Region:Middle East

Author(s):Geetanshi

Product Code:KRAC7857

Pages:94

Published On:December 2025

By Product Type:The product type segmentation includes various categories of wearable medical devices that cater to different health monitoring and management needs. The dominant sub-segment is Diagnostic Devices, which includes ECG monitors, blood pressure monitors, and glucose monitors. These devices are widely used due to the increasing prevalence of chronic diseases such as diabetes and hypertension. Following closely are Smartwatches with health monitoring features and Fitness trackers, which have gained popularity among health-conscious consumers for their convenience and multifunctionality. The market is also seeing growth in Therapeutic Devices and Smart clothing, driven by advancements in technology and consumer demand for integrated health solutions. The therapeutic device segment is expected to experience accelerated growth, with a strong pipeline of innovative solutions such as wearable pain relievers, insulin management devices, and intelligent asthma management products.

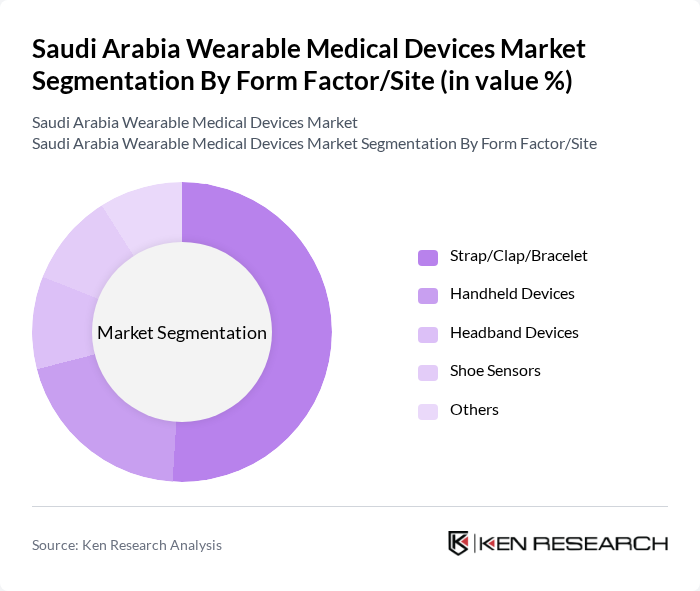

By Form Factor/Site:The form factor segmentation categorizes wearable medical devices based on their design and how they are worn or used. The leading sub-segment is Strap/Clap/Bracelet devices, which accounted for 51% market share in 2023 due to their ease of use and comfort. Handheld devices are also gaining traction, particularly for diagnostic purposes, while Headband devices and Shoe sensors are emerging as innovative solutions for specific health monitoring needs. The market is witnessing a gradual shift towards more integrated and multifunctional devices, which is driving the growth of various form factors. Advancements in technology, including ECG tracking features along with pulse rate and respiratory monitoring featured with Bluetooth and cloud connectivity, are further expected to drive the market.

The Saudi Arabia Wearable Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koninklijke Philips N.V. (Philips Healthcare), Garmin Ltd., Apple Inc., Covidien (Medtronic), Polar Electro, Sotera Wireless, Huawei Device Co., Ltd., Omron Healthcare Co., Ltd., Samsung Electronics, Xiaomi Corporation, Abbott Laboratories, AliveCor, Withings, Oura Health, and King Saud University (locally developed medical devices) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable medical devices market in Saudi Arabia appears promising, driven by technological advancements and increasing health consciousness among the population. As the government continues to promote digital health initiatives, the integration of AI and machine learning into wearable devices will enhance their functionality. Furthermore, the expansion of telehealth services will facilitate remote patient monitoring, making healthcare more accessible. These trends indicate a robust growth trajectory for the market, with significant potential for innovation and collaboration in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic Devices (ECG monitors, blood pressure monitors, glucose monitors) Therapeutic Devices (wearable pain relievers, insulin management devices, asthma management products) Smartwatches with health monitoring features Fitness trackers Smart clothing and wearable sensors Respiratory monitoring devices Others |

| By Form Factor/Site | Strap/Clap/Bracelet (51.51% market share in 2023) Handheld devices Headband devices Shoe sensors Others |

| By Application | Home healthcare (largest revenue share in 2023) Remote patient monitoring (fastest growing segment) Sports and fitness Chronic disease management Others |

| By End-User | Hospitals and healthcare facilities Home healthcare providers Fitness and wellness centers Research institutions and clinical trial centers Individual consumers |

| By Distribution Channel | Online retail and e-commerce platforms Offline retail (pharmacies, medical stores) Direct sales through manufacturers Healthcare provider partnerships Distributors and wholesalers |

| By Technology | Bluetooth-enabled devices with cloud connectivity Wi-Fi-enabled devices Cellular-enabled devices NFC-enabled devices AI and machine learning-integrated devices |

| By Region | Central Region (Riyadh) Eastern Region Western Region (Jeddah, Mecca) Southern Region Northern Region |

| By User Demographics | Age group (Children, Adults, Seniors) Gender (Male, Female) Income level (Low, Middle, High) Health status (Chronic disease patients, fitness enthusiasts, general wellness) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Nurses, Healthcare Administrators |

| Patients Using Wearable Devices | 90 | Chronic Disease Patients, Fitness Enthusiasts |

| Technology Developers | 75 | Product Managers, R&D Engineers |

| Regulatory Bodies | 45 | Policy Makers, Compliance Officers |

| Insurance Companies | 60 | Underwriters, Claims Adjusters |

The Saudi Arabia Wearable Medical Devices Market is valued at approximately USD 310 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, rising health awareness, and technological advancements in wearable devices.