Region:Middle East

Author(s):Rebecca

Product Code:KRAC9817

Pages:89

Published On:November 2025

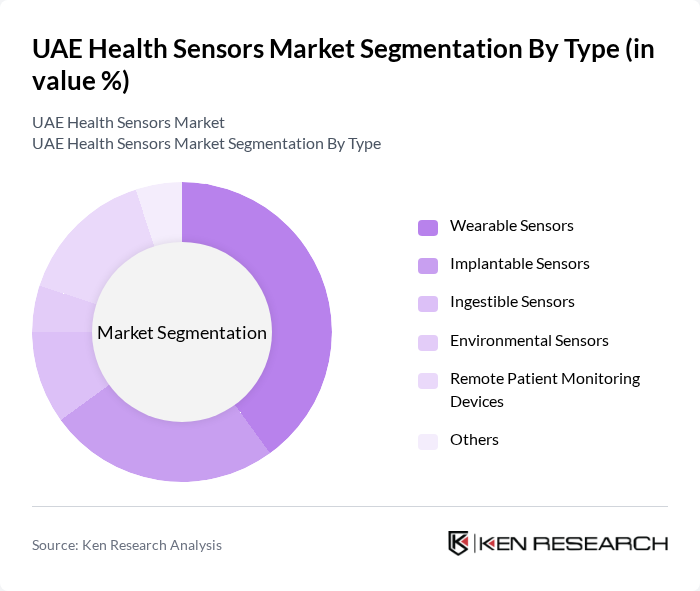

By Type:The market is segmented into various types of health sensors, including wearable sensors, implantable sensors, ingestible sensors, environmental sensors, remote patient monitoring devices, and others. Each type serves distinct purposes and caters to different consumer needs. Wearable sensors, such as fitness trackers and smartwatches, are the most widely adopted, offering real-time health monitoring and lifestyle management. Implantable and ingestible sensors are primarily used for clinical and diagnostic applications, while environmental sensors and remote patient monitoring devices support broader health and wellness management .

Wearable sensors dominate the market due to their increasing adoption among consumers for fitness tracking and health monitoring. Devices such as fitness trackers and smartwatches have gained popularity, driven by consumer demand for real-time health data and lifestyle management. The convenience and accessibility of these devices have made them a preferred choice for health monitoring, leading to significant market growth. Integration with AI and cloud analytics further enhances the value proposition of wearable sensors .

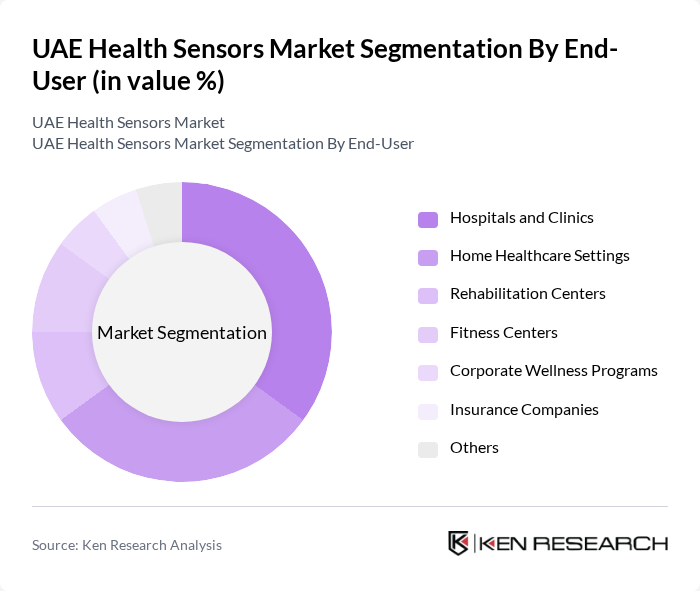

By End-User:The market is segmented based on end-users, including hospitals and clinics, home healthcare settings, rehabilitation centers, fitness centers, corporate wellness programs, insurance companies, and others. Each segment has unique requirements and applications for health sensors. Hospitals and clinics lead in adoption due to their need for continuous patient monitoring and chronic disease management, while home healthcare settings are rapidly growing as remote monitoring and telemedicine become more prevalent .

Hospitals and clinics are the leading end-users of health sensors, primarily due to the increasing need for patient monitoring and management in clinical settings. The integration of health sensors in hospital systems enhances patient care, improves operational efficiency, and supports chronic disease management, making them indispensable in modern healthcare. Home healthcare settings are also expanding rapidly, supported by telehealth adoption and patient demand for remote monitoring solutions .

The UAE Health Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, Medtronic, Abbott Laboratories, GE Healthcare, Honeywell, Fitbit Inc., Samsung Electronics Co., Ltd., Omron Healthcare, Withings, iHealth Labs, Garmin Ltd., Biotronik, AliveCor, Inc., DarioHealth, Apple Inc., Huawei Technologies Co., Ltd., Xiaomi Corporation, Oura Health Ltd., BioTelemetry, Inc., Zephyr Technology Corporation, Empatica Srl contribute to innovation, geographic expansion, and service delivery in this space .

The UAE health sensors market is poised for significant transformation, driven by the integration of advanced technologies and a focus on personalized healthcare solutions. As the government continues to promote digital health initiatives, the adoption of telehealth services is expected to rise, enhancing patient engagement. Furthermore, the increasing elderly population will necessitate innovative health monitoring solutions, creating a favorable environment for market expansion and collaboration between technology providers and healthcare institutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Sensors (Fitness Trackers, Smartwatches, Health Monitoring Bands, Smart Clothing, Wearable ECG Monitors, Wearable Blood Pressure Monitors) Implantable Sensors (Glucose Monitors, Cardiac Monitors, Neurostimulators) Ingestible Sensors (Capsule Endoscopy, Medication Adherence Sensors) Environmental Sensors (Air Quality, Temperature, Humidity Sensors for Healthcare Environments) Remote Patient Monitoring Devices Others (Biophysical Sensors, Multi-parameter Monitors) |

| By End-User | Hospitals and Clinics Home Healthcare Settings Rehabilitation Centers Fitness Centers Corporate Wellness Programs Insurance Companies Others |

| By Application | Chronic Disease Management Fitness and Wellness Monitoring Remote Patient Monitoring Emergency Health Alerts Clinical Trials Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors B2B Sales Others |

| By Technology | Bluetooth Enabled Devices Wi-Fi Enabled Devices NFC Technology Cellular Enabled Devices MEMS-based Sensors CMOS-based Sensors Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Hospital Administrators |

| Patients Using Health Sensors | 80 | Chronic Disease Patients, Fitness Enthusiasts |

| Health Technology Developers | 60 | Product Managers, R&D Engineers |

| Insurance Companies | 50 | Underwriters, Health Policy Analysts |

| Regulatory Bodies | 40 | Health Regulators, Compliance Officers |

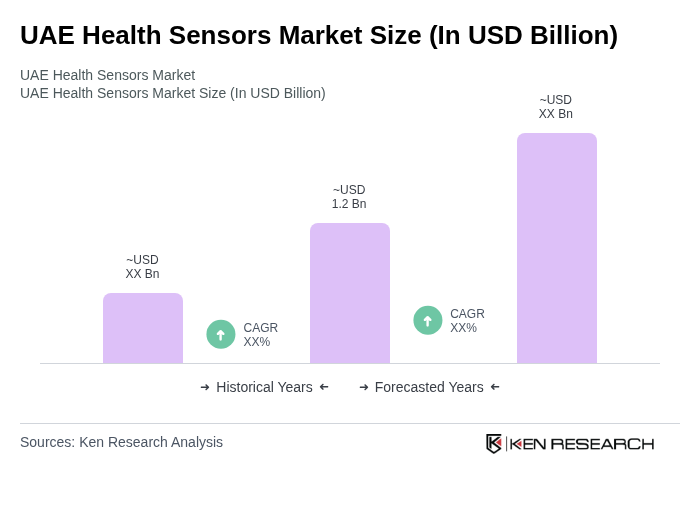

The UAE Health Sensors Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the rising prevalence of chronic diseases, increased health awareness, and advancements in sensor technology.