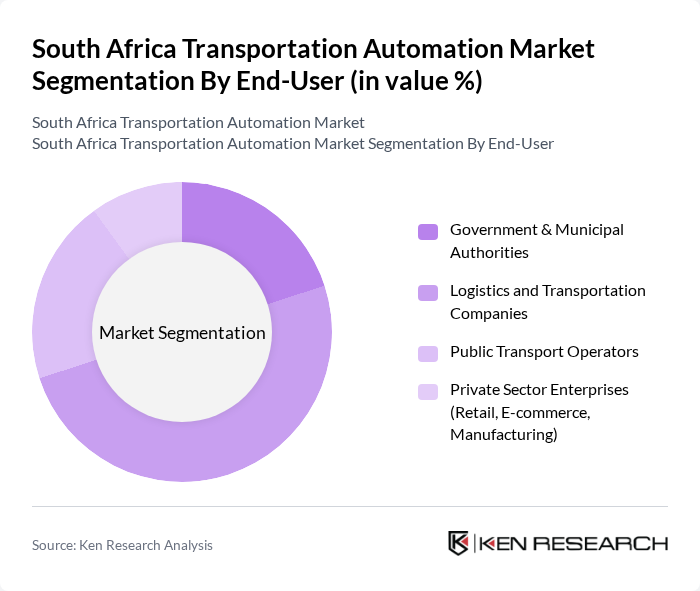

By End-User:The market is segmented by end-users, including Government & Municipal Authorities, Logistics and Transportation Companies, Public Transport Operators, and Private Sector Enterprises (Retail, E-commerce, Manufacturing). The Logistics and Transportation Companies segment is the most significant contributor, propelled by the need for automation in supply chain management, the growth of e-commerce, and the adoption of digital logistics solutions. These companies are increasingly investing in automation to enhance operational efficiency, reduce delivery times, and remain competitive .

The South Africa Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as MiX Telematics, Imperial Logistics (Imperial, a DP World Company), Alstom South Africa, Siemens Mobility South Africa, Transnet SOC Ltd, Bombela Operating Company (Gautrain), Uber South Africa, Bolt South Africa, DSV South Africa, Bidvest Panalpina Logistics, Huawei Technologies South Africa (Smart Transport Solutions), EOH Holdings (Automation & IoT Solutions), Syntell (Traffic Management & Enforcement Automation), DriveRisk (Fleet Safety & Automation), AEVERSA (Electric & Autonomous Vehicle Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The South African transportation automation market is poised for significant transformation as urbanization accelerates and technology continues to evolve. In future, the integration of AI and machine learning will enhance operational efficiencies, while the shift towards sustainable transportation will drive innovation. Additionally, the government's commitment to infrastructure investment will create a favorable environment for automation adoption. As these trends unfold, businesses must adapt to the changing landscape to capitalize on emerging opportunities in the transportation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Passenger Vehicles (Level 3–5) Autonomous Commercial Vehicles (Trucks, Buses) Automated Public Transport Systems (BRT, Rail) Freight and Logistics Automation Solutions (AGVs, Automated Warehousing) Intelligent Traffic Management Systems Smart Parking and Mobility Solutions Delivery Drones and Last-Mile Robotics Others (e.g., Automated Tolling, Port Automation) |

| By End-User | Government & Municipal Authorities Logistics and Transportation Companies Public Transport Operators Private Sector Enterprises (Retail, E-commerce, Manufacturing) |

| By Application | Urban Mobility & Public Transit Automation Freight and Cargo Management Automation Emergency and Security Services Automation Infrastructure Monitoring & Maintenance Automation |

| By Distribution Mode | Direct Sales (OEMs, System Integrators) Online Procurement Platforms Channel Partners & Distributors |

| By Investment Source | Private Equity & Venture Capital Government Grants & Funding Multilateral & International Aid |

| By Policy Support | Subsidies for Automation Technologies Tax Incentives for Electric & Automated Vehicles Grants for R&D and Pilot Projects |

| By Technology | Artificial Intelligence & Machine Learning IoT & Connected Infrastructure Blockchain for Logistics & Supply Chain Advanced Sensors & LIDAR Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Automation | 60 | Transit Authority Managers, Technology Implementers |

| Logistics and Freight Automation | 50 | Logistics Coordinators, Fleet Operations Managers |

| Smart Traffic Management Systems | 40 | City Planners, Traffic Engineers |

| Automated Delivery Solutions | 45 | Last-Mile Delivery Managers, E-commerce Logistics Heads |

| Railway Automation Technologies | 40 | Railway Operations Managers, Safety Compliance Officers |

The South Africa Transportation Automation Market is valued at approximately USD 3 billion, reflecting significant growth driven by advancements in digital technologies, urbanization, and the demand for efficient transportation solutions.