Region:Middle East

Author(s):Rebecca

Product Code:KRAD8492

Pages:94

Published On:December 2025

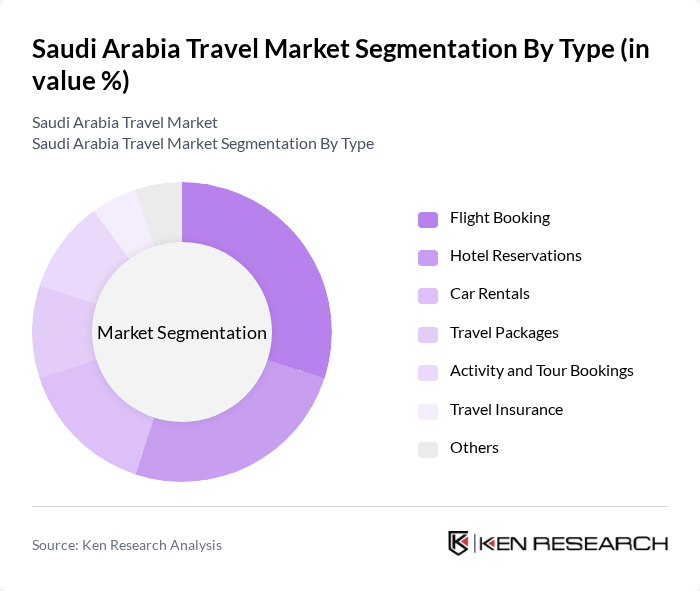

By Type:The travel market can be segmented into various types, including flight booking, hotel reservations, car rentals, travel packages, activity and tour bookings, travel insurance, and others. Among these, flight booking and hotel reservations are the most significant segments, driven by the increasing number of travelers and the growing demand for accommodation options.

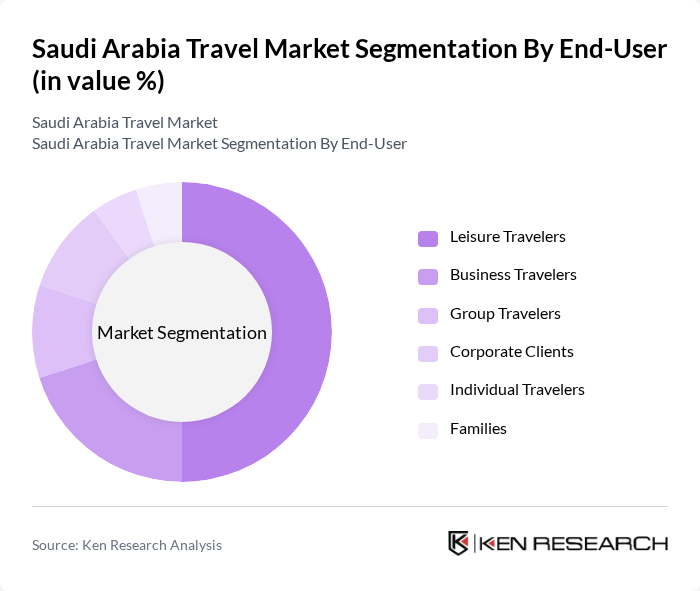

By End-User:The end-user segmentation includes leisure travelers, business travelers, group travelers, corporate clients, individual travelers, and families. Leisure travelers dominate the market, driven by the increasing interest in tourism and cultural experiences in Saudi Arabia.

The Saudi Arabia Travel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Airlines (Saudia), Riyadh Air, Almosafer, Al Tayyar Travel Group, Dnata Travel, Accor Hotels, Hilton Worldwide, Marriott International, Booking.com, Expedia Group, TripAdvisor, Emirates Group, Flyadeal, Travel Leaders Group, Coherent Market Insights Partners contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia travel market is poised for significant transformation, driven by ongoing government initiatives and a focus on enhancing the visitor experience. As infrastructure projects progress, the country is expected to see a rise in both domestic and international tourism. The emphasis on cultural and religious tourism, coupled with eco-friendly initiatives, will likely attract a diverse range of travelers. Additionally, the integration of technology in travel services will streamline operations and improve customer engagement, setting the stage for a robust tourism sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flight Booking Hotel Reservations Car Rentals Travel Packages Activity and Tour Bookings Travel Insurance Others |

| By End-User | Leisure Travelers Business Travelers Group Travelers Corporate Clients Individual Travelers Families |

| By Sales Channel | Direct Online Sales Mobile Applications Third-Party Aggregators Travel Agents |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Others |

| By Accommodation Type | Five-Star Hotels Four-Star Hotels Resorts Serviced Apartments Vacation Rentals Others |

| By Travel Mode | Full-Service Carriers Low-Cost Carriers Road Travel Rail Travel Sea Travel |

| By Geographic Region | Central Region Western Region Eastern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Inbound Tourism Preferences | 120 | International Tourists, Travel Bloggers |

| Domestic Travel Trends | 100 | Local Travelers, Family Vacation Planners |

| Travel Agency Insights | 80 | Travel Agents, Tour Operators |

| Hotel and Accommodation Feedback | 70 | Hotel Managers, Hospitality Consultants |

| Tourism Policy Impact Assessment | 60 | Government Officials, Tourism Policy Analysts |

The Saudi Arabia travel market is valued at approximately USD 118 billion, driven by the Vision 2030 initiative aimed at diversifying the economy and promoting tourism as a key sector. This growth reflects increased domestic and international travel.