Region:Middle East

Author(s):Rebecca

Product Code:KRAD8183

Pages:90

Published On:December 2025

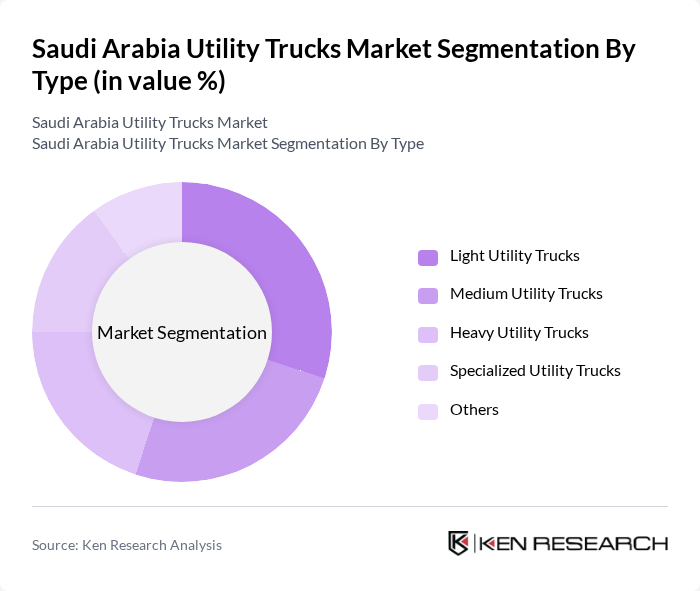

By Type:The utility trucks market can be segmented into various types, including Light Utility Trucks, Medium Utility Trucks, Heavy Utility Trucks, Specialized Utility Trucks, and Others. Among these, Light Utility Trucks are gaining traction due to their versatility and suitability for urban environments, while Heavy Utility Trucks are preferred for large-scale construction and mining operations. The demand for Specialized Utility Trucks is also on the rise, driven by specific industry needs.

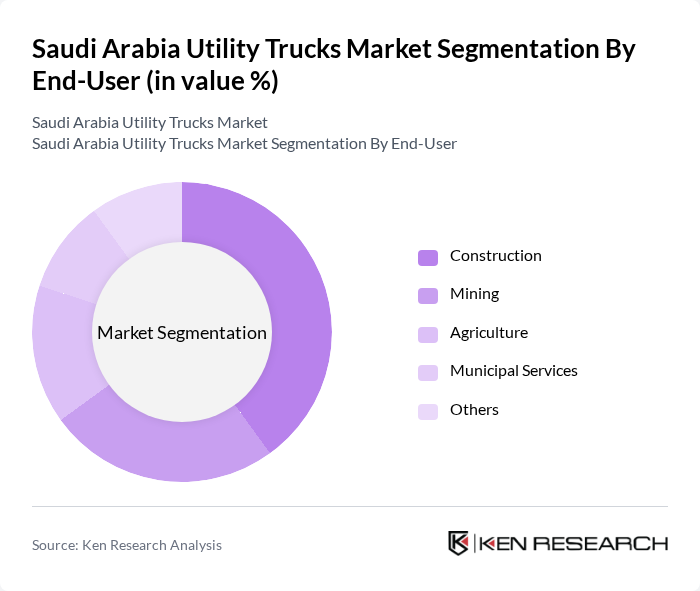

By End-User:The end-user segmentation includes Construction, Mining, Agriculture, Municipal Services, and Others. The Construction sector is the largest consumer of utility trucks, driven by ongoing infrastructure projects and urban development. Mining also represents a significant portion of the market due to the demand for heavy-duty trucks capable of transporting materials in challenging terrains.

The Saudi Arabia Utility Trucks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Isuzu Motors Ltd., Hino Motors, Ltd., Ford Motor Company, Mercedes-Benz AG, Volvo Group, MAN Truck & Bus SE, Mitsubishi Fuso Truck and Bus Corporation, Scania AB, Nissan Motor Co., Ltd., Freightliner Trucks, Kenworth Truck Company, Mack Trucks, Inc., International Truck and Engine Corporation, Tata Motors Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the utility trucks market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and a shift towards sustainable transportation solutions. The adoption of electric utility trucks is gaining traction, supported by government incentives aimed at reducing carbon emissions. Additionally, advancements in technology, such as autonomous driving features, are expected to enhance operational efficiency. As the logistics sector continues to evolve, utility trucks will play a pivotal role in meeting the demands of a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Utility Trucks Medium Utility Trucks Heavy Utility Trucks Specialized Utility Trucks Others |

| By End-User | Construction Mining Agriculture Municipal Services Others |

| By Payload Capacity | Up to 1 Ton to 3 Tons to 5 Tons Above 5 Tons Others |

| By Fuel Type | Diesel Gasoline Electric Hybrid Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Transportation Construction Waste Management Emergency Services Others |

| By Market Segment | Public Sector Private Sector Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Fleet Management | 120 | Fleet Managers, Project Directors |

| Municipal Utility Services | 100 | Operations Supervisors, City Planners |

| Oil & Gas Sector Logistics | 110 | Supply Chain Managers, Procurement Specialists |

| Transportation and Logistics Providers | 90 | Business Development Managers, Logistics Coordinators |

| Utility Truck Dealerships | 80 | Sales Managers, Customer Service Representatives |

The Saudi Arabia Utility Trucks Market is valued at approximately USD 1.5 billion, driven by increasing demand across sectors such as construction, agriculture, and municipal services, alongside government initiatives focused on infrastructure development and economic diversification under Vision 2030.